When tax season rolls around, one of the most important documents you will need to fill out is the IRS Form 1040. This form is used by individuals to report their annual income and calculate the amount of tax they owe to the federal government. While the thought of filling out tax forms may seem daunting, having a printable version of the Form 1040 can make the process much easier.

Printable IRS Form 1040 is readily available online, making it convenient for taxpayers to access and complete. This form is typically used by individuals who have relatively straightforward tax situations, such as those who earn income from a regular job and do not have many deductions or credits to claim. By filling out this form accurately and submitting it on time, you can ensure that you are meeting your tax obligations and avoiding any penalties or fines.

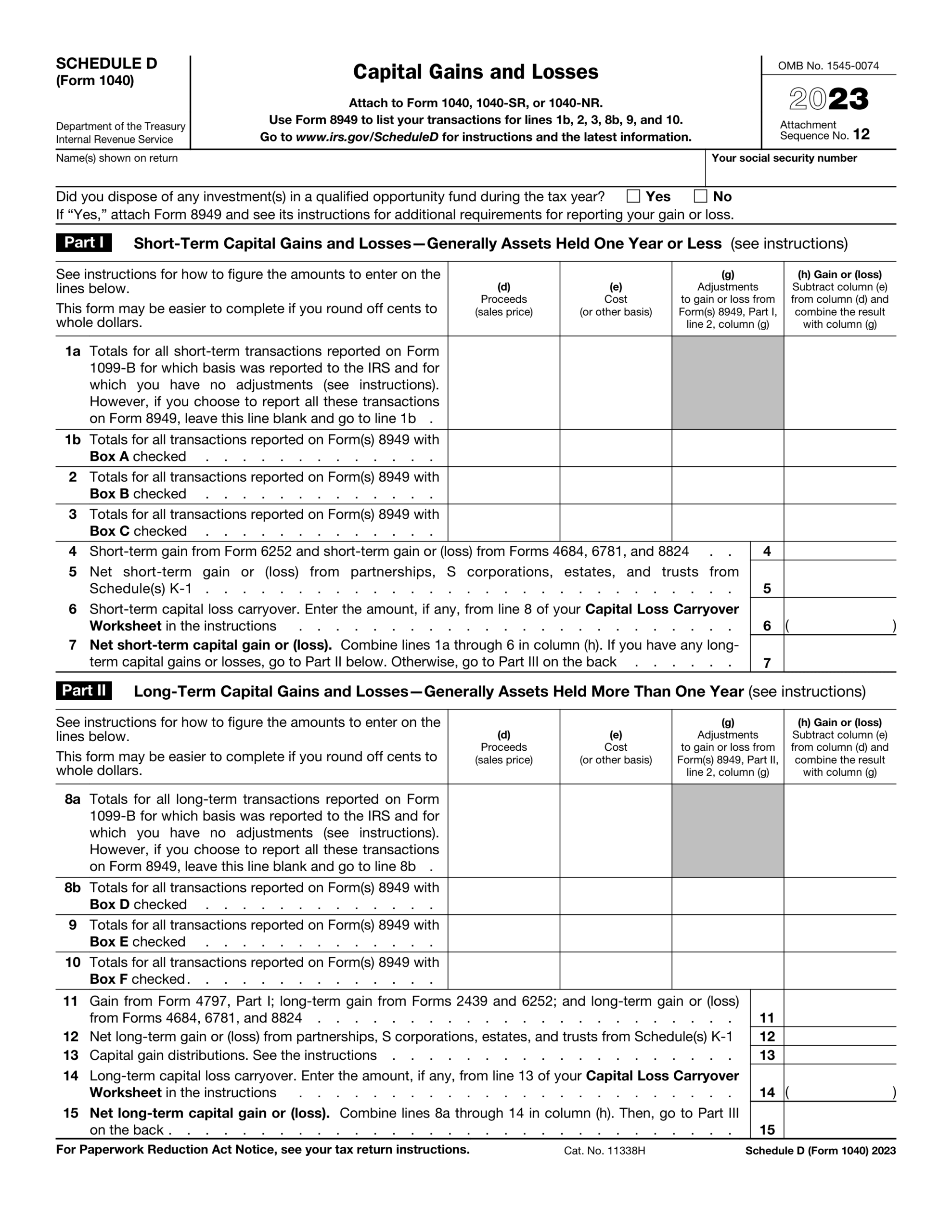

Printable IRS Form 1040

When filling out the Printable IRS Form 1040, you will need to provide information about your income, deductions, credits, and any taxes you have already paid throughout the year. It is important to carefully review the instructions provided with the form to ensure that you are including all the necessary information and calculations. Additionally, be sure to double-check your work before submitting the form to avoid any errors that could delay the processing of your tax return.

One of the benefits of using the printable version of the IRS Form 1040 is that you can easily save a copy for your records or make corrections if needed. This can be especially helpful if you are filing your taxes electronically and want to keep a digital copy of your return for future reference. By having a printable form on hand, you can also work on your taxes at your own pace and refer back to it as needed.

In conclusion, having access to a Printable IRS Form 1040 can make the process of filing your taxes much more manageable. By carefully filling out this form and submitting it on time, you can ensure that you are meeting your tax obligations and avoiding any penalties. Be sure to take advantage of the resources available to you, such as online tax software and printable forms, to make the process as smooth as possible.