When it comes to filing taxes as a self-employed individual or a small business owner, the IRS Form 1040 Schedule C is an essential document that you need to be familiar with. This form is used to report income or loss from a business you operated or a profession you practiced as a sole proprietor. It is important to accurately fill out this form to ensure that you are complying with IRS regulations and to avoid any potential penalties.

As a business owner, you are required to report your business income and expenses on Schedule C of your Form 1040. This form allows you to deduct various business expenses, such as supplies, advertising, travel, and utilities, from your gross income to determine your net profit or loss. It is crucial to keep detailed records of your business expenses throughout the year to accurately report them on Schedule C.

Printable Irs Form 1040 Schedule C

Printable Irs Form 1040 Schedule C

Printable IRS Form 1040 Schedule C

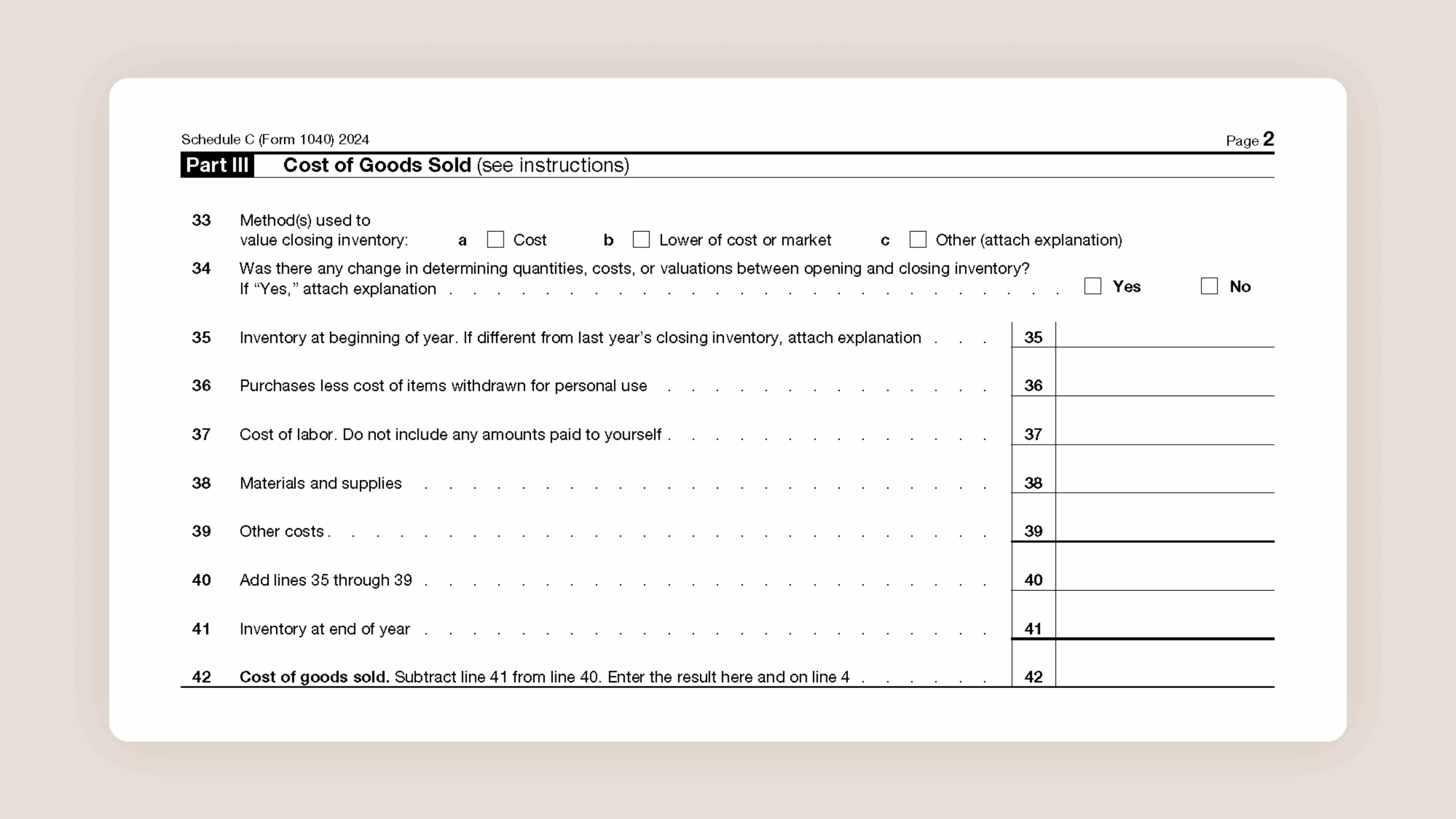

Printable IRS Form 1040 Schedule C can be easily found on the IRS website or through reputable tax preparation software. This form includes various sections where you need to provide details about your business income, expenses, and deductions. It is important to carefully review the instructions provided with the form to ensure that you are filling it out correctly.

One of the most important sections of Schedule C is Part II, where you report your business expenses. This section allows you to deduct various expenses related to running your business, such as rent, insurance, and professional fees. It is important to accurately report these expenses to minimize your tax liability and maximize your deductions.

Once you have completed Schedule C, you will transfer the net profit or loss amount to your Form 1040. This amount will then be used to calculate your total tax liability for the year. It is important to review your completed Schedule C for accuracy before submitting it along with your tax return to the IRS.

In conclusion, understanding and accurately filling out Printable IRS Form 1040 Schedule C is essential for self-employed individuals and small business owners. By carefully documenting your business income and expenses throughout the year and accurately reporting them on Schedule C, you can ensure compliance with IRS regulations and maximize your deductions. Be sure to consult with a tax professional if you have any questions or need assistance with completing this form.