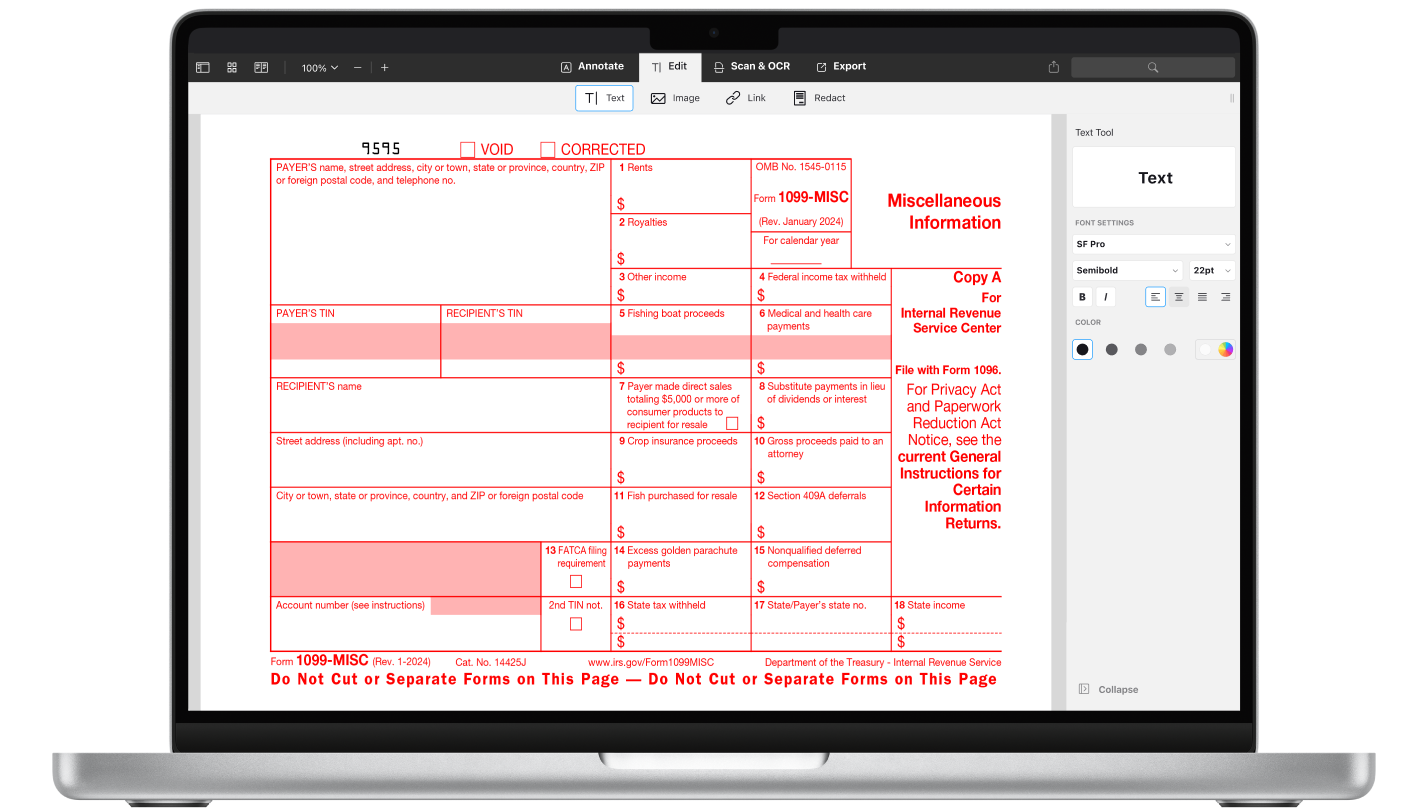

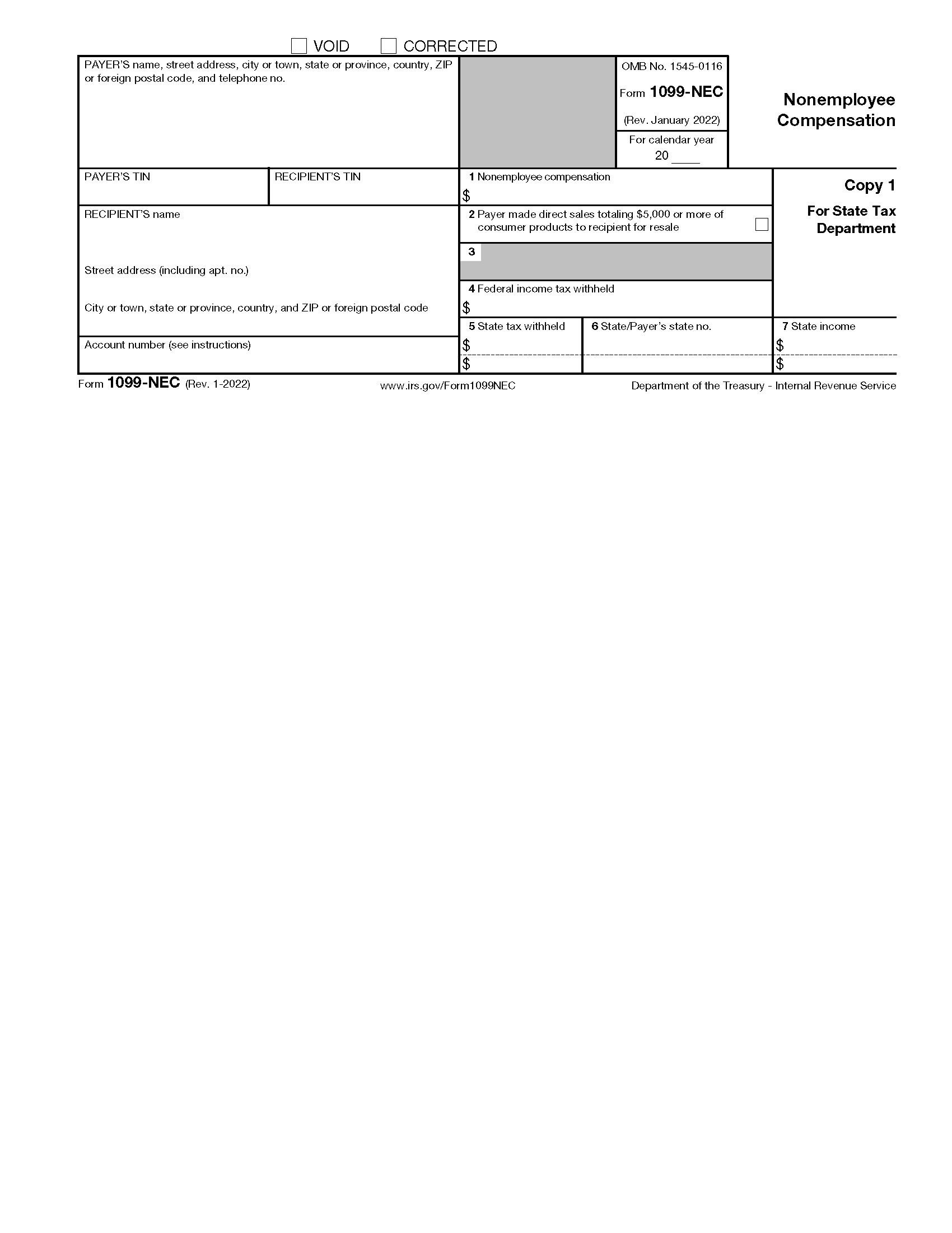

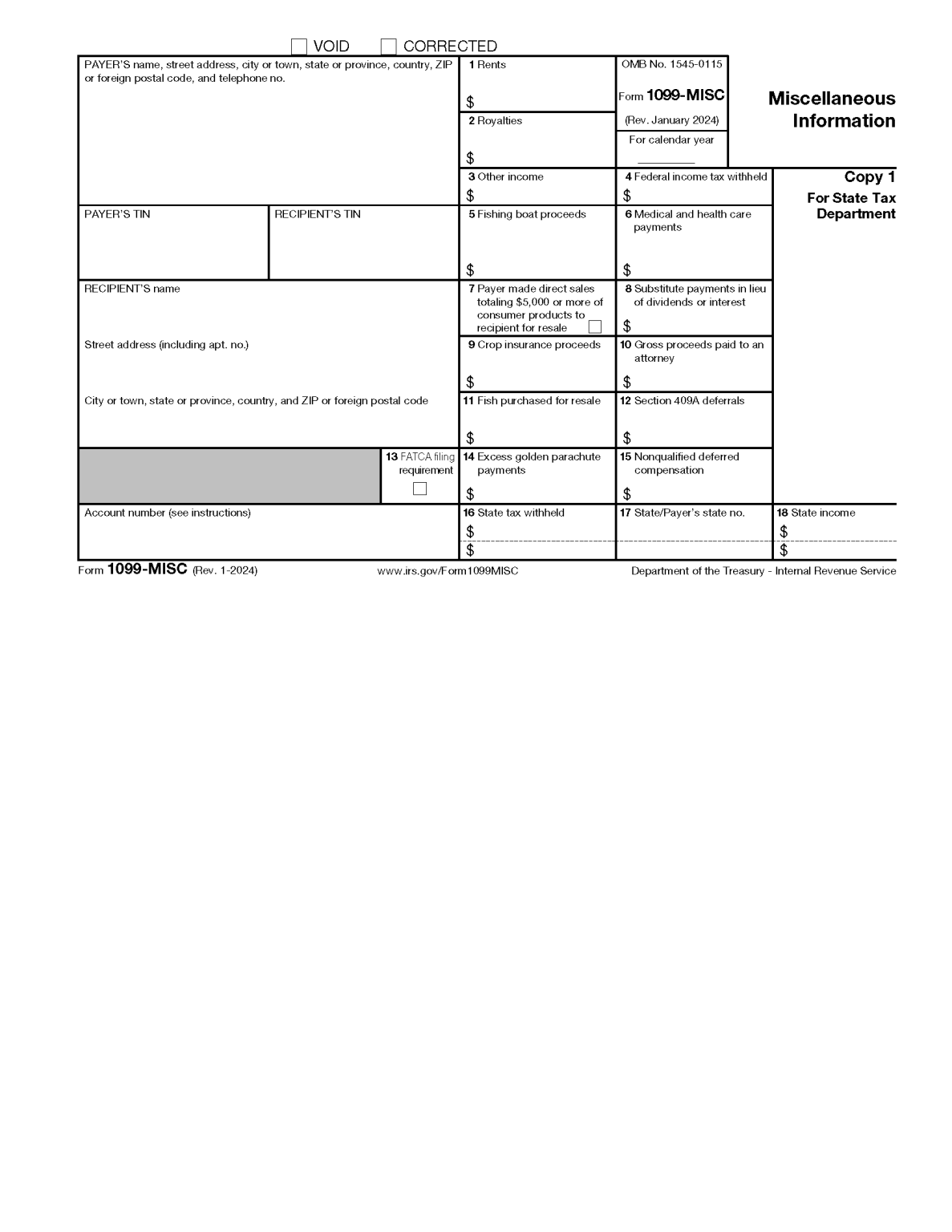

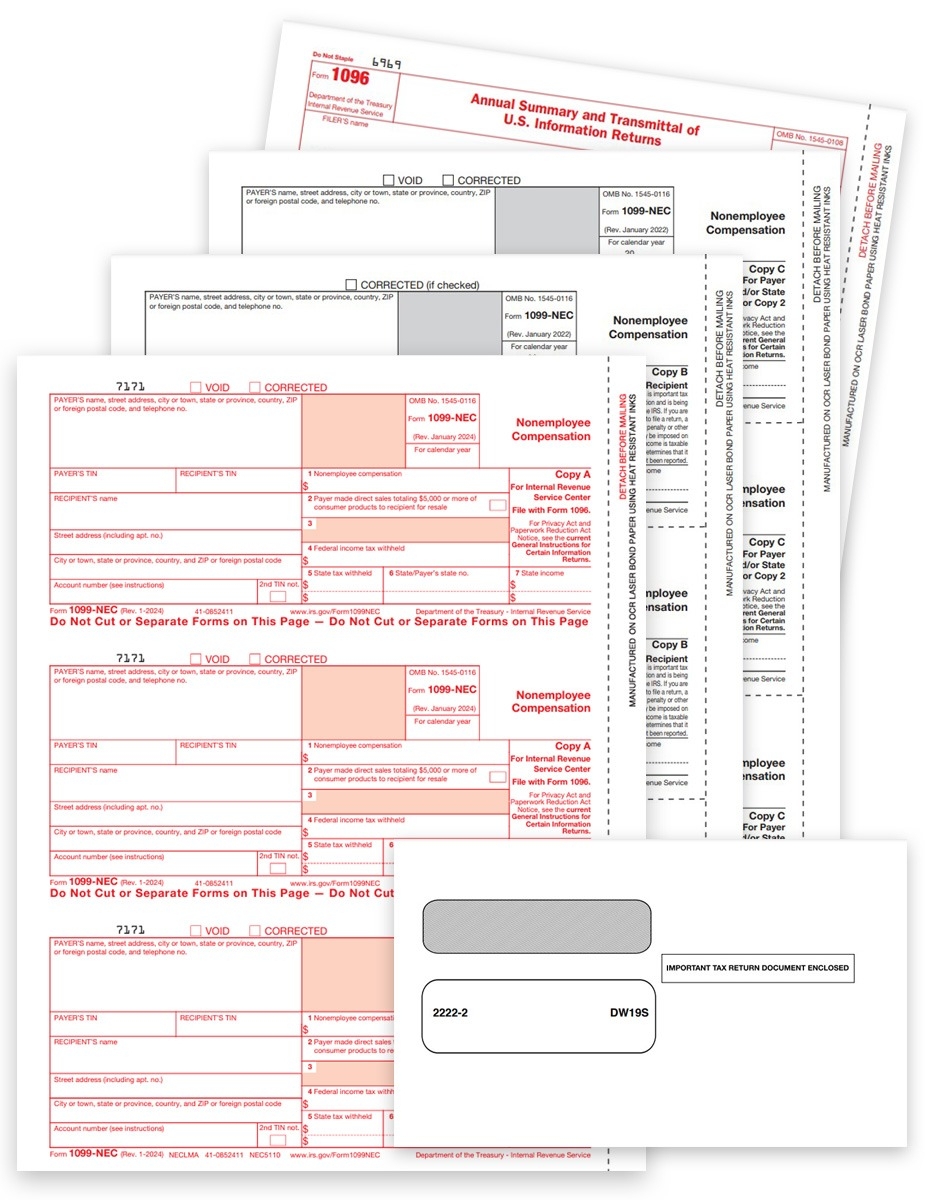

As the tax season approaches, many individuals and businesses are gearing up to file their taxes. One important aspect of this process is having access to the necessary forms. The IRS provides a wide range of forms for taxpayers to report their income, deductions, and credits accurately. For those who prefer to file their taxes on paper, having printable IRS tax forms is essential.

