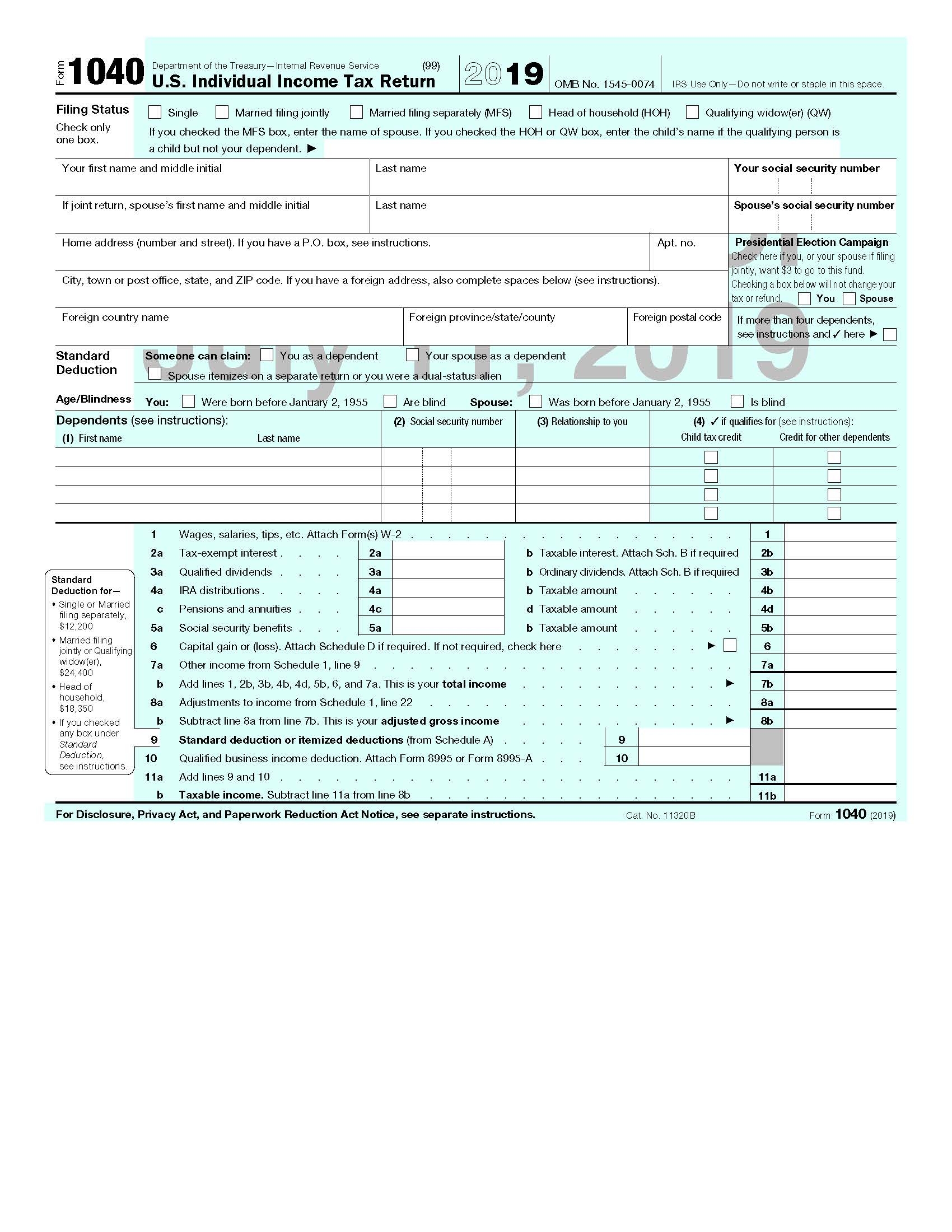

Filing taxes can be a daunting task for many individuals. However, with the availability of printable federal income tax Form 1040, the process can be made much simpler. This form is used by individuals to report their annual income and calculate the amount of tax they owe to the government.

Printable Federal Income Tax Form 1040 is an essential document that every taxpayer needs to fill out accurately and submit to the Internal Revenue Service (IRS) by the specified deadline. By using this form, taxpayers can ensure that they are complying with the tax laws and regulations set by the government.

Printable Federal Income Tax Form 1040

Printable Federal Income Tax Form 1040

When filling out the Printable Federal Income Tax Form 1040, taxpayers are required to provide information about their income, deductions, credits, and any taxes that have already been withheld. It is important to carefully review all the instructions provided on the form to avoid any errors that could result in penalties or delays in processing.

One of the advantages of using the Printable Federal Income Tax Form 1040 is that it allows taxpayers to easily calculate their tax liability and determine if they are eligible for any tax breaks or credits. By accurately filling out this form, taxpayers can minimize their tax burden and maximize their potential refund.

Overall, Printable Federal Income Tax Form 1040 is a valuable tool that simplifies the tax filing process for individuals. By utilizing this form and following the instructions provided, taxpayers can ensure that they are meeting their obligations to the government while also taking advantage of any potential tax benefits available to them.

So, if you are looking to file your taxes accurately and efficiently, be sure to utilize the Printable Federal Income Tax Form 1040. By doing so, you can streamline the tax filing process and avoid any potential issues with the IRS.