As tax season approaches, it’s important to make sure you have all the necessary forms in order to accurately report your income to the IRS. One such form is the IRS 1099 form, which is used to report various types of income other than wages, salaries, and tips. Having a printable version of this form can make the process much easier and convenient.

Whether you’re a freelancer, independent contractor, or have received income from sources other than a traditional employer, you may need to fill out a 1099 form. By having a printable version of this form readily available, you can quickly and easily report your income without any hassle.

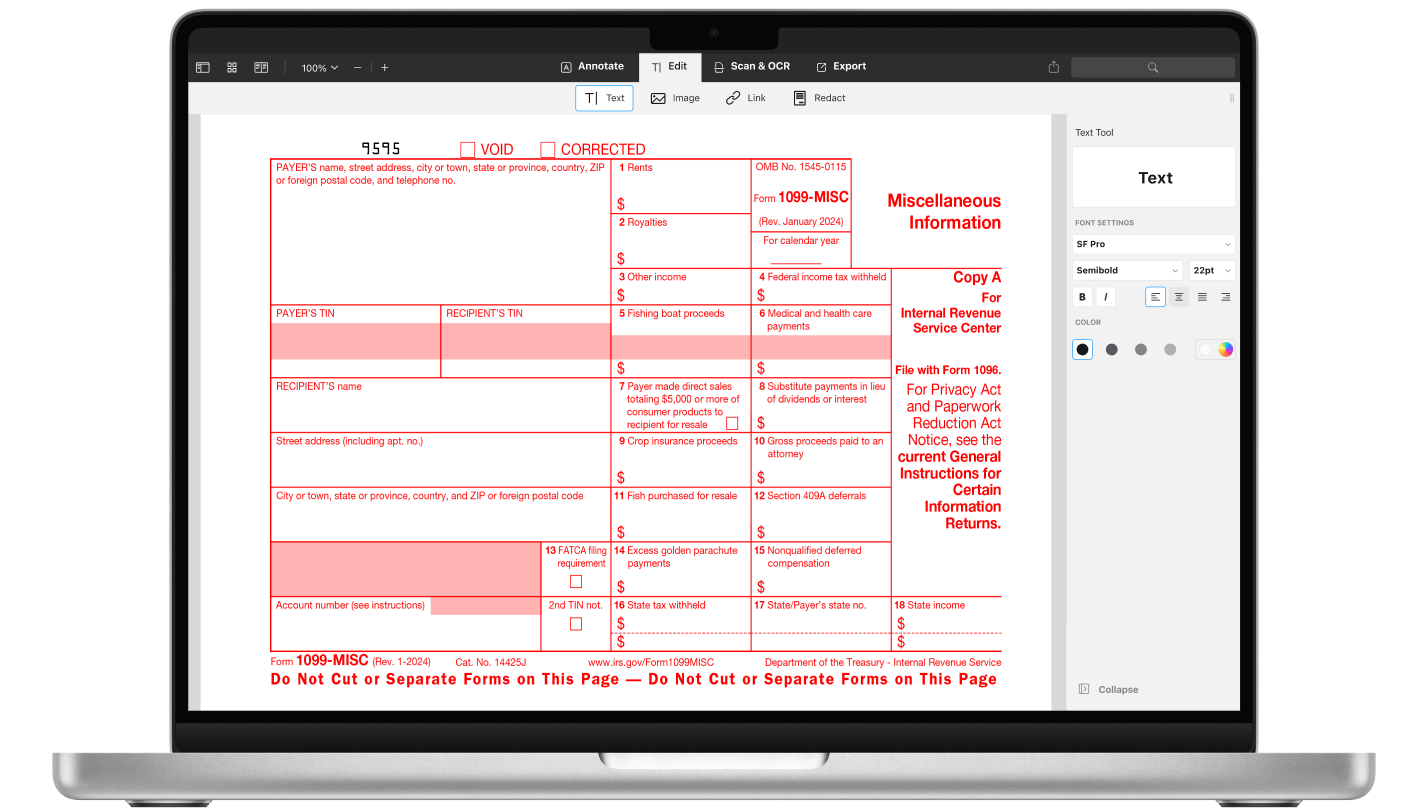

Printable IRS 1099 Form

One of the advantages of using a printable IRS 1099 form is the convenience it offers. Instead of having to wait for a physical copy to arrive in the mail, you can simply download and print the form from the IRS website. This can save you time and ensure that you have all the necessary paperwork in order to file your taxes accurately.

Additionally, having a printable IRS 1099 form allows you to fill it out at your own pace and in the comfort of your own home. You can take your time to review all the information and ensure that it is accurate before submitting it to the IRS. This can help prevent any errors or discrepancies that could lead to penalties or fines.

Furthermore, a printable IRS 1099 form can be easily stored and accessed for future reference. By keeping a digital copy on your computer or in a secure online storage system, you can quickly refer back to it in case you need to provide proof of income for any reason. This can help streamline the process and eliminate the need to search for physical copies of the form.

In conclusion, having a printable IRS 1099 form can make the tax-filing process much simpler and more convenient. By downloading and printing this form, you can ensure that you have all the necessary documentation to accurately report your income to the IRS. So, don’t wait until the last minute – get your printable IRS 1099 form today and stay ahead of the tax season!