Printable 2025 IRS tax forms are readily available online for taxpayers to download and print at their convenience. These forms include the 1040, 1040A, and 1040EZ forms for individual taxpayers, as well as various schedules and worksheets for reporting specific types of income or deductions. Having access to these forms allows taxpayers to fill them out accurately and submit them to the IRS in a timely manner.

One of the most commonly used forms is the 1040 form, which is used by individual taxpayers to report their income, deductions, and credits for the tax year. This form is essential for calculating the amount of tax owed or the refund due. Additionally, taxpayers may need to attach additional schedules to the 1040 form, depending on their specific financial situation.

For businesses, there are also a variety of printable IRS tax forms available for download. These forms include the 1120 form for corporations, the 1065 form for partnerships, and the 990 form for tax-exempt organizations. Business owners can use these forms to report their business income, expenses, and credits accurately to the IRS.

Overall, having access to printable 2025 IRS tax forms is crucial for taxpayers who prefer to file their taxes on paper. By downloading and printing these forms, individuals and businesses can ensure that they are reporting their income and deductions accurately and avoiding any potential errors or delays in the tax filing process.

In conclusion, printable 2025 IRS tax forms are essential tools for taxpayers to report their income, deductions, and credits accurately. By downloading and printing these forms, individuals and businesses can ensure that they comply with tax laws and file their taxes in a timely manner. So, be sure to check the IRS website for the latest printable forms and start preparing for the upcoming tax season.

