When it comes to filing taxes, having the right forms is crucial. In Georgia, income tax forms are necessary for individuals and businesses to report their earnings and calculate their tax liability. However, finding the right forms can sometimes be a hassle. That’s where printable blank Georgia income tax forms come in handy.

Printable blank Georgia income tax forms are readily available online, making it easy for taxpayers to access and fill out the necessary documents. Whether you’re a resident of Georgia or a non-resident with income from Georgia sources, having these forms on hand can simplify the tax filing process.

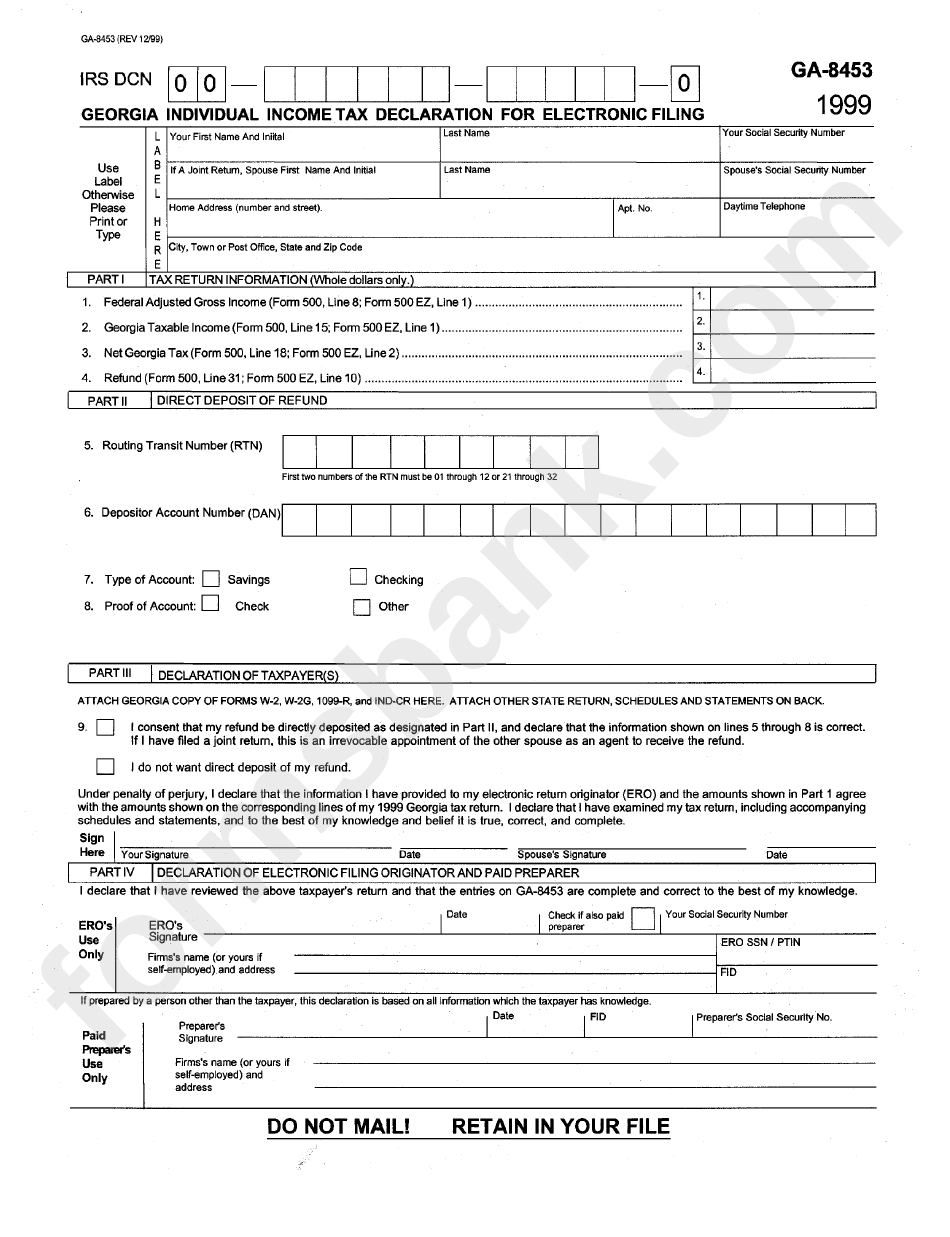

Printable Blank Georgia Income Tax Forms

Printable Blank Georgia Income Tax Forms

Printable Blank Georgia Income Tax Forms

These forms include the Georgia Individual Income Tax Return (Form 500), which is used by residents to report their income, deductions, and credits. There are also forms for non-residents and part-year residents, as well as for businesses, estates, and trusts. By using these blank forms, taxpayers can accurately report their income and ensure they’re complying with Georgia tax laws.

Additionally, printable blank Georgia income tax forms can be filled out electronically or printed and completed by hand. This flexibility allows taxpayers to choose the method that works best for them. Plus, having access to these forms online means you can easily make corrections or fill out additional forms if needed.

It’s important to note that these blank forms should be filled out accurately and completely to avoid any delays or penalties in the tax filing process. Be sure to double-check your information before submitting your forms to the Georgia Department of Revenue.

Overall, printable blank Georgia income tax forms are a valuable resource for taxpayers in the state. By having these forms on hand, you can ensure that your tax filing process goes smoothly and that you’re reporting your income correctly. So, next time tax season rolls around, make sure to have these forms ready to go.

In conclusion, printable blank Georgia income tax forms are essential for individuals and businesses to accurately report their earnings and calculate their tax liability. By using these forms, taxpayers can simplify the tax filing process and ensure they’re in compliance with Georgia tax laws. So, don’t wait until the last minute – download your blank forms today and get started on your taxes!