When it comes to filing your taxes, the 1040 form is one of the most important documents you will need. This form is used by individuals to report their income, deductions, and credits to the IRS. It is crucial to fill out this form accurately and completely to avoid any issues with the IRS.

For those who prefer to file their taxes manually, having access to a printable 1040 form can be very convenient. This document can be easily downloaded and printed from the IRS website, allowing individuals to fill it out by hand and mail it in.

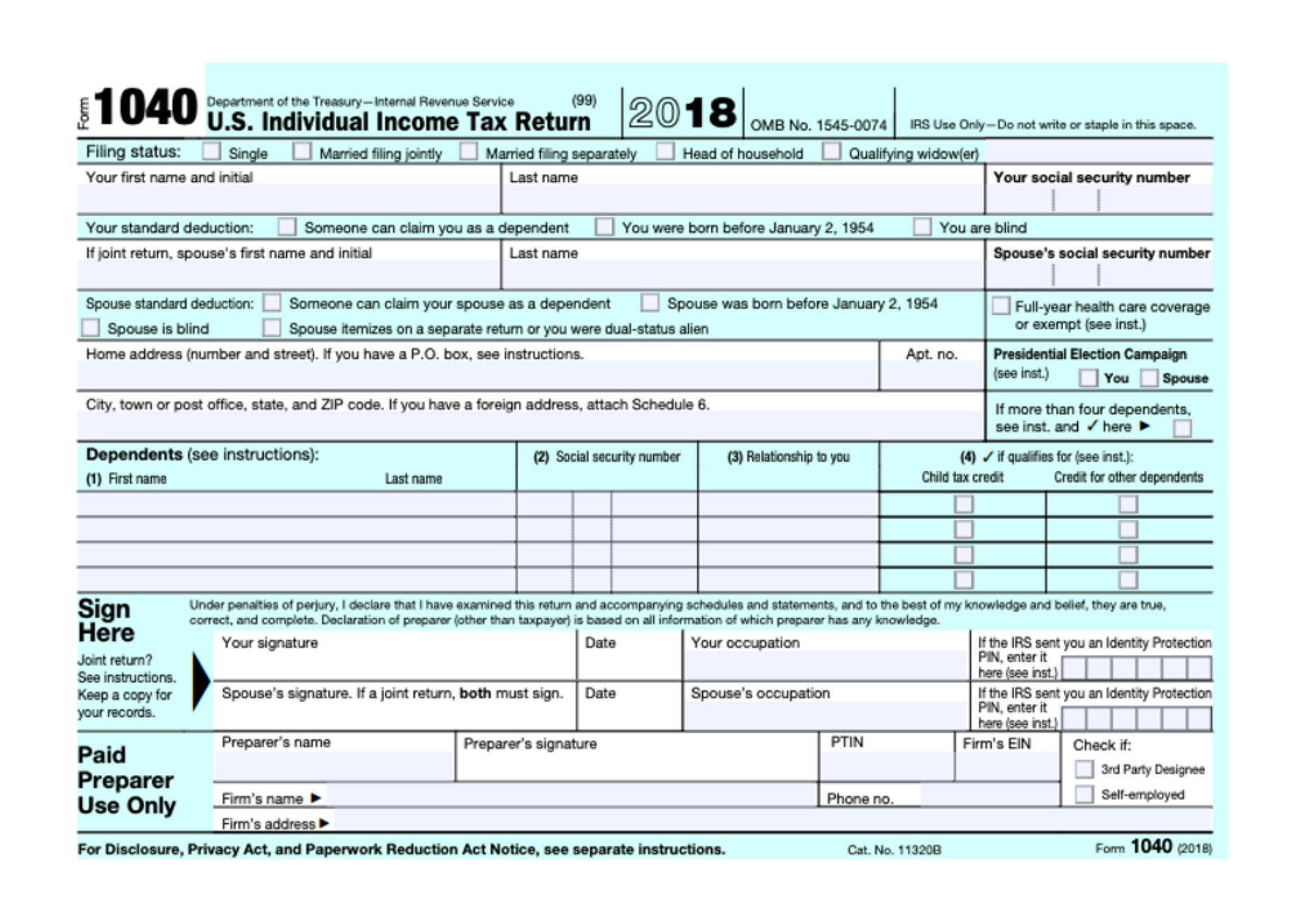

Printable 1040 Form

The printable 1040 form is available in PDF format on the IRS website. This form includes all the necessary sections for reporting income, deductions, and credits. It also provides instructions on how to fill out each section correctly, making it easier for individuals to complete their tax return accurately.

When using the printable 1040 form, it is important to double-check all the information before submitting it to the IRS. Any errors or omissions could result in delays in processing your return or even penalties from the IRS. It is recommended to review the form with a tax professional to ensure accuracy.

Another advantage of using the printable 1040 form is that it allows individuals to keep a copy of their tax return for their records. This can be helpful in case of any future audits or inquiries from the IRS. Having a physical copy of your tax return can provide peace of mind and assurance that your taxes were filed correctly.

In conclusion, the printable 1040 form is a valuable resource for individuals who prefer to file their taxes manually. This document provides all the necessary sections and instructions for accurately reporting income, deductions, and credits. By using this form and double-checking all information before submitting, individuals can ensure a smooth tax filing process.