When it comes to tax season, there are a plethora of forms that individuals and businesses need to fill out in order to comply with IRS regulations. One such form is the IRS W-9, which is used to gather information from independent contractors and vendors. This form is essential for businesses to properly report payments made to these individuals and ensure compliance with tax laws.

It is important for businesses to have a thorough understanding of the IRS W-9 form and its requirements. By collecting this information from vendors and contractors, businesses are able to accurately report payments made to these individuals to the IRS. Failure to collect this information can result in penalties and fines for non-compliance.

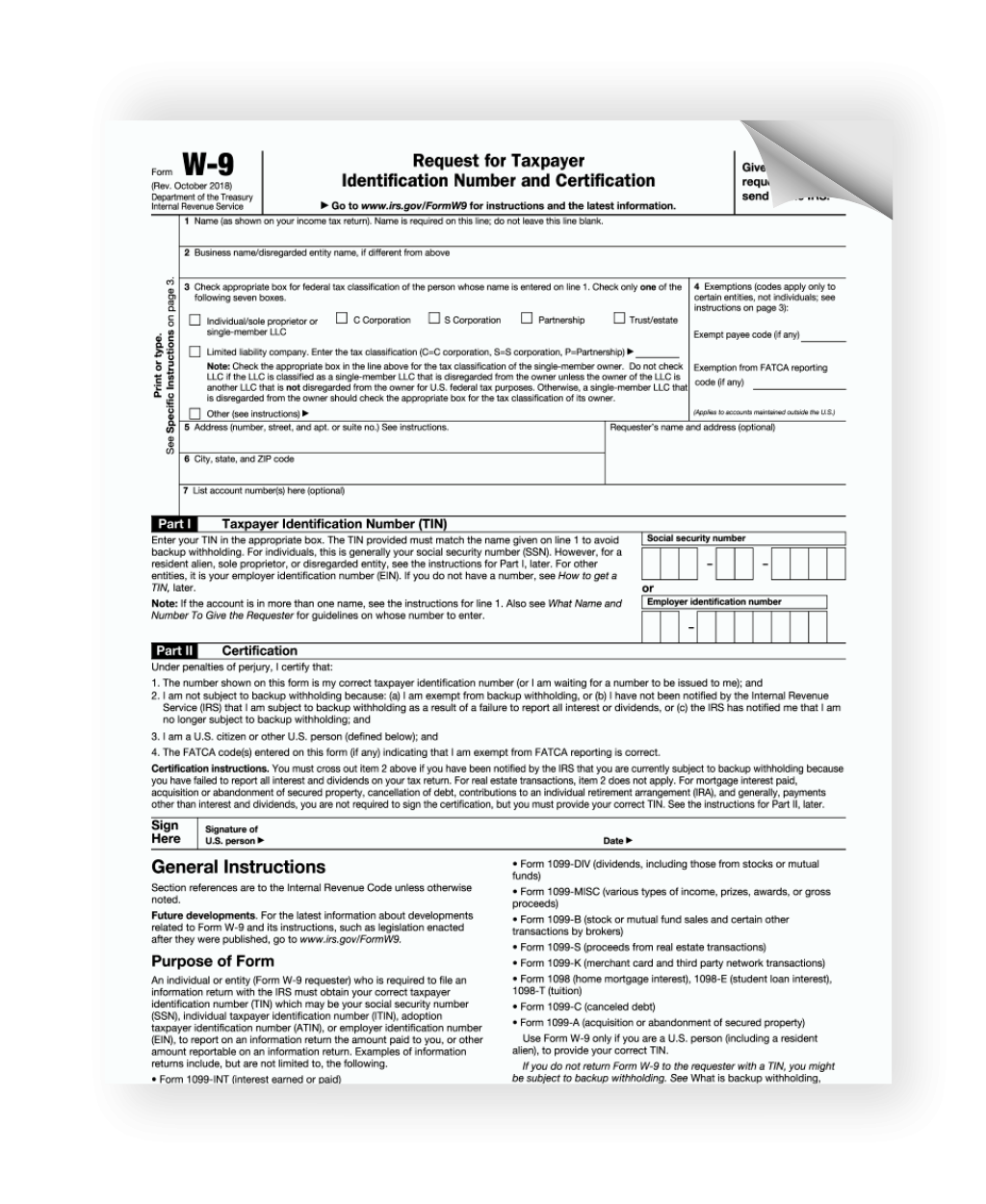

IRS W-9 Printable Form

The IRS W-9 form is a simple document that requires basic information such as the individual or business’s name, address, and taxpayer identification number (TIN). This form is used by businesses to report income paid to independent contractors and vendors, as well as to report other types of income such as interest, dividends, and royalties.

Having a printable version of the IRS W-9 form is essential for businesses that work with independent contractors and vendors. This form can easily be distributed to individuals to collect the necessary information for tax reporting purposes. By having a printable version of the form readily available, businesses can streamline the process of collecting this information and ensure compliance with IRS regulations.

Businesses should also keep in mind that the IRS W-9 form must be kept on file for at least four years after the date of payment to the individual. This ensures that businesses have the necessary documentation in the event of an IRS audit or inquiry. By maintaining accurate records and properly filing the IRS W-9 form, businesses can avoid potential issues with the IRS and ensure compliance with tax laws.

In conclusion, the IRS W-9 printable form is a crucial document for businesses that work with independent contractors and vendors. By collecting the necessary information from individuals and maintaining accurate records, businesses can ensure compliance with IRS regulations and avoid potential penalties for non-compliance. It is important for businesses to understand the importance of the IRS W-9 form and to have a thorough understanding of its requirements to avoid any issues during tax season.