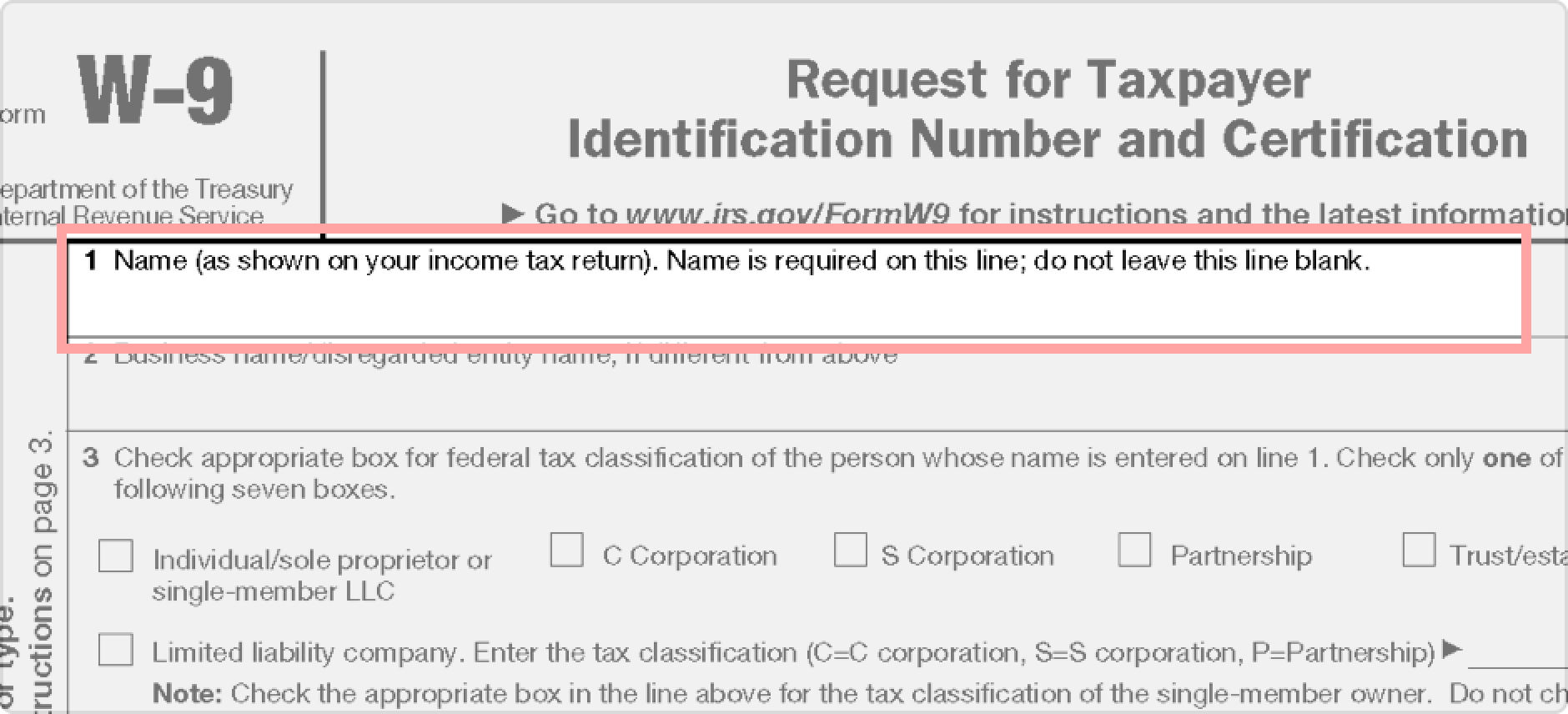

The Irs W9 Form is an essential document used for tax purposes in the United States. It is commonly requested by employers from their employees, as well as by businesses from independent contractors. The form is used to gather information about an individual or a company, such as their name, address, and taxpayer identification number (TIN).

One of the key features of the Irs W9 Form is that it is printable, making it easy to fill out and submit. This allows individuals and businesses to easily provide the necessary information required for tax reporting purposes. The form can be downloaded from the Internal Revenue Service (IRS) website or obtained from various other sources.

Irs W9 Form Printable

When filling out the Irs W9 Form, it is important to ensure that all the information provided is accurate and up to date. Any errors or discrepancies in the form can lead to delays in processing and potential legal consequences. It is recommended to carefully review the form before submitting it to avoid any issues.

Additionally, the Irs W9 Form is used to certify that the information provided is correct, under penalty of perjury. This means that individuals or businesses must attest to the accuracy of the information they provide on the form. It is important to take this certification seriously and only provide truthful information.

After filling out the Irs W9 Form, individuals or businesses can submit it to the requesting party, whether it is an employer, a business partner, or the IRS itself. It is important to keep a copy of the completed form for personal records and reference. This can be helpful in case there are any disputes or inquiries regarding the information provided.

In conclusion, the Irs W9 Form is a critical document for tax reporting purposes in the United States. Its printable format makes it easy to fill out and submit, ensuring that the necessary information is accurately provided. By following the guidelines and instructions on the form, individuals and businesses can comply with tax regulations and avoid any potential issues.