April 15th is the deadline for filing your federal income tax return with the Internal Revenue Service (IRS). However, if you find yourself unable to complete your tax return by this date, you have the option to file for an extension. The IRS allows taxpayers to request an extension, giving them an additional six months to file their tax return.

By filing for an extension, you can avoid late filing penalties that may be imposed if you miss the tax deadline. It is important to note that an extension to file your tax return does not grant you an extension to pay any taxes owed. You are still required to estimate and pay any taxes due by the original filing deadline to avoid interest and penalties.

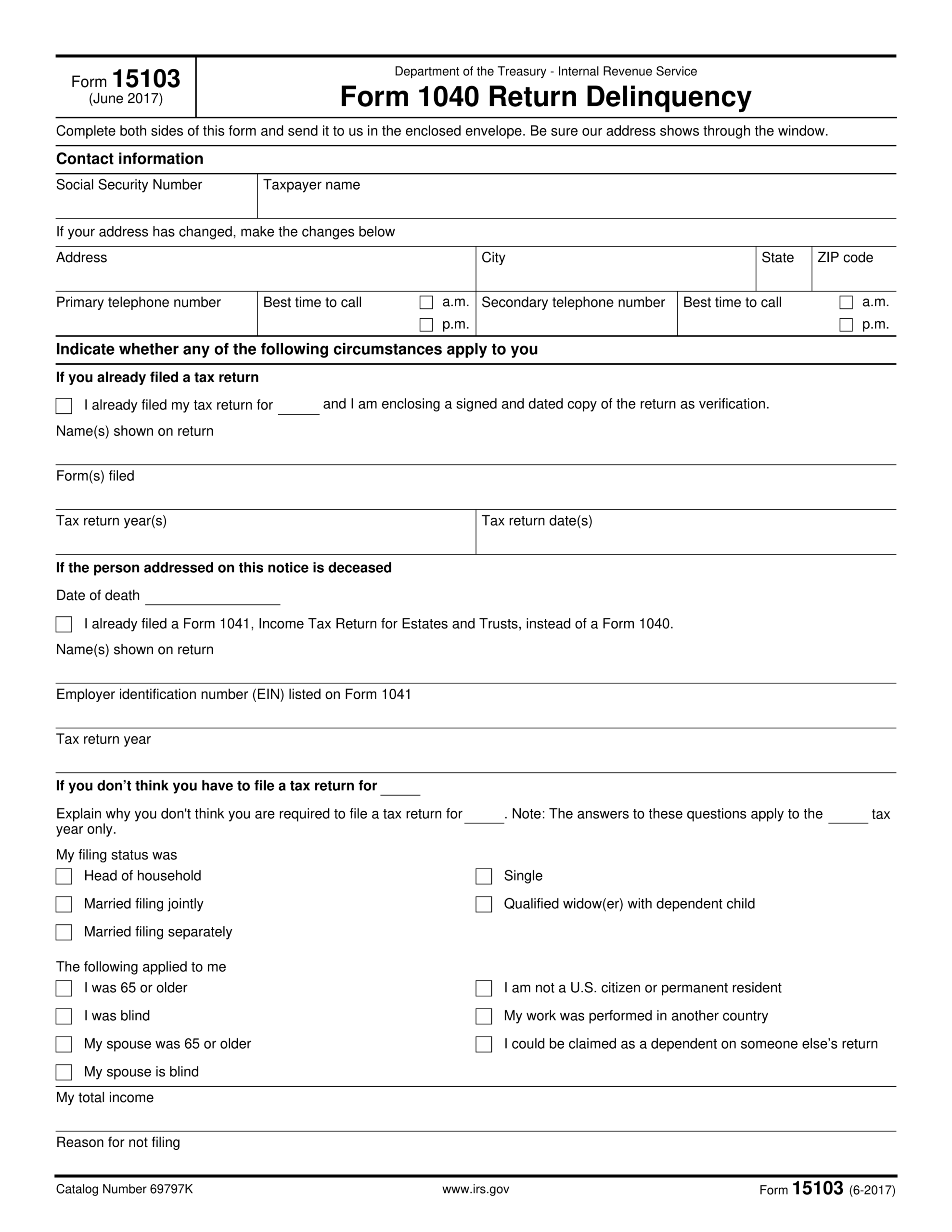

Printable Irs Extension Form 2025

Printable Irs Extension Form 2025

Printable IRS Extension Form 2025 is the form you need to fill out to request an extension for filing your federal income tax return. This form allows you to extend the deadline for filing your tax return until October 15th. By submitting this form, you can buy yourself more time to gather all necessary documentation and ensure your tax return is accurate and complete.

When completing the IRS Extension Form 2025, you will need to provide your name, address, Social Security number, and an estimate of your total tax liability for the year. It is important to be as accurate as possible when estimating your tax liability to avoid underestimating and facing penalties for late payment.

Once you have filled out the form, you can submit it electronically or mail it to the IRS. It is recommended to file for an extension as soon as you realize you will not be able to meet the tax deadline to avoid any potential issues. Remember, while an extension gives you more time to file your tax return, it does not extend the deadline for paying any taxes owed.

In conclusion, if you find yourself needing more time to file your federal income tax return, Printable IRS Extension Form 2025 can help. By submitting this form, you can extend the deadline for filing your tax return and avoid late filing penalties. Just remember to estimate and pay any taxes owed by the original deadline to stay in compliance with IRS regulations.