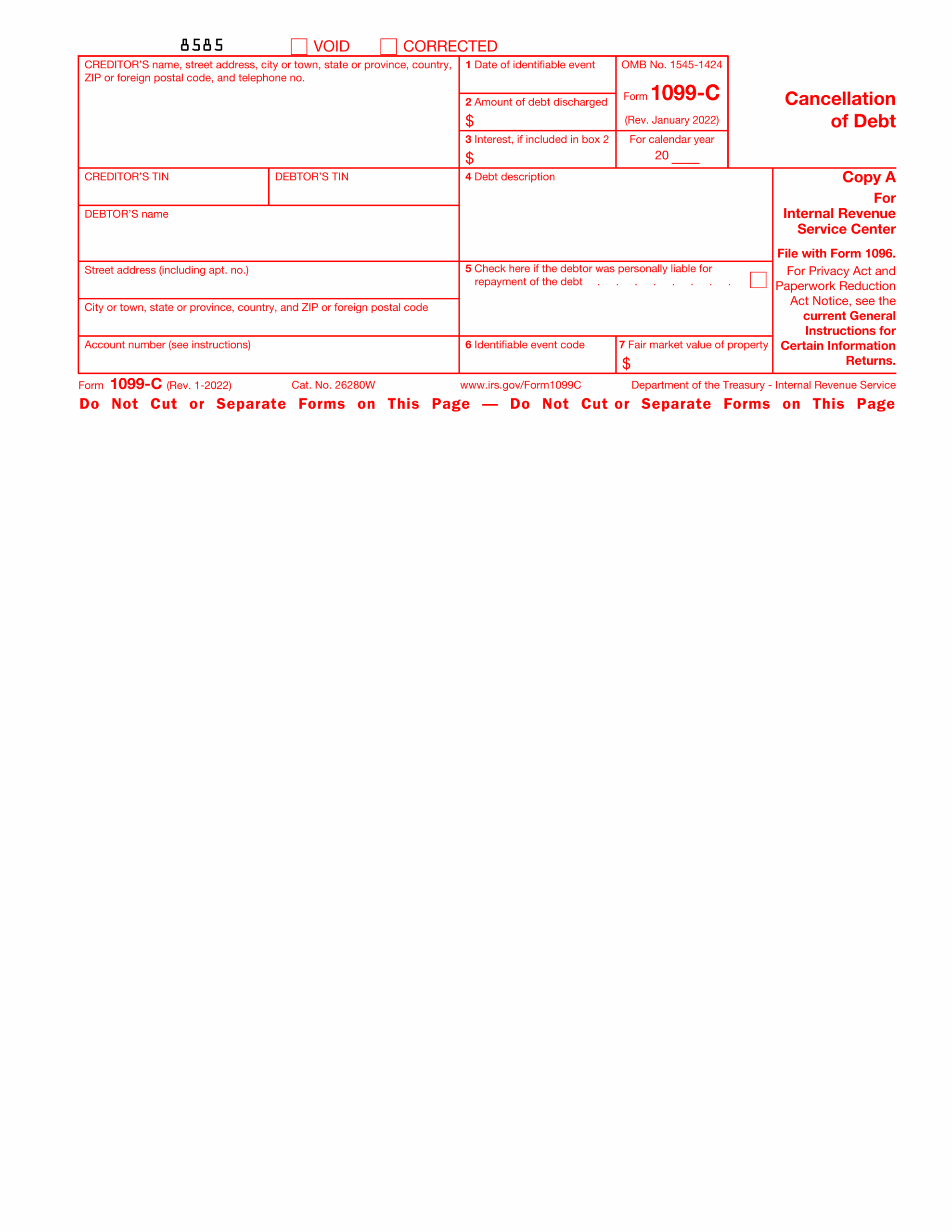

As tax season approaches, many individuals and businesses are preparing to file their annual tax returns. One crucial document that is often required is the 1099 form, which is used to report various types of income, such as self-employment earnings, interest, dividends, and more. Having a printable 1099 form in PDF format can make the process of filling out and submitting this important document much easier and more convenient.

With a printable 1099 form in PDF format, you can easily access and download the necessary form from the comfort of your own home or office. This eliminates the need to visit a tax office or wait for forms to be mailed to you, saving you time and hassle. Additionally, PDF forms are easily fillable, allowing you to enter your information directly onto the document before printing it out for submission.

Using a printable 1099 form in PDF format can also help ensure accuracy when completing your tax return. The form is typically formatted in a way that makes it easy to input the required information in the correct fields, reducing the risk of errors or omissions. This can help prevent delays in processing your return and may even help you avoid potential penalties for incorrect information.

Furthermore, having a printable 1099 form in PDF format gives you the flexibility to save and store electronic copies of your completed forms for your records. This can be especially useful if you need to refer back to your tax documents in the future or if you are audited by the IRS. Keeping digital copies of your forms can help streamline the process of managing your tax information and ensure that you have easy access to important documents when needed.

In conclusion, utilizing a printable 1099 form in PDF format can simplify the process of reporting income and filing your taxes. With the convenience of being able to download, fill out, and save electronic copies of the form, you can make the task of completing your tax return more efficient and accurate. Take advantage of this digital tool to help streamline your tax preparation and ensure that you meet all necessary reporting requirements.