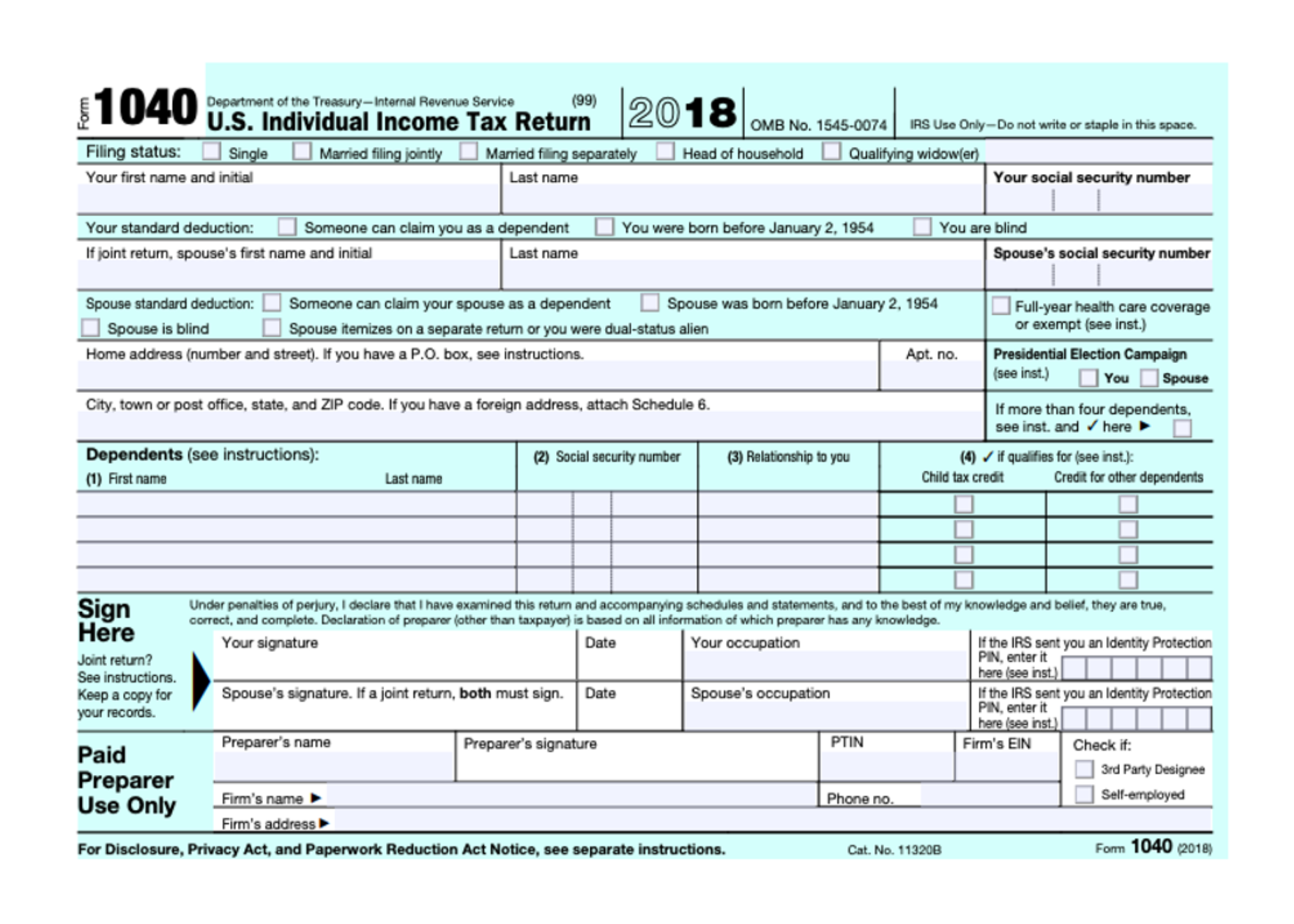

As tax season approaches, many individuals are gearing up to file their taxes. One of the most common forms that taxpayers need to fill out is the 1040 tax form. This form is used to report an individual’s income and determine how much tax they owe to the government.

For those who prefer to file their taxes the old-fashioned way, printable 1040 tax forms are readily available online. This allows individuals to fill out the form by hand and mail it to the IRS. It’s a convenient option for those who may not have access to tax preparation software or prefer to handle their taxes on their own.

When filling out the printable 1040 tax form, it’s important to double-check all information to ensure accuracy. Any mistakes or missing information can result in delays in processing or even potential audits by the IRS. It’s also essential to gather all necessary documents, such as W-2s, 1099s, and receipts, to support the information provided on the form.

One of the advantages of using the printable 1040 tax form is that it allows individuals to take their time and carefully review their tax return before submitting it. This can help prevent errors and ensure that all deductions and credits are claimed accurately. Additionally, filling out the form by hand can provide a better understanding of one’s tax situation and how taxes are calculated.

After completing the printable 1040 tax form, individuals can either mail it to the IRS or submit it electronically using IRS e-file. E-filing is a faster and more secure way to file taxes, as it eliminates the risk of lost or misplaced mail. However, for those who prefer the traditional method, mailing the form is still a valid option.

In conclusion, the printable 1040 tax form is a useful tool for individuals who prefer to file their taxes manually. It provides a straightforward way to report income, claim deductions, and calculate tax owed. Whether filing by mail or electronically, it’s important to ensure that all information is accurate and supported by the necessary documentation.