When making a donation to a charitable organization, it is important to keep track of your contribution for tax purposes. One way to do this is by using a printable donation receipt form. This form allows you to document the details of your donation, including the amount given, the date of the donation, and the name of the organization receiving the donation.

Printable donation receipt forms are easy to use and can be found online for free. By using a printable form, you can ensure that you have all the necessary information in one place to provide to the IRS when it comes time to file your taxes.

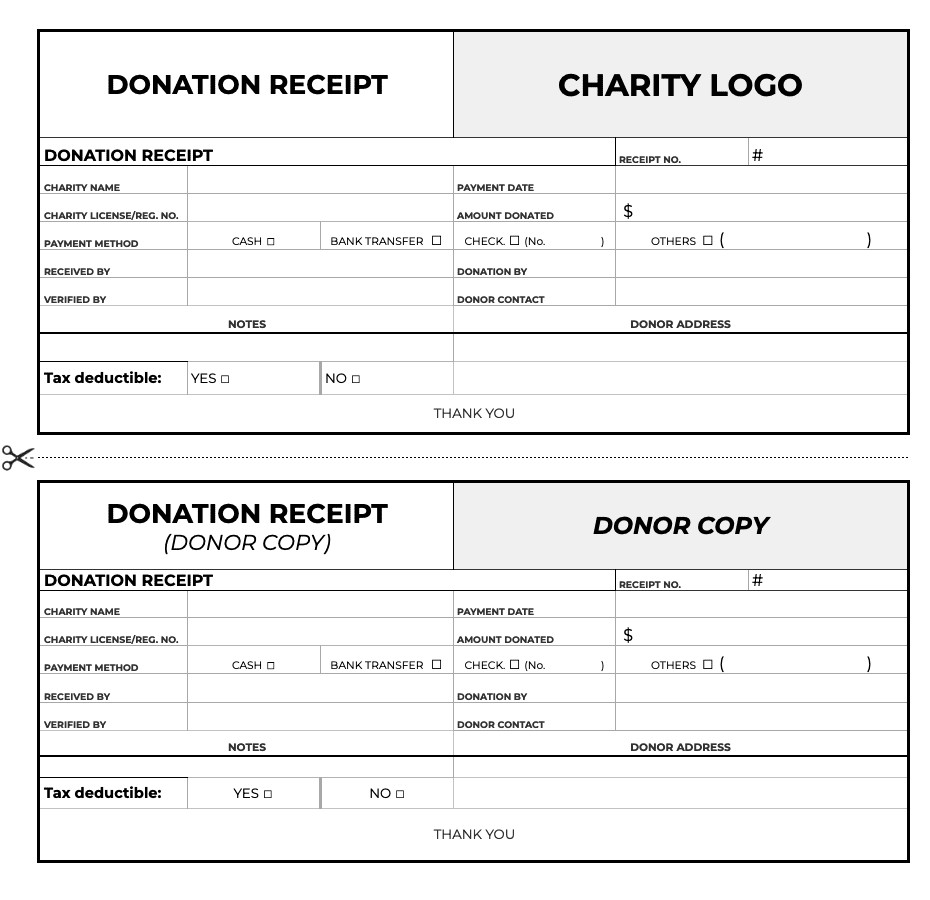

Printable Donation Receipt Form

Printable Donation Receipt Form

When filling out a printable donation receipt form, be sure to include your name and contact information, as well as the name of the organization you are donating to. You should also include the date of the donation, the amount given, and any specific instructions for how the donation should be used.

Having a printable donation receipt form on hand can also help you keep track of your charitable giving throughout the year. By documenting each donation as you make it, you can easily see how much you have given and to which organizations, making it easier to budget for future donations.

Overall, using a printable donation receipt form is a simple and effective way to keep track of your charitable contributions and ensure that you have the necessary documentation for tax purposes. By taking the time to fill out a receipt form each time you make a donation, you can stay organized and prepared when tax season rolls around.

So next time you make a donation, consider using a printable donation receipt form to help you keep track of your contribution and simplify the tax filing process.