As tax season approaches, many individuals are starting to gather their financial documents and prepare to file their taxes. One crucial form that most taxpayers will need to fill out is the IRS 1040 form. This form is used to report an individual’s income, deductions, and credits for the year, and ultimately determine how much tax is owed or refunded.

For those who prefer to file their taxes by mail rather than electronically, having a printable IRS 1040 form on hand is essential. This form can be easily downloaded from the IRS website or obtained from a local tax office. Having a physical copy of the form allows individuals to carefully review and fill out their tax information before submitting it to the IRS.

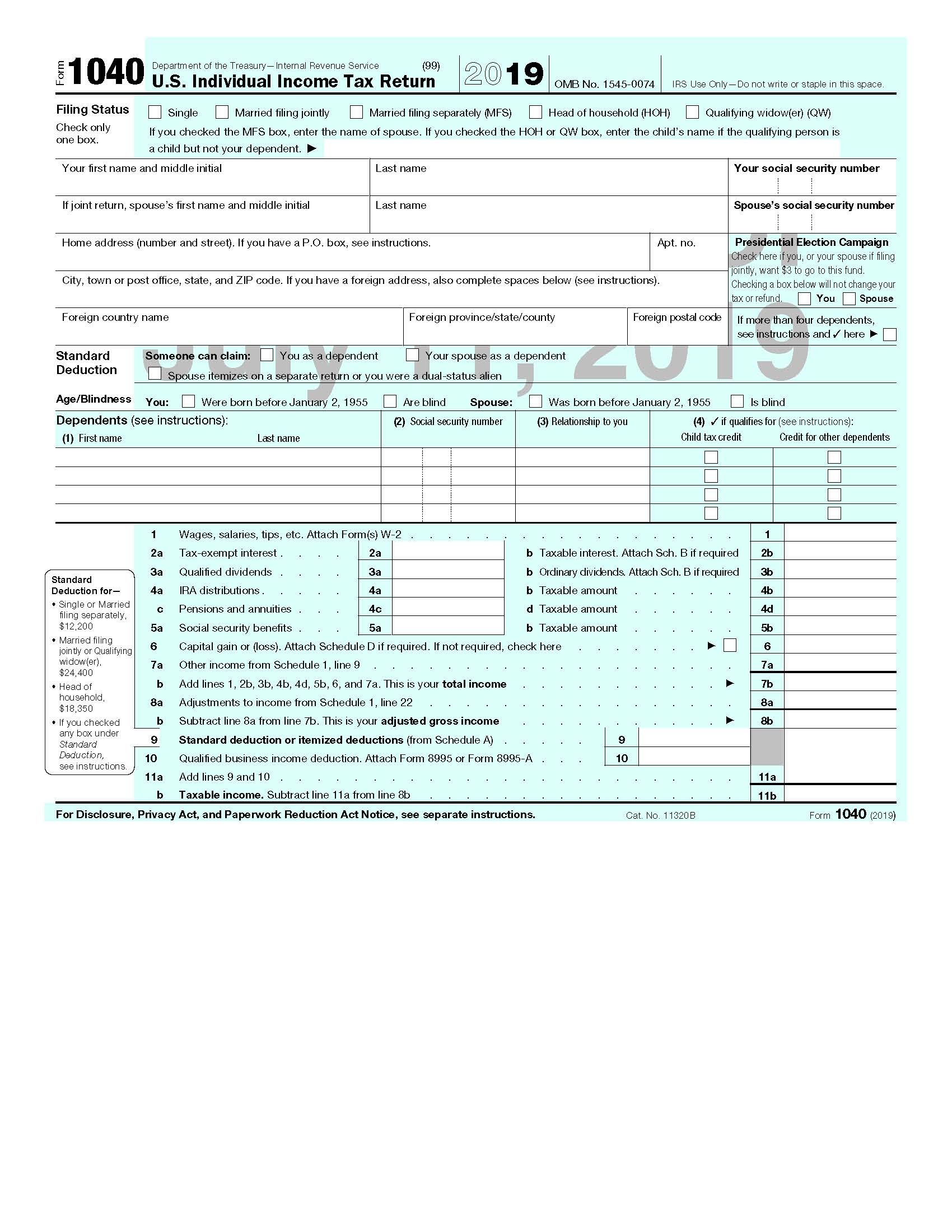

Printable IRS 1040 Form

When filling out the IRS 1040 form, it is important to double-check all information to ensure accuracy. Any errors or missing information could result in delays in processing your tax return or potential penalties from the IRS. The form includes sections for personal information, income, deductions, tax credits, and ultimately calculating your tax liability or refund.

It is also important to note that there are different versions of the IRS 1040 form, depending on your filing status and sources of income. For example, there is a 1040EZ form for those with simple tax situations, as well as a 1040A form for individuals with more complex tax situations but who do not itemize deductions. It is crucial to use the correct form to accurately report your tax information.

Once you have completed the IRS 1040 form, be sure to sign and date it before submitting it to the IRS. If you are mailing your tax return, it is recommended to send it via certified mail to ensure it is received by the deadline. Alternatively, you can file your taxes electronically using tax preparation software or through a professional tax preparer.

In conclusion, having a printable IRS 1040 form is essential for individuals who prefer to file their taxes by mail. By carefully filling out the form and double-checking all information, you can ensure a smooth tax filing process and potentially maximize your tax refund. Remember to file your taxes by the deadline to avoid any penalties or interest from the IRS.