Quickly Access and Print Printable 2025 Irs Tax Forms

Printable payroll form are ideal for companies that prefer paper documentation or need physical copies for employee records. Most forms include fields for employee name, pay period, gross pay, taxes, and net pay—making them both complete and user-friendly.

Begin streamlining your payment tracking today with a trusted printable payroll template. Reduce admin effort, reduce errors, and maintain clear records—all while keeping your employee payment data professional.

W9 Tax Form 2025 Printable Printable W9 Form 2025

W9 Tax Form 2025 Printable Printable W9 Form 2025

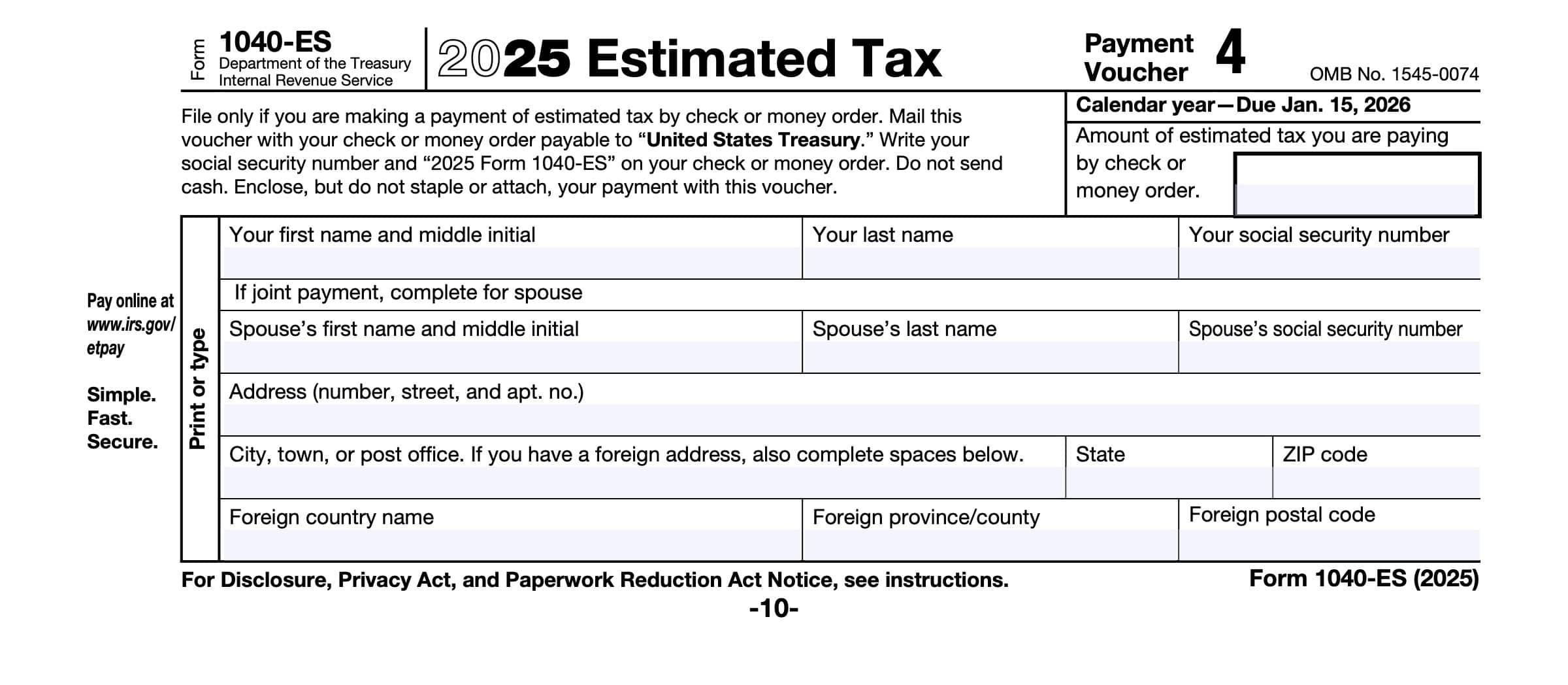

