As tax season approaches, many individuals and businesses are required to pay estimated taxes to the IRS throughout the year. Estimated tax forms are used to report and pay these taxes on a quarterly basis to avoid penalties and interest charges. While the process may seem daunting, printable IRS estimated tax forms make it easier for taxpayers to stay compliant and organized.

With printable IRS estimated tax forms, individuals and businesses can easily access and complete the necessary paperwork to report their estimated tax payments. These forms typically include information such as income, deductions, credits, and tax liability for the year. By filling out these forms accurately and timely, taxpayers can avoid potential issues with the IRS and ensure they are meeting their tax obligations.

Printable Irs Estimated Tax Forms

Printable Irs Estimated Tax Forms

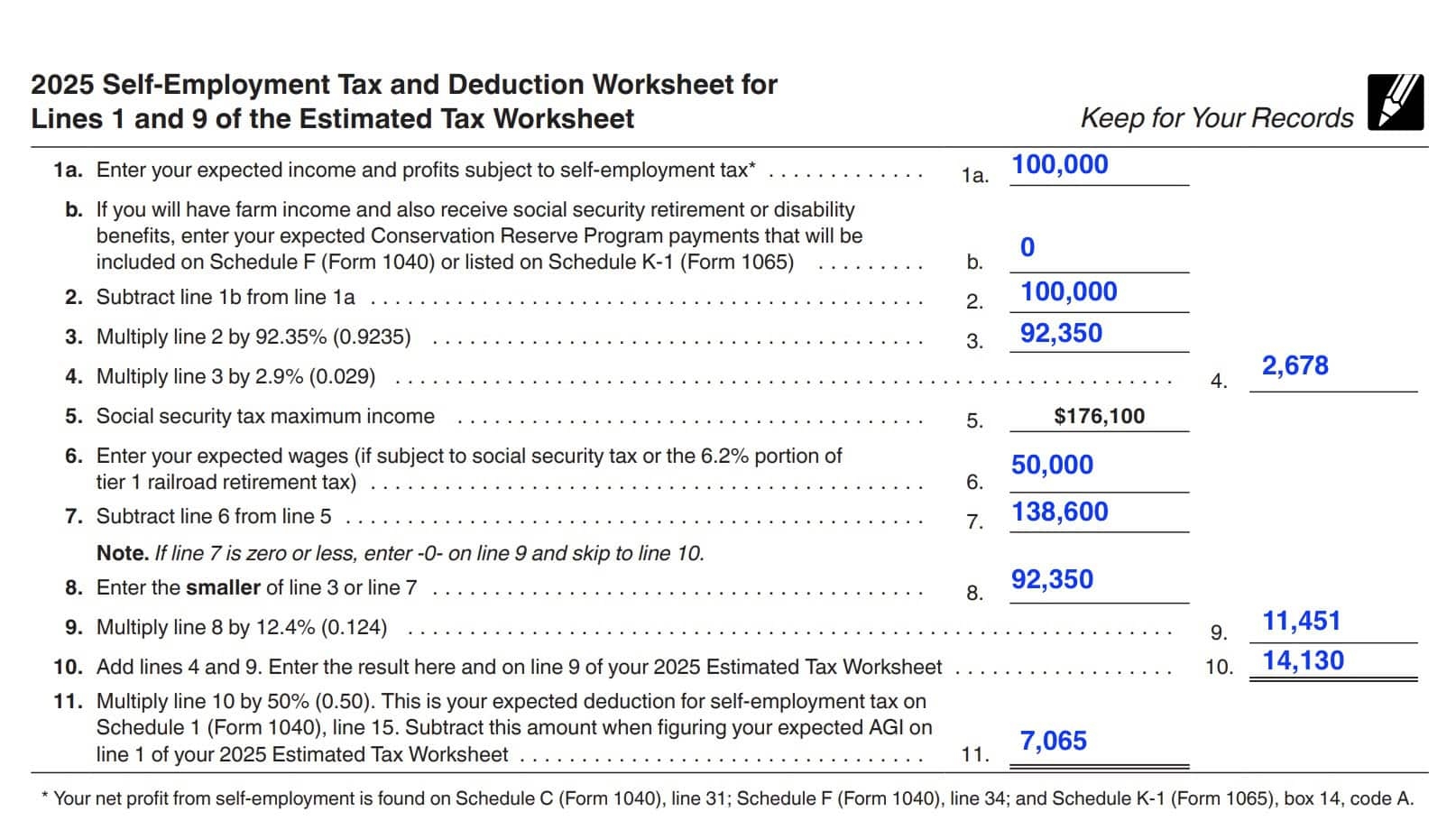

One of the most commonly used IRS estimated tax forms is Form 1040-ES, which is used by individuals who are self-employed, have income from sources other than wages, or do not have taxes withheld from their paychecks. This form allows taxpayers to calculate and report their estimated tax payments for the year, including any self-employment tax and additional Medicare tax. By using printable Form 1040-ES, individuals can easily track their estimated tax payments and stay on top of their tax obligations.

In addition to Form 1040-ES, businesses may also need to use Form 1120-W to report and pay their estimated taxes. This form is used by corporations to calculate their estimated tax liability for the year and make quarterly payments to the IRS. By using printable Form 1120-W, businesses can ensure they are meeting their tax obligations and avoid penalties for underpayment of estimated taxes.

Overall, printable IRS estimated tax forms are a valuable resource for individuals and businesses to stay compliant with their tax obligations. By using these forms to report and pay their estimated taxes accurately and timely, taxpayers can avoid penalties and interest charges from the IRS. With easy access to printable forms online, taxpayers can stay organized and on track with their estimated tax payments throughout the year.

So, whether you are a self-employed individual or a corporation, make sure to utilize printable IRS estimated tax forms to simplify the process of reporting and paying your estimated taxes. By staying proactive and informed, you can avoid potential issues with the IRS and ensure you are meeting your tax obligations for the year.