Alabama residents who need to file their state income taxes can easily access printable forms online. These forms are essential for individuals and businesses to report their income and calculate the amount of tax owed to the state government.

By providing printable forms, the Alabama Department of Revenue aims to simplify the tax filing process for its residents. Whether you are a full-time employee, self-employed individual, or business owner, having access to these forms makes it easier to comply with state tax laws.

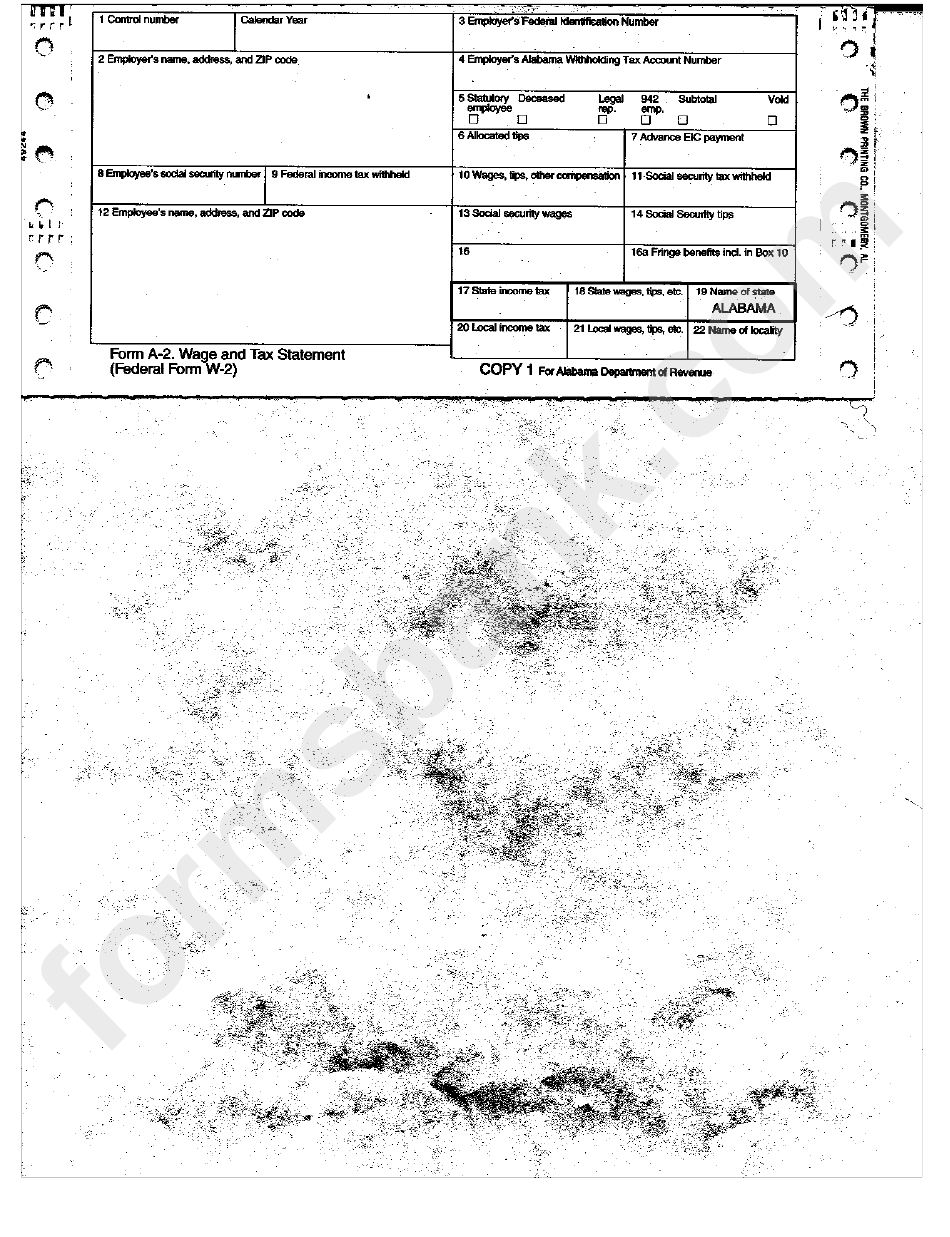

Printable Alabama Income Tax Forms

Printable Alabama Income Tax Forms

When it comes to filing your Alabama state income taxes, there are several forms that you may need to fill out. These include Form 40 (Individual Income Tax Return), Form 40NR (Nonresident Income Tax Return), Form 65 (Partnership Return of Income), and Form 20C (Corporation Income Tax Return).

In addition to these forms, there are various schedules and worksheets that may need to be completed depending on your specific tax situation. These forms and documents can be downloaded from the Alabama Department of Revenue website or obtained from local tax offices.

It is important to accurately fill out these forms and submit them by the deadline to avoid penalties and interest charges. If you need assistance with completing your tax forms or have questions about the filing process, the Alabama Department of Revenue offers resources and support to help individuals and businesses navigate the tax system.

Overall, having access to printable Alabama income tax forms makes it easier for residents to fulfill their tax obligations and ensure compliance with state tax laws. By taking the time to complete these forms accurately and on time, individuals and businesses can avoid potential issues and penalties with the state tax authorities.