As an independent contractor, tax season can be a stressful time as you gather all the necessary documents to file your taxes. One important form that you will need is the 1099 form, which reports the income you received from clients or companies throughout the year. Having a printable 1099 form can make the process much easier and more efficient.

Printable 1099 forms are readily available online and can be easily downloaded and printed from the comfort of your own home. These forms are specifically designed for independent contractors and include all the necessary fields for reporting your income accurately. By having a printable form on hand, you can fill it out at your convenience and ensure that all the information is correct before submitting it to the IRS.

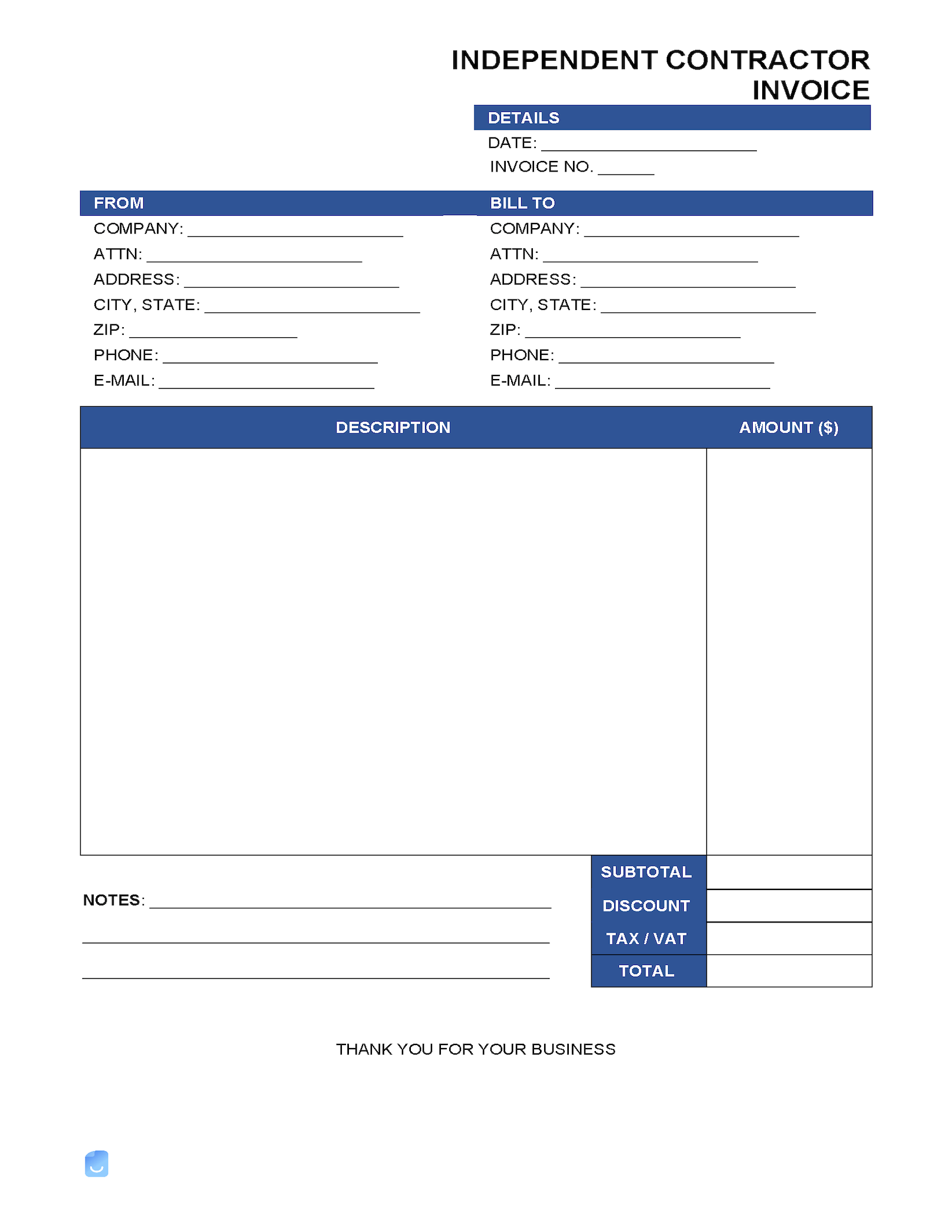

Printable 1099 Forms For Independent Contractors

Printable 1099 Forms For Independent Contractors

When searching for printable 1099 forms, be sure to choose a reputable source to ensure that the form complies with IRS regulations. Many websites offer free downloadable forms, while others may charge a small fee for access to their forms. It is important to double-check that the form includes all the required fields, such as your name, address, tax identification number, and income details.

Using a printable 1099 form can save you time and hassle during tax season, allowing you to focus on other aspects of your business. By being organized and prepared with all the necessary documents, you can streamline the tax filing process and avoid any potential errors or delays. Having a clear and accurate record of your income is crucial for staying compliant with tax laws and regulations.

In conclusion, printable 1099 forms are a valuable resource for independent contractors who need to report their income accurately to the IRS. By utilizing these forms, you can simplify the tax filing process and ensure that all the necessary information is included. Be sure to download a reputable form from a trusted source and take the time to fill it out correctly to avoid any potential issues. With a printable 1099 form in hand, you can confidently file your taxes and stay on top of your financial responsibilities as an independent contractor.