When tax season rolls around, it’s important to have all the necessary forms in order to accurately file your taxes. One form that many individuals may need is the interest income tax form. This form is used to report any interest income earned throughout the year, such as interest from bank accounts, savings accounts, or investments.

Having a printable interest income tax form on hand can make the tax filing process much easier. Instead of having to wait for the form to arrive in the mail, you can simply print it out from the comfort of your own home. This can save you time and ensure that you have all the necessary documents ready when it’s time to file your taxes.

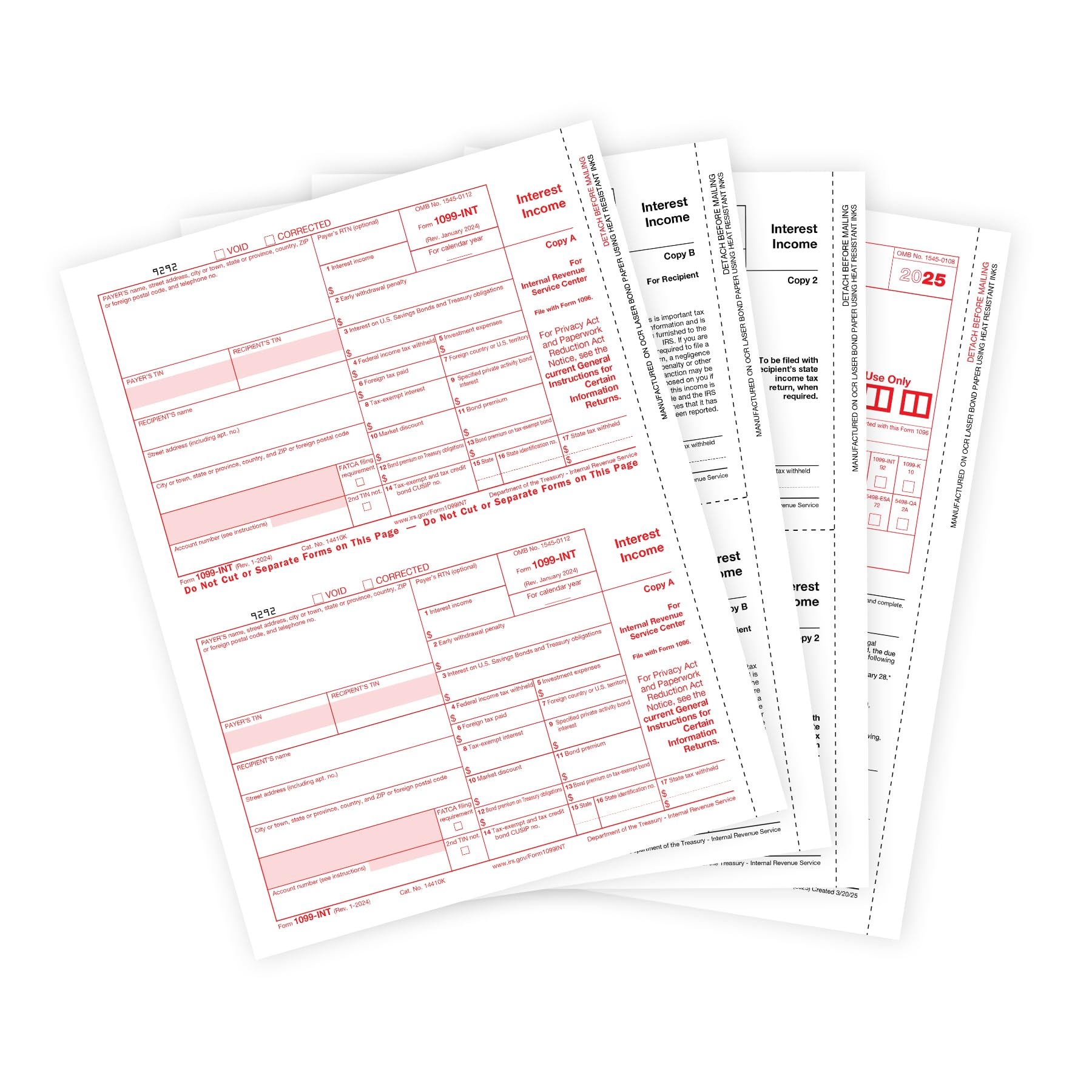

Printable Interest Income Tax Form

Printable Interest Income Tax Form

Printable Interest Income Tax Form

When filling out the printable interest income tax form, you will need to provide information such as your name, address, social security number, and the amount of interest income you earned during the year. You will also need to report any taxes that were withheld from your interest income, as well as any additional income that may need to be reported on the form.

It’s important to accurately report your interest income on your tax return to avoid any penalties or fines from the IRS. Failing to report this income can result in serious consequences, so it’s crucial to take the time to fill out the form correctly and completely.

Once you have filled out the printable interest income tax form, you can either mail it in along with your tax return or file it electronically, depending on your preferred method of filing. Be sure to keep a copy of the form for your records, as well as any other supporting documents that may be needed in the event of an audit.

By using a printable interest income tax form, you can streamline the tax filing process and ensure that you are accurately reporting all of your income. This can help you avoid any issues with the IRS and make the tax season a little less stressful. So be sure to download and print out your interest income tax form today to get started on filing your taxes!

In conclusion, having a printable interest income tax form can make the tax filing process much easier and more convenient. By accurately reporting your interest income, you can avoid any potential penalties or fines and ensure that your taxes are filed correctly. So don’t wait until the last minute – make sure you have all the necessary forms ready to go when tax season rolls around!