When starting a new job or experiencing a significant life change, such as getting married or having a child, it is essential to fill out an IRS W4 form. This form helps your employer determine how much federal income tax to withhold from your paycheck. By accurately completing this form, you can avoid unexpected tax bills or penalties at the end of the year.

It is crucial to update your W4 form regularly to ensure that the correct amount of taxes is being withheld from your paycheck. Failure to do so could result in owing the IRS money when you file your tax return. By filling out an IRS W4 printable form, you can make adjustments to your withholding allowances based on changes in your financial situation.

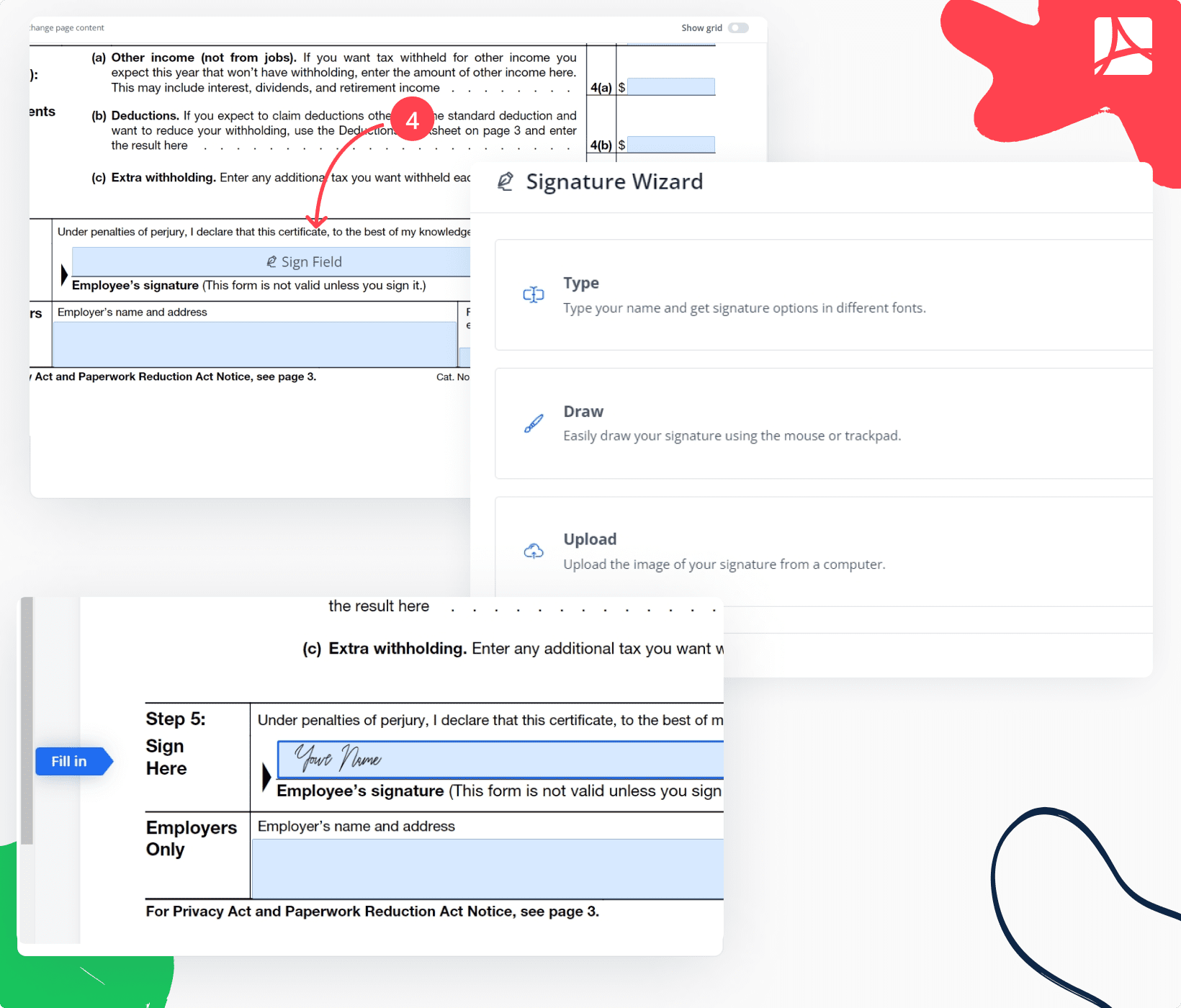

IRS W4 Printable Form

When filling out the IRS W4 form, you will need to provide information such as your filing status, number of dependents, and any additional income you may have. This information helps your employer calculate the amount of federal income tax to withhold from your paycheck. It is crucial to be accurate when completing this form to avoid under or over-withholding.

One of the advantages of the IRS W4 printable form is that it allows you to make updates and changes as needed. If you experience a change in your financial situation, such as getting a raise or taking on a second job, you can easily update your W4 form to reflect these changes. This ensures that you are having the correct amount of taxes withheld from your paycheck.

By taking the time to fill out an IRS W4 printable form accurately, you can avoid potential tax issues and ensure that you are not caught off guard by unexpected tax bills. It is essential to review your withholding allowances regularly and make updates as needed to reflect changes in your financial situation. By doing so, you can have peace of mind knowing that you are on the right track with your taxes.

In conclusion, filling out an IRS W4 form is crucial for ensuring that the correct amount of taxes is being withheld from your paycheck. By using the IRS W4 printable form, you can easily make updates and changes as needed to reflect changes in your financial situation. Taking the time to complete this form accurately can help you avoid tax issues and ensure that you are prepared come tax time.