Managing your finances is crucial to staying on top of your expenses and ensuring that your finances are in order. One tool that can help you keep track of your spending and account balances is a check register. A check register is a simple document that allows you to record all your transactions, including checks written, deposits made, and other withdrawals or payments.

While many people now use digital tools to manage their finances, having a physical check register can still be beneficial. It provides a tangible record of your transactions that you can refer back to at any time. Plus, it can be helpful for those who prefer to have a visual representation of their financial activities.

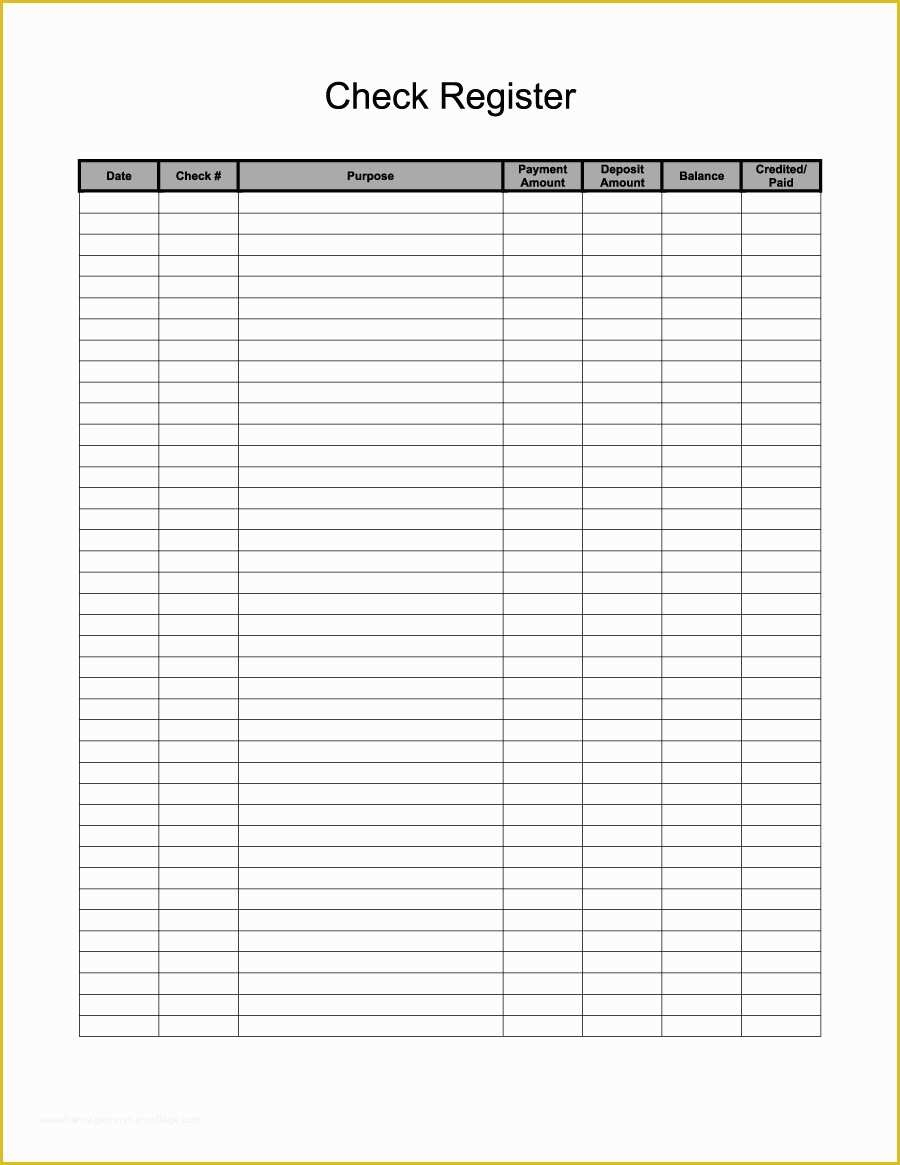

Printable Check Register For Checkbook

Printable Check Register For Checkbook

Handling employee payments doesn’t have to be difficult. A printable payroll offers a quick, accurate, and user-friendly method for tracking employee pay, hours, and taxes—without the need for complicated tools.

Stay Organized with a Printable Payroll – Straightforward & Efficient Tool!

Whether you’re a startup founder, administrator, or sole proprietor, using aprintable payroll form helps ensure proper documentation. Simply download the template, print it, and complete it by hand or type directly into the file before printing.

Printable check registers for checkbooks are readily available online and can be easily downloaded and printed for personal use. These templates typically include columns for the date, check number, description of the transaction, debit or credit amount, and running balance. By filling in this information for each transaction, you can easily keep track of your account balance and reconcile it with your bank statement.

Using a printable check register can help you avoid overdrafts, identify any unauthorized transactions, and monitor your spending habits. It can also serve as a backup in case your digital records are lost or inaccessible. Simply keep your check register updated and in a safe place along with your checkbook.

In conclusion, a printable check register for your checkbook is a handy tool for managing your finances and staying organized. Whether you prefer to track your transactions manually or alongside digital tools, having a physical record of your financial activities can provide peace of mind and help you stay on top of your financial goals.