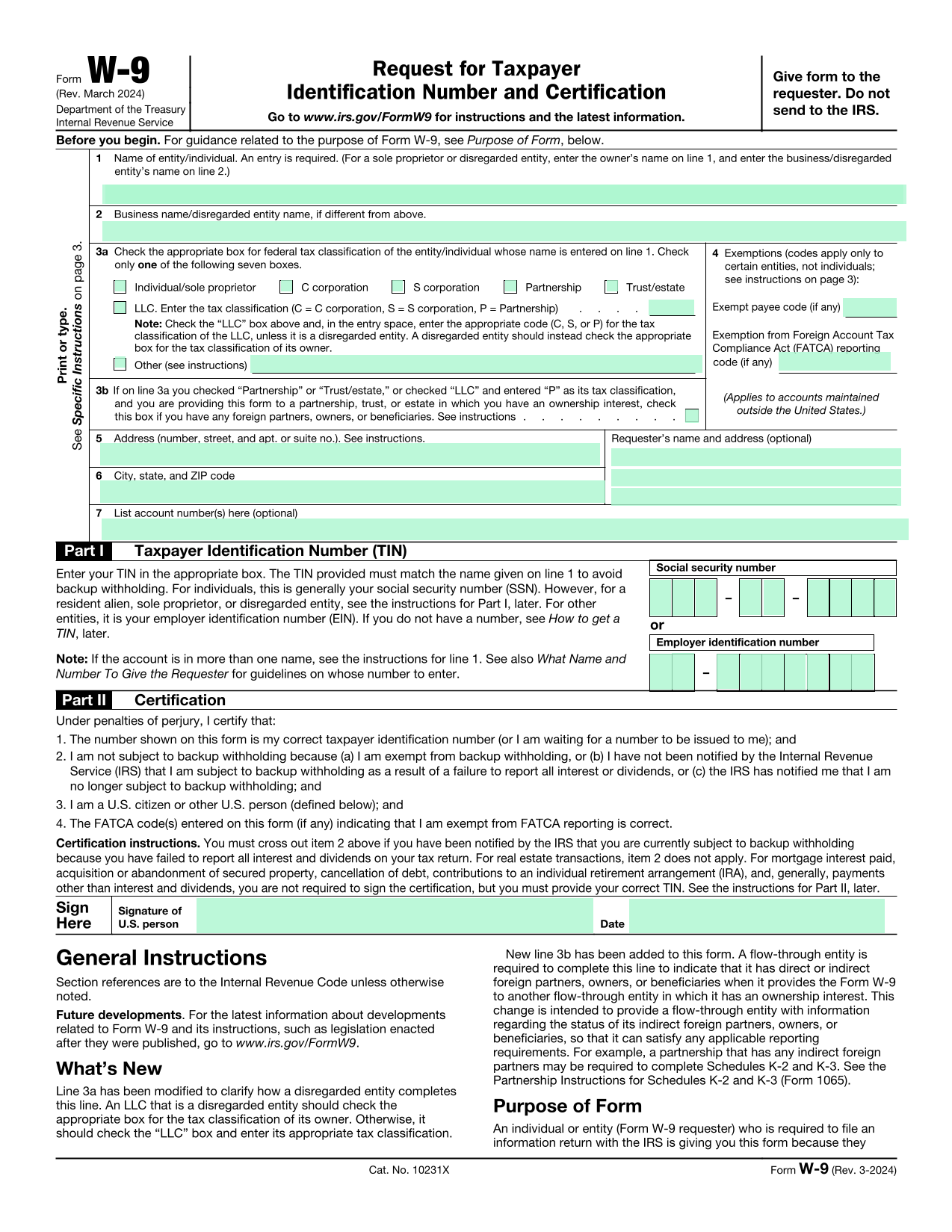

As we look ahead to the year 2025, it’s important to stay informed about any changes or updates to tax forms, including the IRS W-9 form. The W-9 form is used by businesses to request taxpayer identification information from individuals or entities they are making payments to. This form is essential for reporting income to the IRS and ensuring compliance with tax laws.

One of the key updates to the IRS W-9 form for 2025 is the option for electronic filing. With the increasing use of technology and online platforms, the IRS has made it easier for taxpayers to submit their W-9 forms electronically. This streamlined process can save time and reduce the risk of errors in the submission of important tax information.

