Filing your taxes can be a daunting task, but with the right resources, it can be a breeze. One of the most commonly used forms for filing taxes is the 1040ez form. This form is designed for individuals with simple tax situations and can be easily filled out and submitted.

One of the main advantages of using the 1040ez form is that it is straightforward and easy to understand. It is a one-page form that requires basic information such as your income, deductions, and credits. This form is perfect for those who have no dependents, do not own a home, and have income from wages, salaries, tips, and scholarships.

Printable 1040ez Forms

If you prefer to file your taxes manually or if you simply want to have a hard copy of your tax forms, printable 1040ez forms are readily available online. You can easily download and print these forms from the IRS website or other reputable tax preparation websites. Having a physical copy of the form allows you to fill it out at your own pace and keep a record for your files.

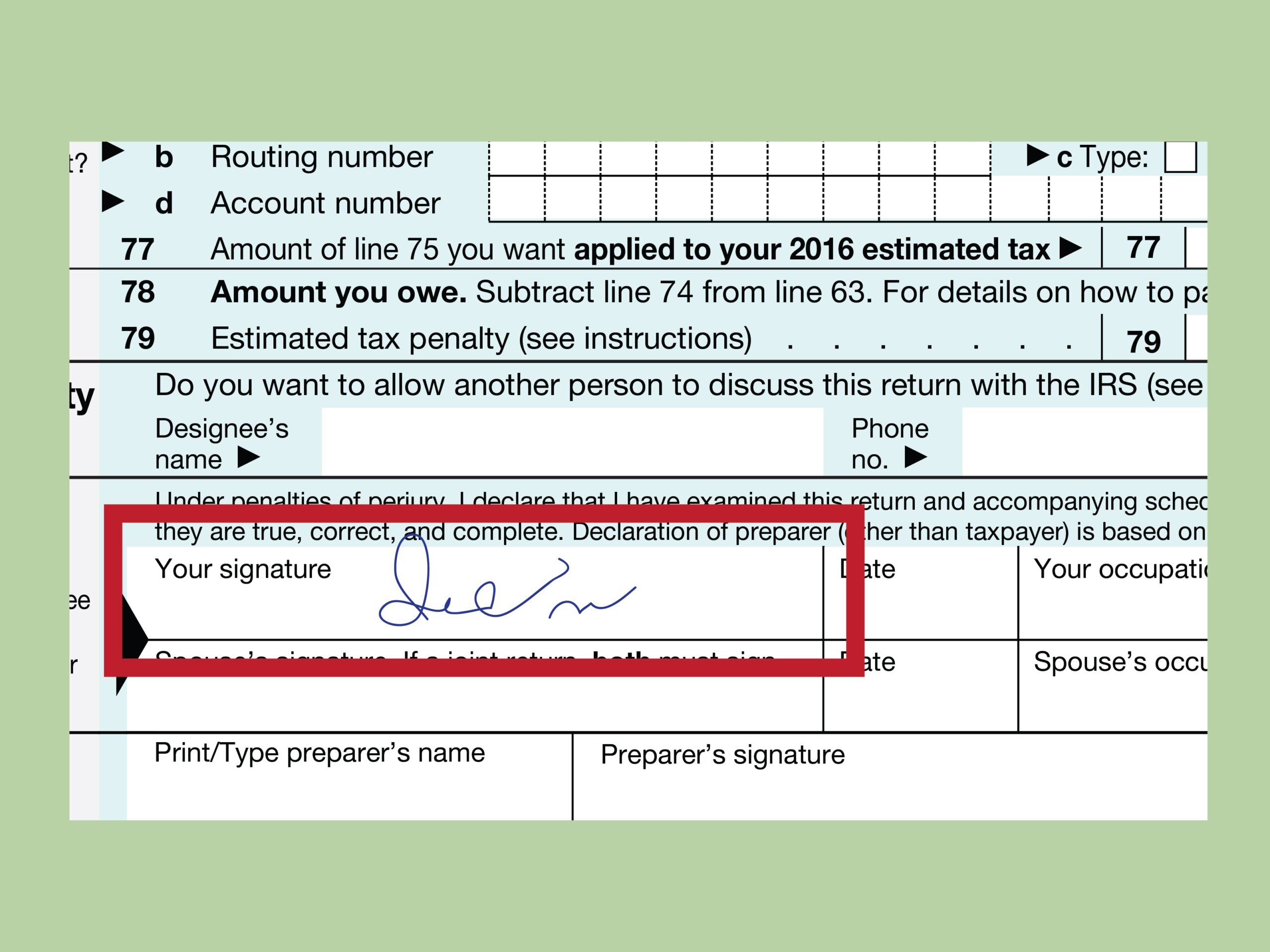

Before filling out the 1040ez form, make sure you have all the necessary documents on hand, such as your W-2 form, any 1099 forms, and records of any deductions or credits you may be eligible for. Double-check your calculations and ensure that all information is accurate before submitting your form.

Once you have completed your 1040ez form, you can either mail it to the IRS or file electronically. Filing electronically is often faster and more convenient, as you will receive confirmation that your form has been received. However, if you prefer to mail your form, be sure to send it to the correct address and include any necessary documentation.

In conclusion, printable 1040ez forms are a convenient and easy way to file your taxes. Whether you choose to file electronically or by mail, having a physical copy of the form can help you stay organized and ensure that you are providing accurate information to the IRS. By following the instructions carefully and double-checking your work, you can file your taxes with confidence using the 1040ez form.