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments

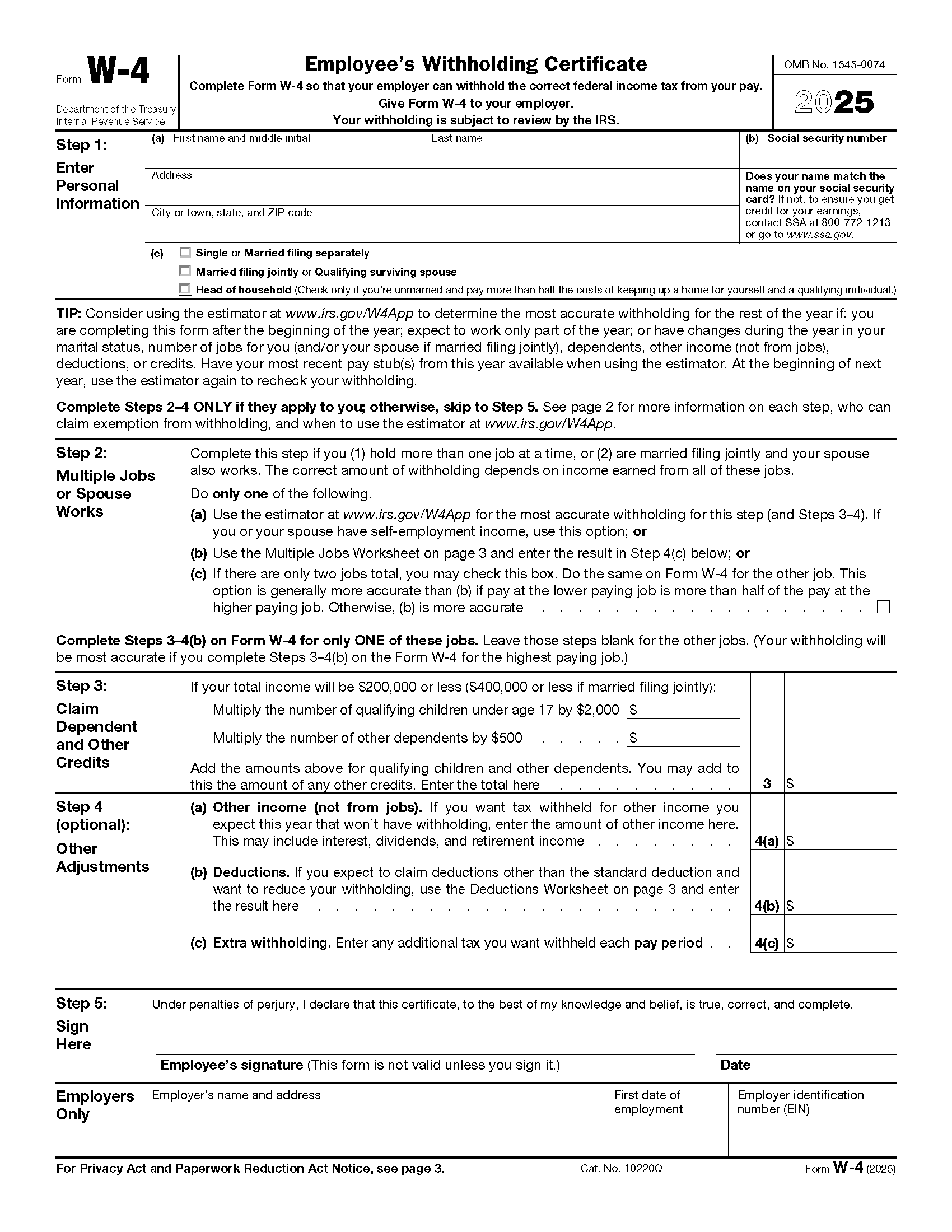

Free IRS Form W4 2024 PDF EForms

Free IRS Form W4 2024 PDF EForms

Managing payroll tasks doesn’t have to be difficult. A Printable 2025 Irs Tax Forms offers a quick, dependable, and user-friendly method for tracking salaries, shifts, and withholdings—without the need for complicated tools.

Whether you’re a startup founder, HR professional, or independent contractor, using apayroll template helps ensure proper documentation. Simply get the template, print it, and complete it by hand or type directly into the file before printing.