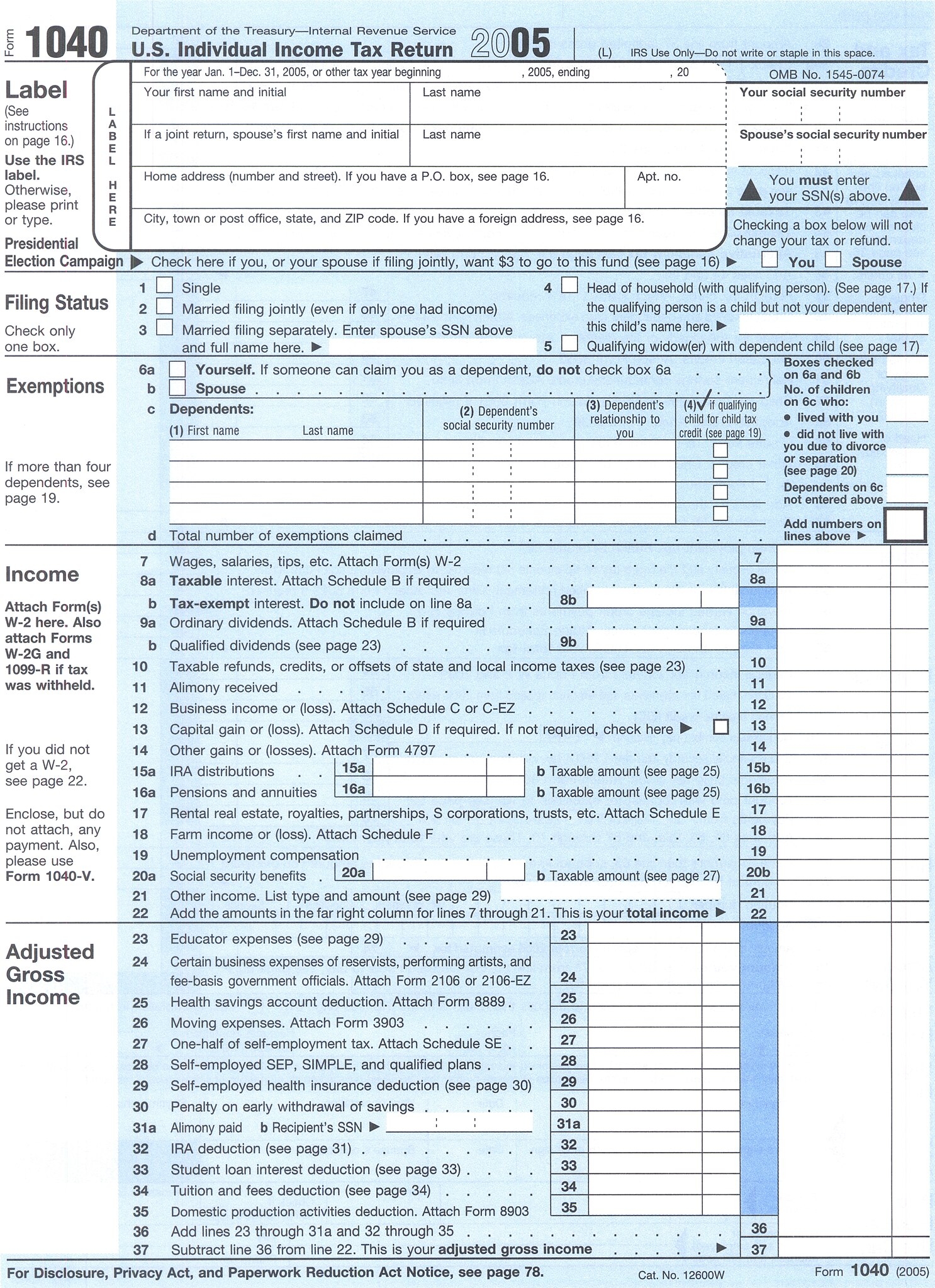

As tax season approaches, many people start thinking about filing their income taxes. One of the most common forms used to file taxes is the 1040a form. This form is used by individuals with simple tax situations and allows for various deductions and credits to be claimed. It is important to have a clear understanding of this form to ensure that you are filing your taxes correctly and maximizing your potential refund.

Printable 1040a income tax forms are readily available online for those who prefer to file their taxes manually. These forms can be easily downloaded and printed from the IRS website or other reputable tax preparation websites. Having a printable form on hand can be convenient for those who prefer to fill out their taxes by hand or for those who may not have access to online tax filing services.

Printable 1040a Income Tax Forms

Printable 1040a Income Tax Forms

Printable 1040a Income Tax Forms

The 1040a form is designed for individuals with taxable income of $100,000 or less and who do not itemize their deductions. This form allows for various adjustments to income, such as student loan interest deductions, IRA contributions, and tuition and fees deductions. It also allows for credits such as the Earned Income Tax Credit and the Child Tax Credit to be claimed.

When filling out the 1040a form, it is important to carefully follow the instructions provided and ensure that all information is accurate. Any errors or omissions could result in delays in processing your return or even potential penalties from the IRS. Double-checking your work and reviewing your form before submitting it can help prevent any mistakes.

Once you have completed your 1040a form, you can either mail it to the IRS or file electronically using an online tax preparation service. If you are expecting a refund, filing electronically can result in a faster processing time and quicker receipt of your refund. However, if you owe taxes, you may choose to mail in your form along with a check or set up a payment plan with the IRS.

In conclusion, printable 1040a income tax forms are a convenient option for those who prefer to file their taxes manually. By understanding the requirements of the form and following the instructions carefully, you can ensure that your taxes are filed accurately and efficiently. Whether you choose to file electronically or by mail, it is important to meet the tax filing deadline to avoid any potential penalties or fees.