Are you a freelancer or independent contractor who receives income from various sources? If so, you may need to report your earnings on a 1099 Miscellaneous Income Form. This form is used to report income that is not covered by a W-2 form, such as earnings from freelance work, rental properties, or other miscellaneous sources.

It is important to accurately report all of your income to the IRS, and the 1099 Miscellaneous Income Form is a key tool in doing so. By using this form, you can ensure that you are in compliance with tax laws and avoid potential penalties for underreporting your earnings.

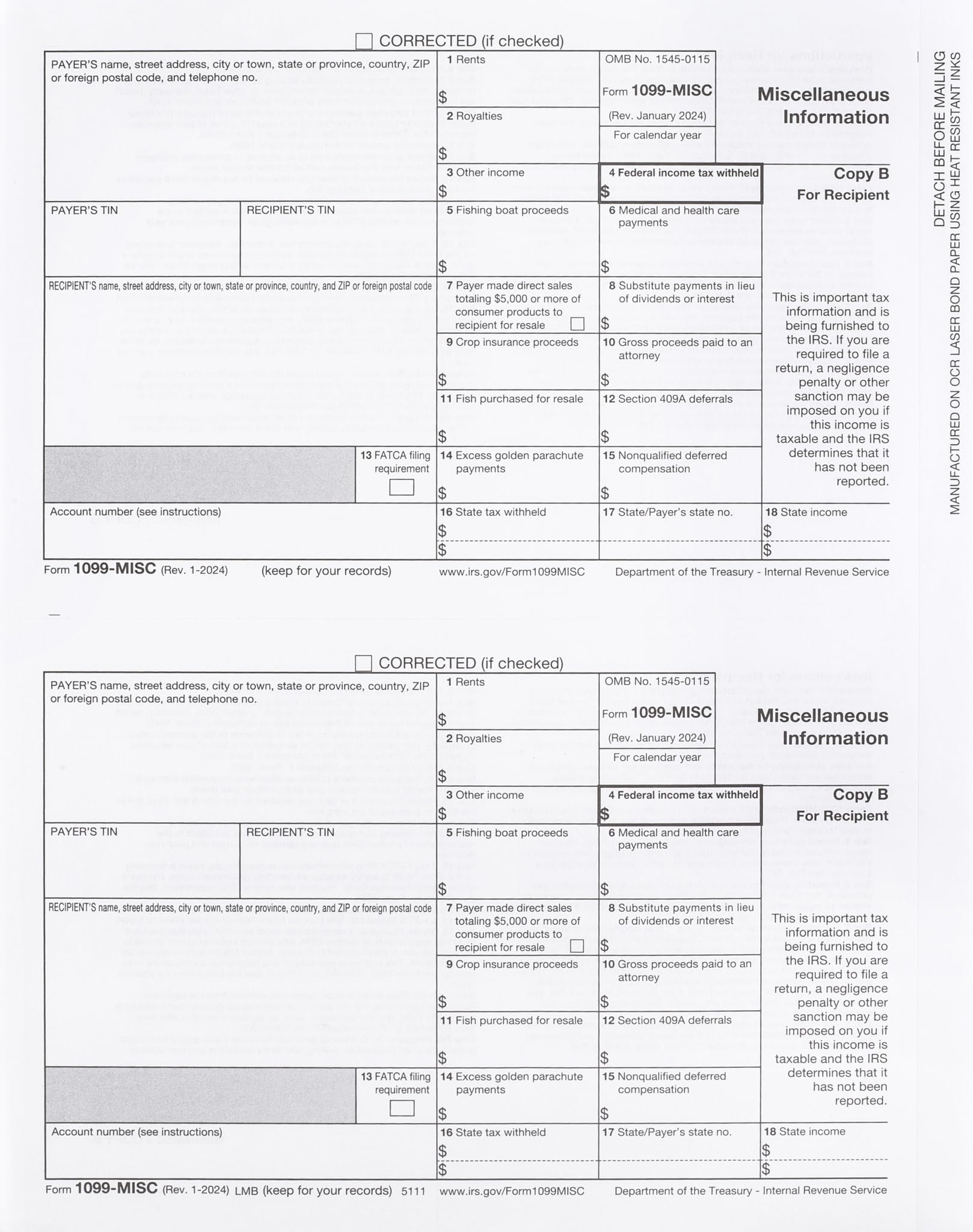

Printable 1099 Miscellaneous Income Form

Printable 1099 Miscellaneous Income Form

When it comes time to file your taxes, having a printable 1099 Miscellaneous Income Form can make the process much easier. With this form in hand, you can quickly and easily input your income information and submit it to the IRS. This can help you streamline the tax filing process and ensure that you meet all necessary deadlines.

There are many resources available online where you can find printable 1099 Miscellaneous Income Forms. These forms are typically easy to access and download, making it simple to get the documentation you need to report your income accurately. By utilizing these resources, you can save time and effort when it comes to tax preparation.

Overall, the 1099 Miscellaneous Income Form is a valuable tool for individuals who receive income from various sources. By using this form to report your earnings, you can stay in compliance with tax laws and avoid potential penalties. With printable versions of this form readily available online, you can make the tax filing process much simpler and more efficient.

Make sure to utilize a printable 1099 Miscellaneous Income Form when reporting your earnings this tax season to ensure that you are in compliance with IRS regulations.