When starting a new job or experiencing a change in your financial situation, it’s important to fill out the IRS Form W-4. This form allows you to indicate how much federal income tax should be withheld from your paycheck. However, with the rise of online resources, you may be wondering if there is a printable version of the form available. Fortunately, the IRS does provide a printable version of the W-4 form for your convenience.

By accessing the IRS website, you can easily find and download the printable W-4 form. This allows you to fill it out at your own pace and have a physical copy for your records. Whether you prefer to fill out forms by hand or simply want a hard copy for your records, having access to a printable W-4 form can make the process much easier.

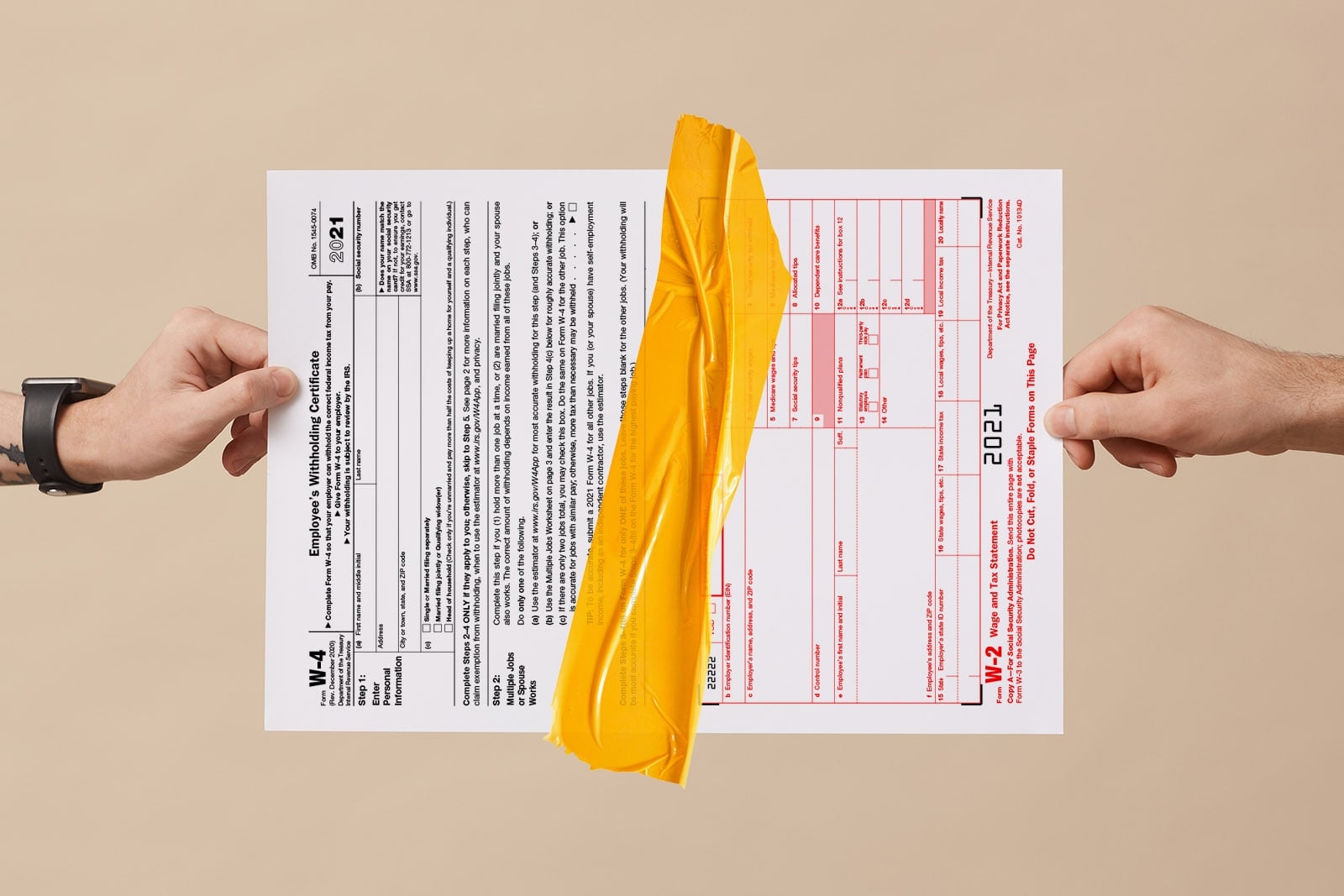

Irs W 4 Printable Form

Once you have downloaded the printable W-4 form, you can begin filling it out according to your individual tax situation. The form will ask for information such as your filing status, number of dependents, and any additional income you may have. By accurately completing this form, you can ensure that the correct amount of taxes are withheld from your paycheck each pay period.

It’s important to note that you may need to update your W-4 form periodically, especially if you experience a change in your financial situation. This can include getting married, having a child, or taking on a second job. By regularly reviewing and updating your W-4 form, you can avoid any surprises come tax time.

Once you have filled out the printable W-4 form, you can submit it to your employer for processing. They will use the information provided to calculate the appropriate amount of federal income tax to withhold from your paycheck. If you have any questions or need assistance with filling out the form, don’t hesitate to reach out to your employer or a tax professional for guidance.

In conclusion, the IRS W-4 printable form is a valuable resource for individuals looking to accurately withhold federal income tax from their paychecks. By accessing and filling out this form, you can ensure that you are meeting your tax obligations and avoiding any potential penalties. Be sure to regularly review and update your W-4 form as needed to reflect any changes in your financial situation.