Additionally, the IRS may introduce new requirements or changes to the W-9 form in 2025 to reflect updates in tax laws or regulations. It’s important for businesses and individuals to stay updated on any changes to the form to ensure compliance with the latest tax requirements. Failure to submit a correct W-9 form can result in penalties or delays in receiving payments.

Another important aspect to consider regarding the IRS W-9 form is the accuracy of the information provided. It’s crucial to ensure that all information on the form is correct and up to date to avoid any issues with tax reporting. Double-checking the information before submitting the form can help prevent errors and potential penalties.

In conclusion, staying informed about the IRS W-9 form for 2025 is essential for businesses and individuals to comply with tax laws and regulations. With potential updates to the form and the option for electronic filing, it’s important to be aware of any changes and ensure accurate information is provided. By staying proactive and informed, taxpayers can avoid potential issues with tax reporting and payments.

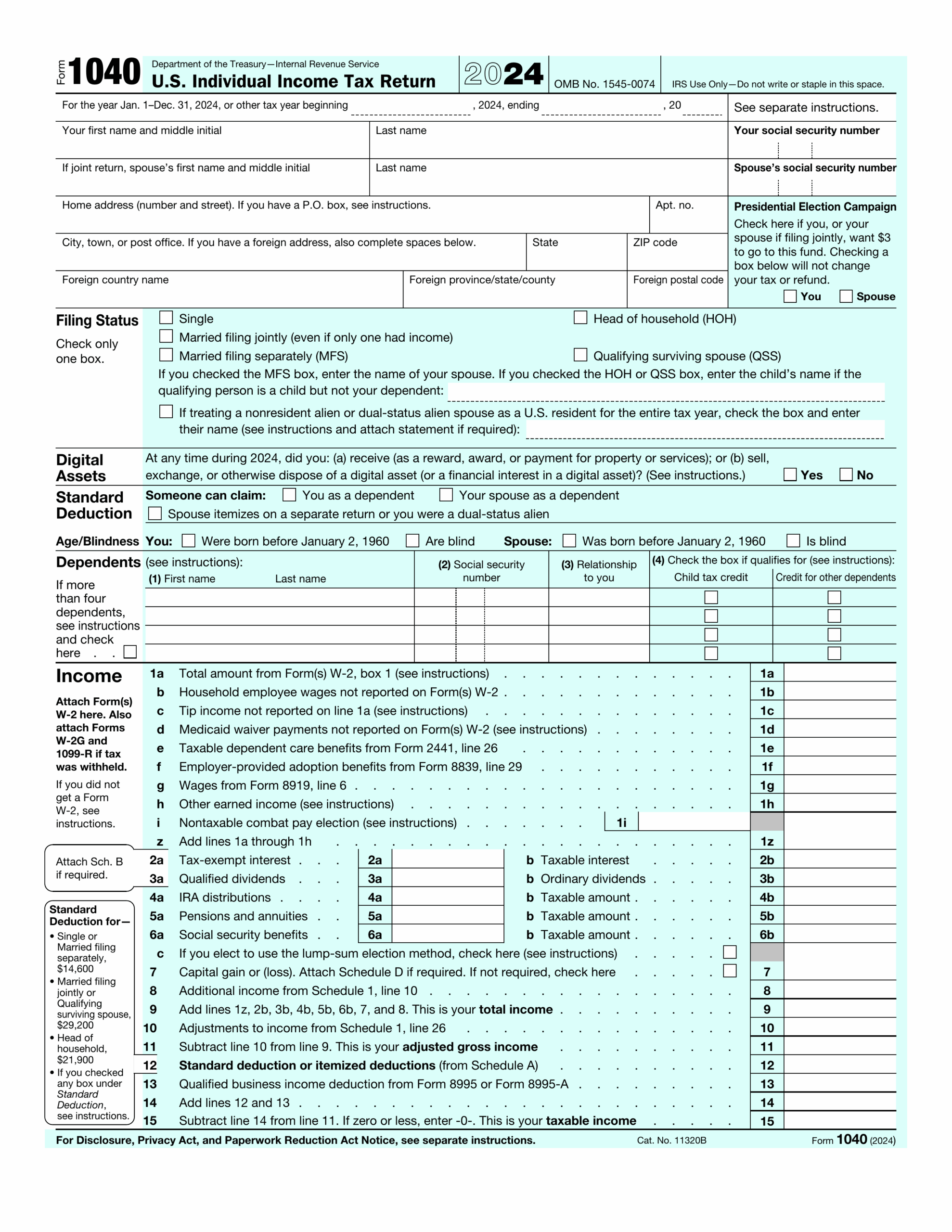

Download and Print Irs W 9 Form Printable 2025

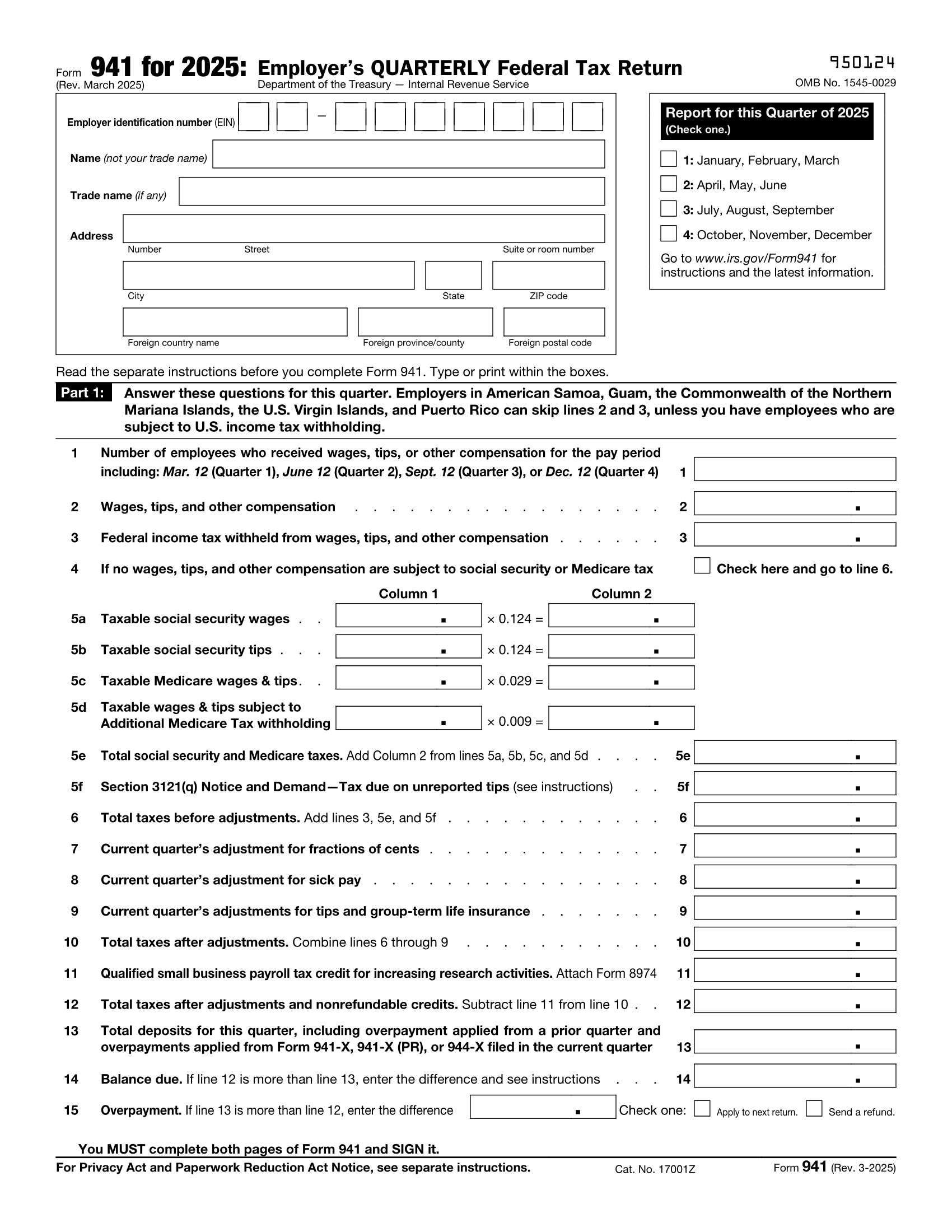

Payroll template are ideal for companies that prefer non-digital systems or need hard copies for audit purposes. Most forms include fields for employee name, date range, total earnings, taxes, and final salary—making them both complete and practical.

