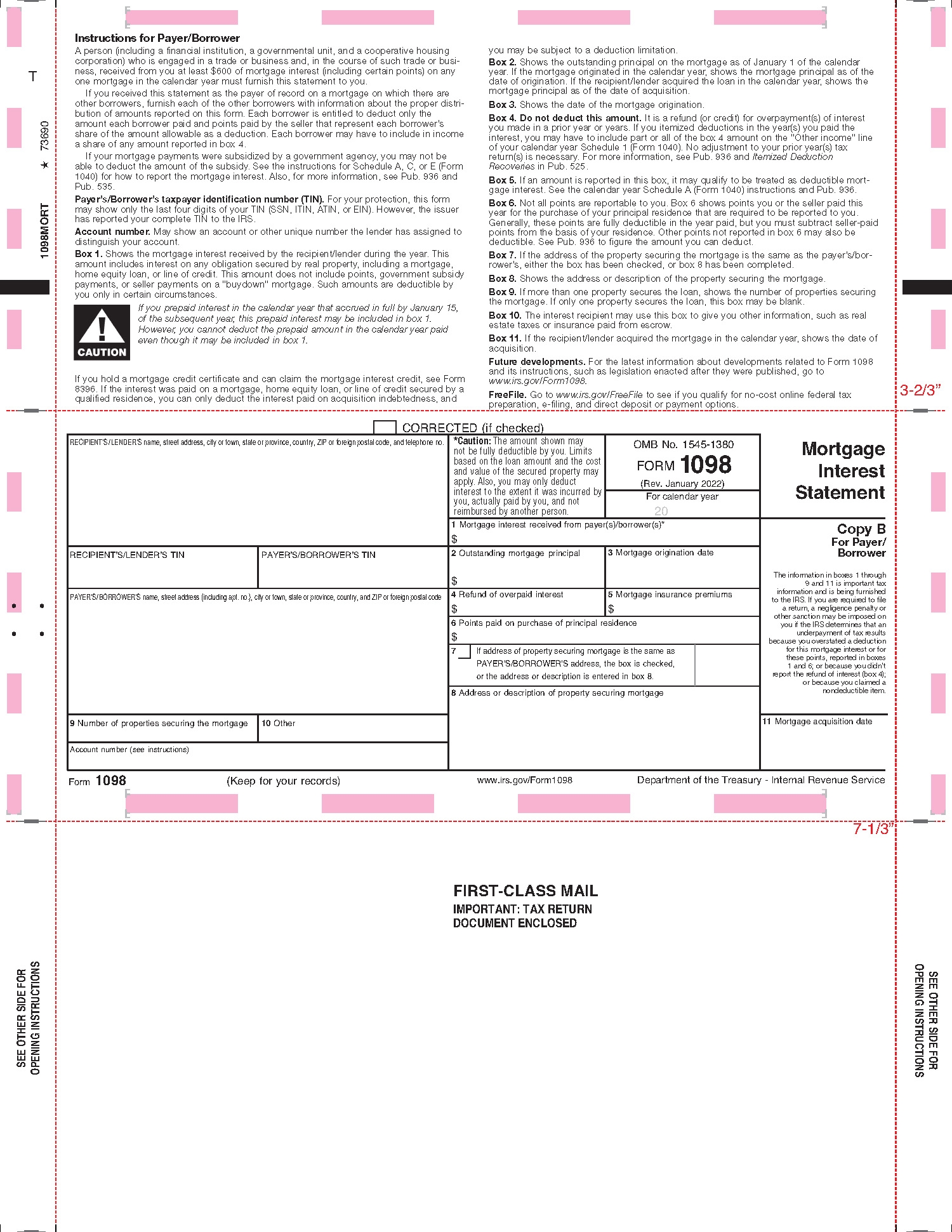

When it comes to tax season, one of the forms you may need to fill out is Form 1098. This form is used to report certain types of income to the IRS, such as mortgage interest or student loan interest. It’s important to make sure you have the correct form and fill it out accurately to avoid any issues with your taxes.

Printable IRS Form 1098 can be easily found online and downloaded for free. This makes it convenient for individuals who need to report their income but may not have access to a physical form. By using the printable form, you can ensure that all the necessary information is filled out correctly and legibly.

Form 1098 is typically used for reporting mortgage interest, student loan interest, and other types of interest payments. When filling out the form, you will need to provide information such as the amount of interest paid, the recipient’s name and address, and the taxpayer identification number. It’s important to double-check all the information before submitting the form to the IRS.

By using the printable IRS Form 1098, you can easily keep track of your income and ensure that you are reporting it accurately to the IRS. This can help you avoid any penalties or audits down the line. Make sure to fill out the form carefully and submit it by the deadline to avoid any issues with your taxes.

Overall, printable IRS Form 1098 is a useful tool for individuals who need to report certain types of income to the IRS. By downloading the form online, you can ensure that all the necessary information is filled out correctly and avoid any issues with your taxes. Make sure to take the time to fill out the form accurately and submit it on time to stay in compliance with IRS regulations.

So, if you need to report mortgage interest, student loan interest, or other types of income, make sure to download and fill out the printable IRS Form 1098 to stay on top of your taxes.