When it comes to taxes, mistakes can happen. Whether you forgot to report income, claimed deductions incorrectly, or made any other errors on your original tax return, the IRS Form 1040X is here to help you make corrections. This form is used to amend a previously filed Form 1040, 1040A, 1040EZ, 1040NR, or 1040NR-EZ.

It’s important to note that you can only amend a return within three years from the date you filed your original return, or within two years from the date you paid the tax, whichever is later. Filing an amended return can help you avoid any potential penalties or interest that may accrue due to errors on your original return.

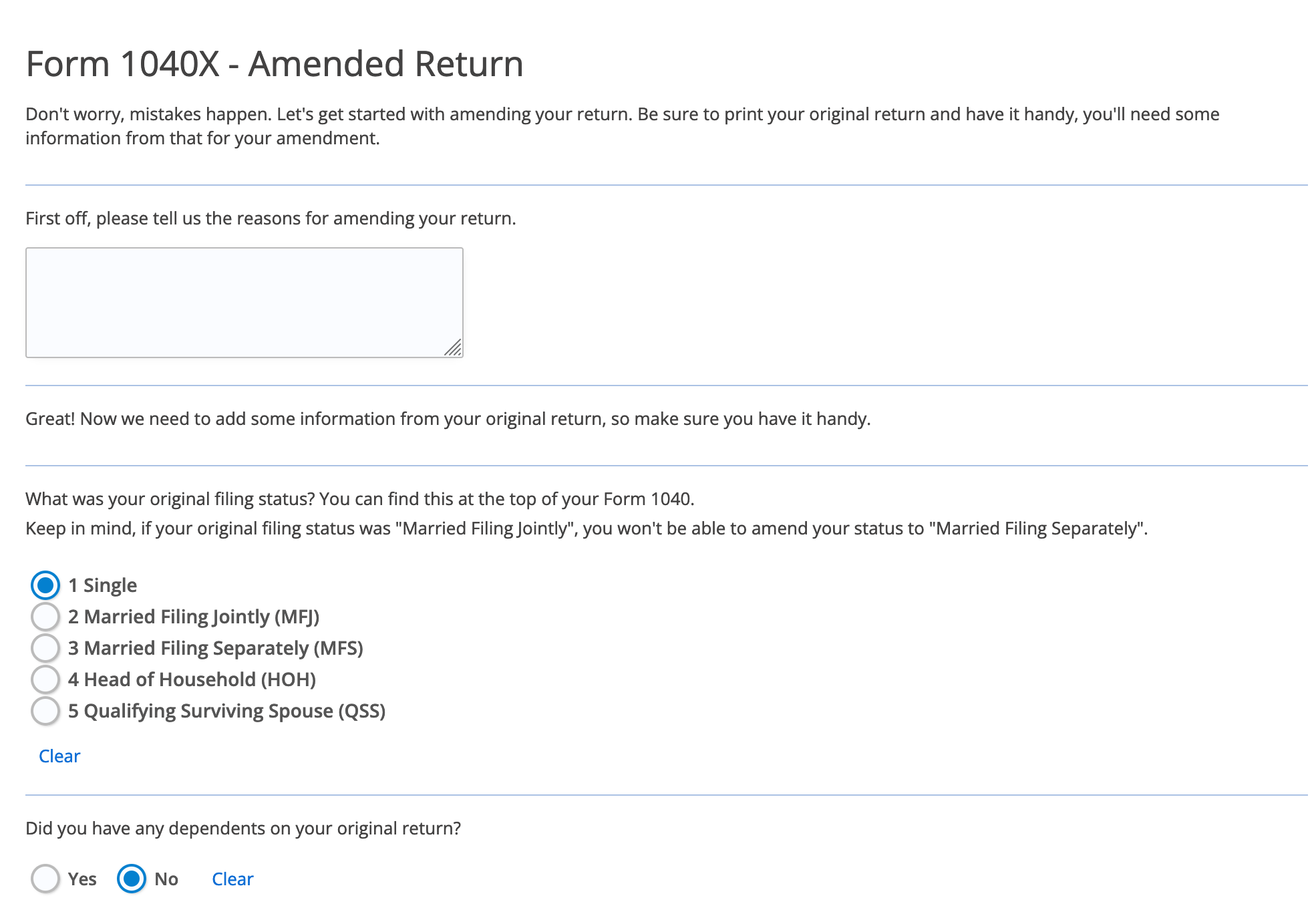

Printable IRS Form 1040X

Obtaining a printable IRS Form 1040X is easy. You can visit the official IRS website and download the form directly from there. The form comes with instructions on how to fill it out correctly, including where to make corrections and what supporting documents you may need to include.

When filling out the Form 1040X, be sure to provide accurate information and explain the changes you are making to your original return. You will also need to attach any necessary forms or schedules that are impacted by the changes you are making. Once complete, you can mail the form to the address provided on the instructions or submit it electronically, depending on your preference.

After submitting your amended return, the IRS will review the changes and notify you of any adjustments to your tax liability. It’s important to keep a copy of your amended return and any supporting documents for your records. If you are due a refund, you will receive it in the form of a check or direct deposit, depending on your preference.

Overall, the IRS Form 1040X is a valuable tool for correcting errors on your tax return and ensuring that you are in compliance with tax laws. By using this form, you can rectify mistakes and avoid any potential issues with the IRS. So, if you need to make changes to a previously filed tax return, don’t hesitate to use the Form 1040X to set things right.