Begin streamlining your payroll process today with a trusted payroll template. Save time, reduce errors, and stay organized—all while keeping your employee payment data organized.

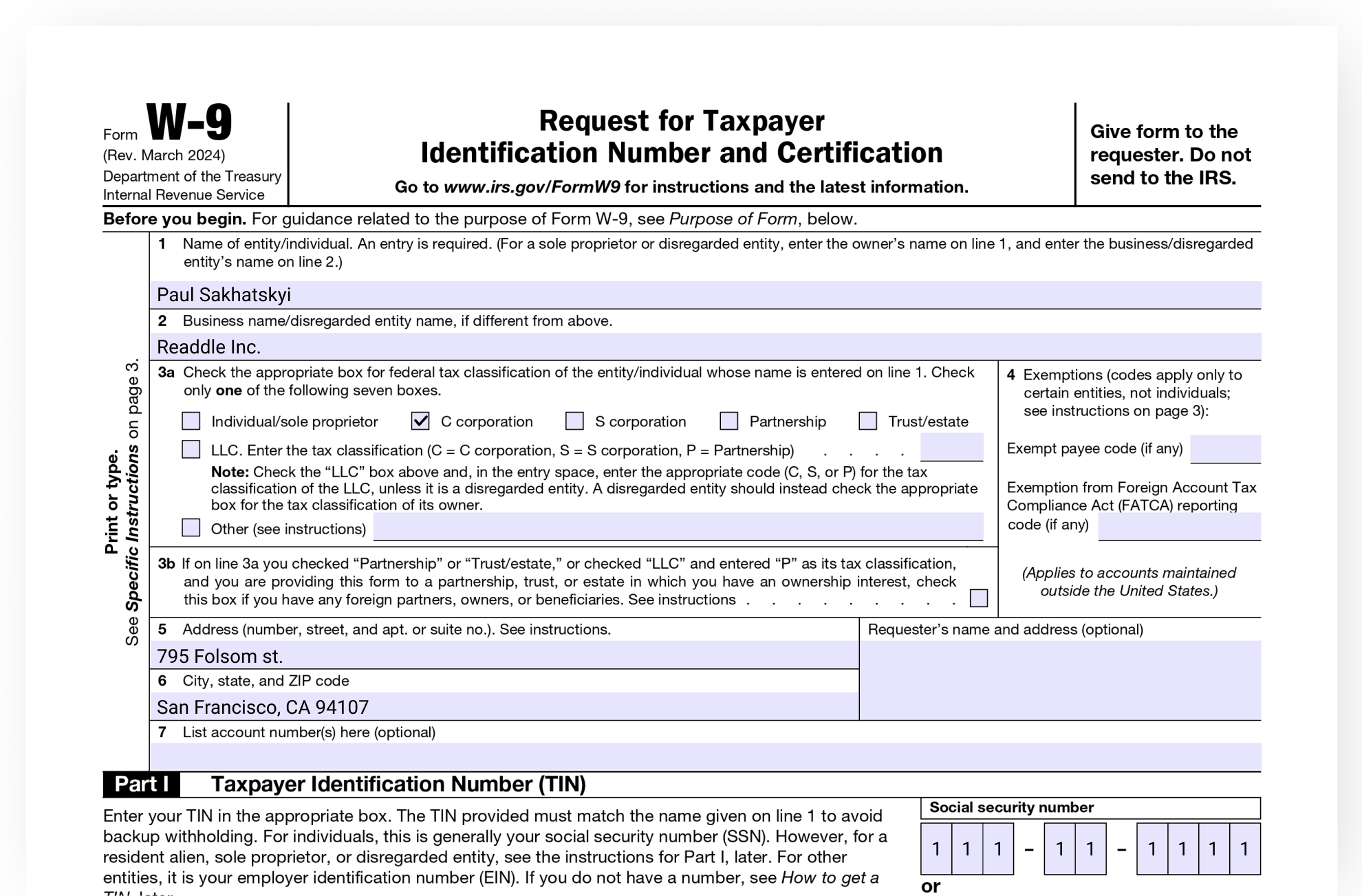

W 9 Form 2024 2025 How To Fill Out And Download PDF Guru

W 9 Form 2024 2025 How To Fill Out And Download PDF Guru

