As tax season approaches, many individuals and businesses are gearing up to file their income tax returns. One of the most important steps in this process is obtaining the necessary forms to accurately report your income and deductions. Fortunately, the IRS provides printable income tax forms that can be easily accessed and filled out at your convenience.

By utilizing printable income tax forms, taxpayers can save time and ensure that their returns are completed accurately. These forms are available for various filing statuses, including individual, partnership, corporation, and more. Whether you are a first-time filer or a seasoned tax professional, having access to printable forms can streamline the filing process and help you meet important deadlines.

Printable Income Tax Forms

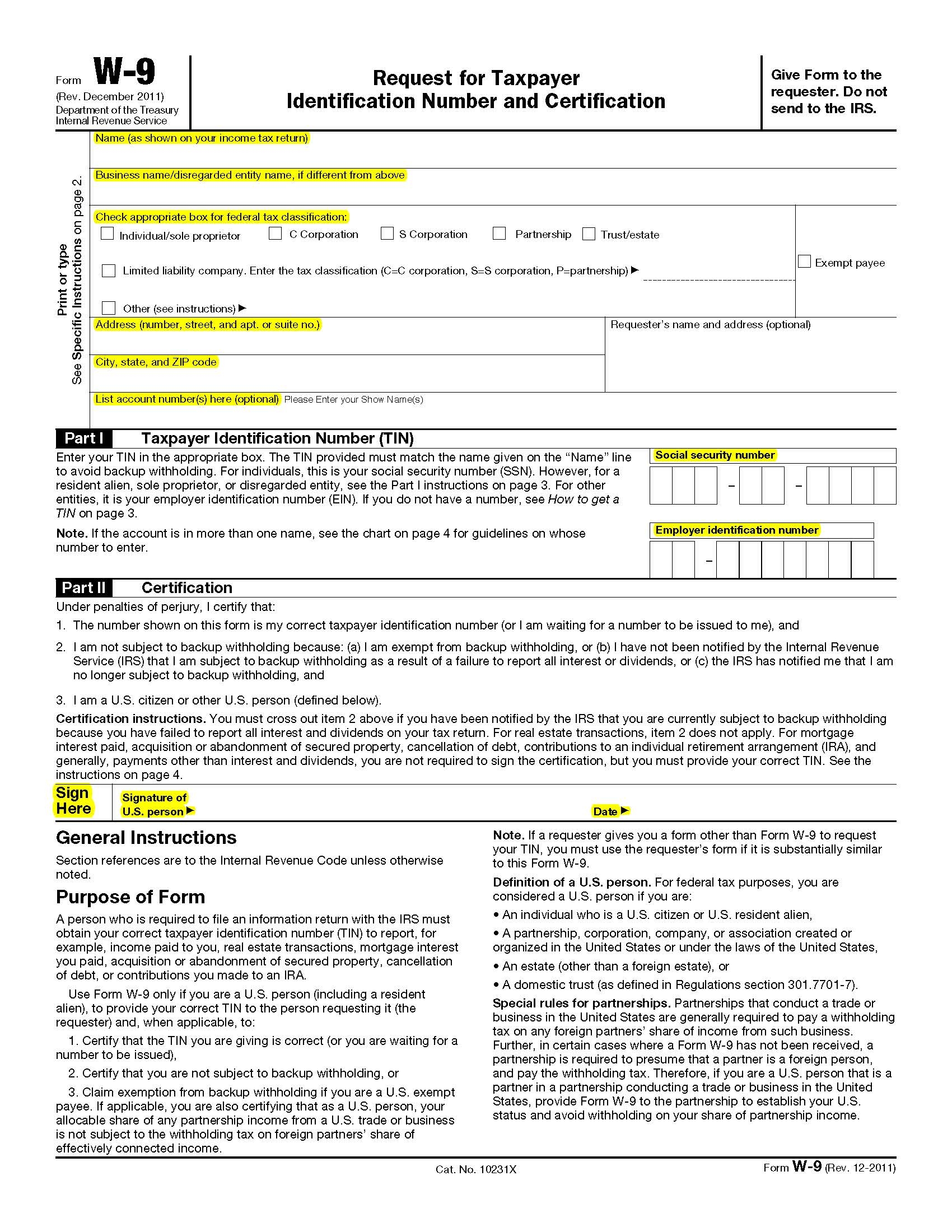

When it comes to filing your income tax return, having the right forms is essential. The IRS offers a wide range of printable forms that cater to different types of income, deductions, and credits. From Form 1040 for individual taxpayers to Form 1065 for partnerships, there is a form available for every taxpayer’s needs.

One of the benefits of using printable income tax forms is the ability to fill them out electronically. Many forms can be completed online and then printed for submission. This not only reduces the risk of errors but also speeds up the processing of your return. Additionally, printable forms are updated annually to reflect any changes in tax laws, ensuring that you are using the most current version.

For those who prefer a more traditional approach, printable forms can also be filled out by hand. Simply download the form you need, print it out, and complete the required information. This method is ideal for taxpayers who are not comfortable with electronic filing or who have complex tax situations that require detailed explanations.

In conclusion, printable income tax forms are a valuable resource for taxpayers looking to file their returns accurately and efficiently. Whether you prefer electronic or manual filing, these forms provide the flexibility and convenience needed to meet your tax obligations. By utilizing printable forms, you can navigate the tax filing process with ease and ensure that your return is submitted on time.