When it comes to filing your taxes, it’s important to make sure you are claiming all the deductions you are eligible for. One way to do this is by using IRS Form 1040 Schedule A, also known as the Itemized Deductions form. This form allows you to list out various expenses that you can deduct from your taxable income, potentially lowering the amount of taxes you owe.

Printable IRS Form 1040 Schedule A can be a useful tool for taxpayers who want to ensure they are taking advantage of all available deductions. By filling out this form, you can see exactly which expenses are deductible and how much you can claim for each category.

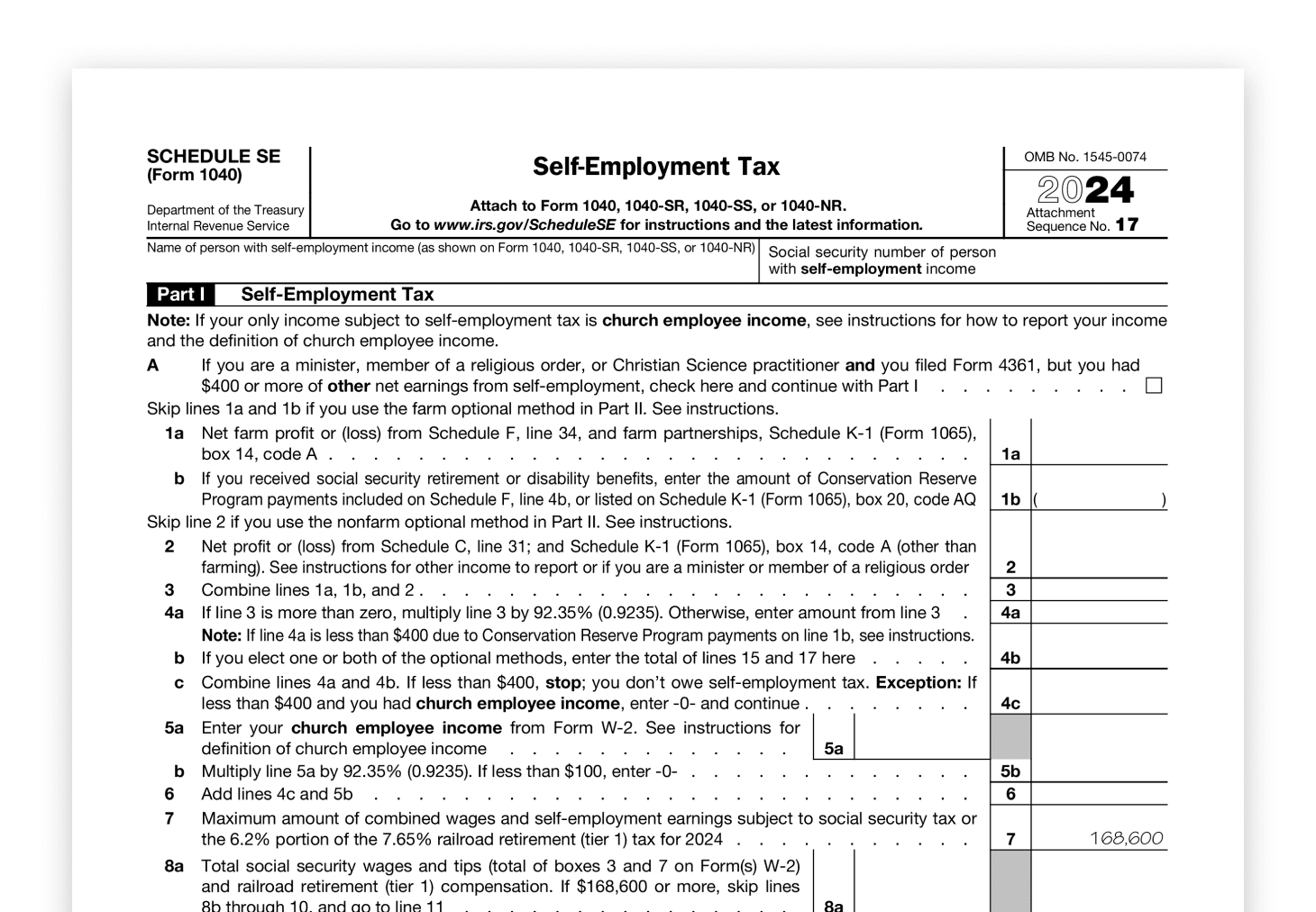

Printable Irs Form 1040 Schedule A

Printable Irs Form 1040 Schedule A

When using the printable IRS Form 1040 Schedule A, make sure to gather all relevant documentation to support your deductions. This may include receipts, invoices, and other records that prove the expenses you are claiming. By being thorough in your record-keeping, you can avoid any potential issues with the IRS down the line.

Some common expenses that can be claimed on IRS Form 1040 Schedule A include medical expenses, mortgage interest, state and local taxes, and charitable contributions. By carefully documenting these expenses and filling out the form accurately, you can maximize your deductions and potentially lower your tax bill.

Overall, Printable IRS Form 1040 Schedule A can be a valuable tool for taxpayers looking to reduce their tax liability. By taking the time to fill out this form and gather supporting documentation, you can ensure that you are claiming all the deductions you are entitled to. So, don’t overlook this important form when filing your taxes!