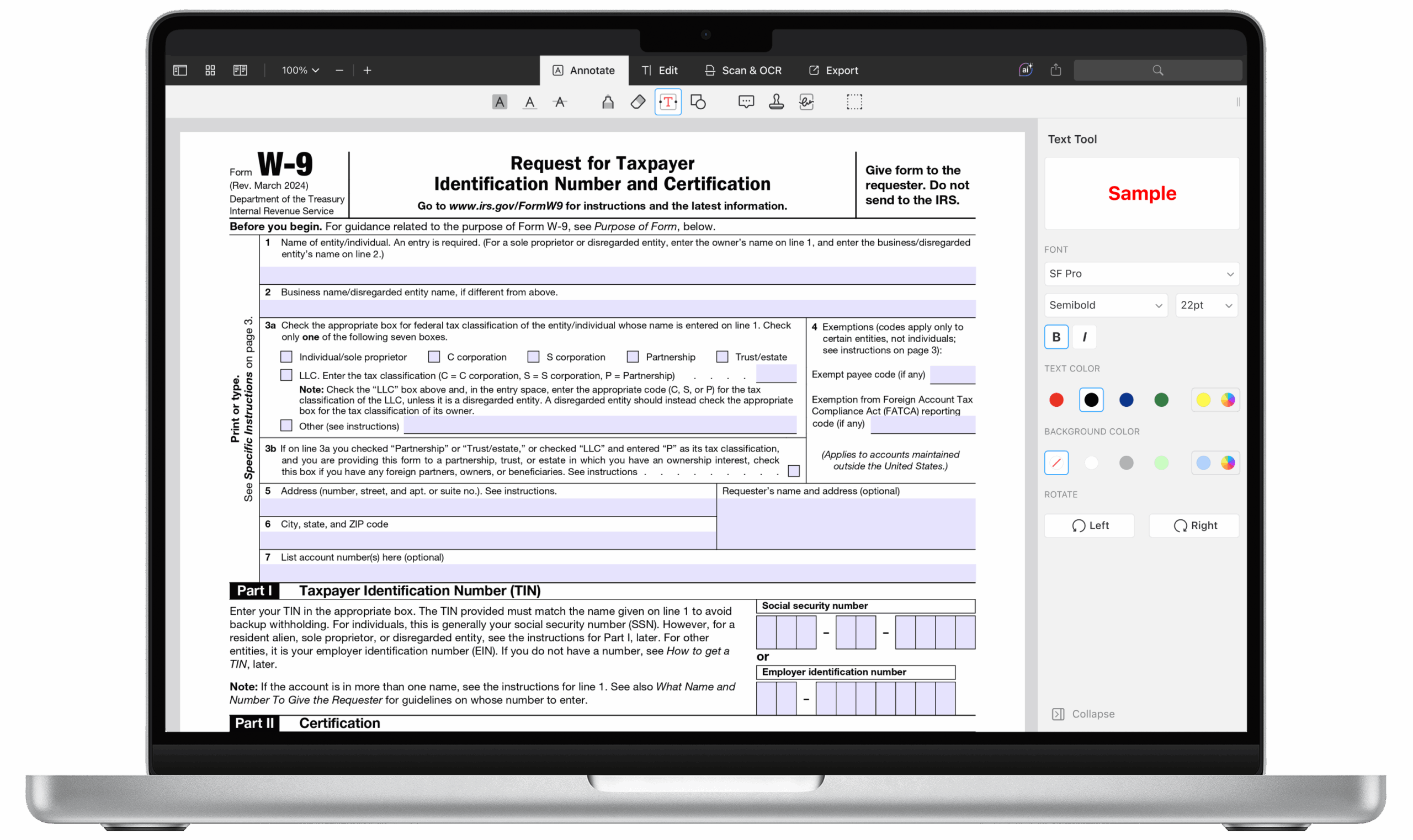

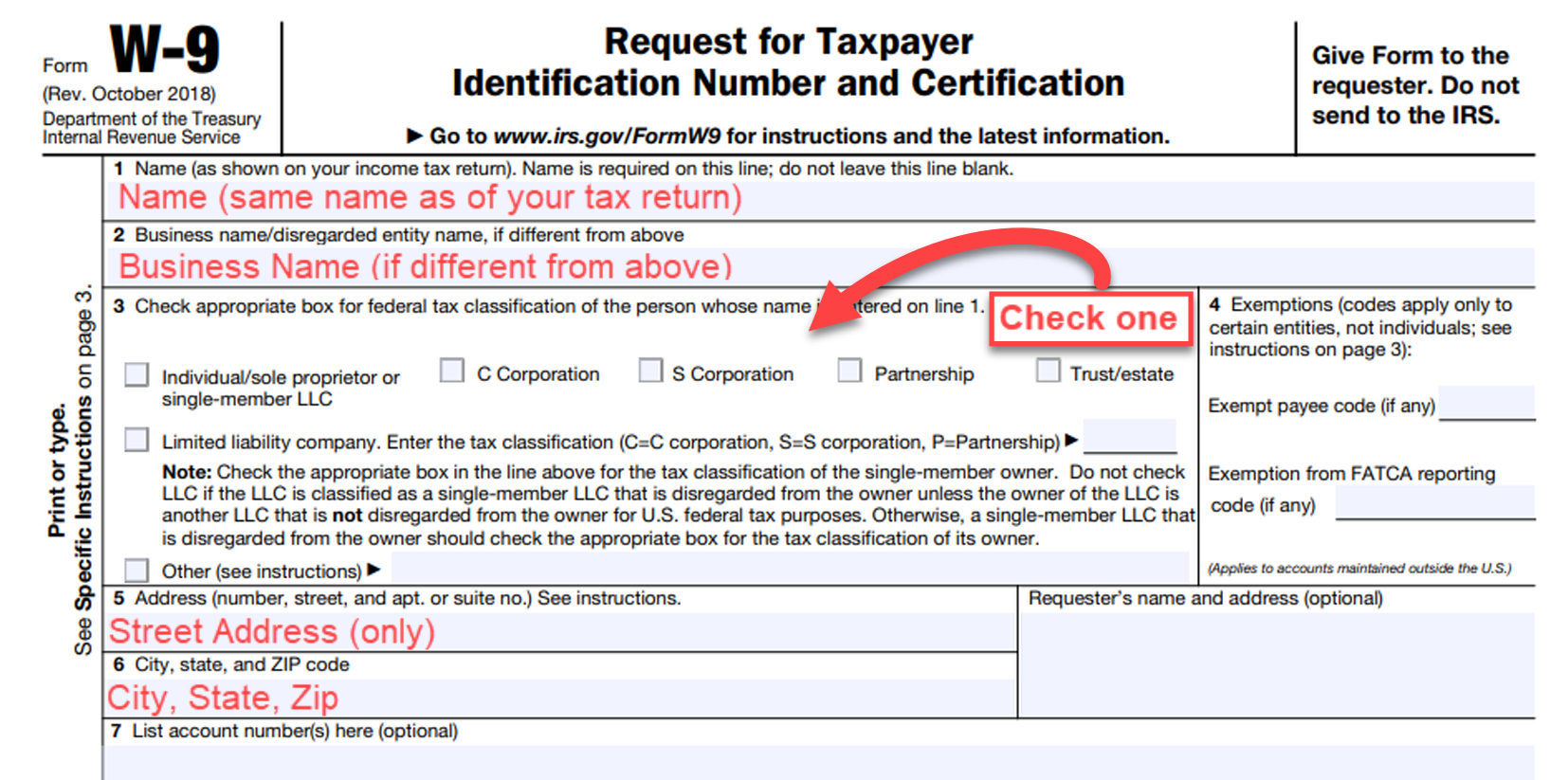

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

Free IRS Form W9 2025 PDF EForms

Free IRS Form W9 2025 PDF EForms

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

Managing payroll tasks doesn’t have to be overwhelming. A printable payroll template offers a fast, reliable, and straightforward method for tracking employee pay, hours, and taxes—without the need for complex software.

Whether you’re a freelancer, payroll manager, or independent contractor, using aprintable payroll template helps ensure compliance with regulations. Simply get the template, print it, and complete it by hand or type directly into the file before printing.