When starting a new job or experiencing a significant life change, it’s important to fill out a W-4 form to ensure that the correct amount of taxes is withheld from your paycheck. The IRS W-4 form is a crucial document that helps your employer determine how much federal income tax to withhold from your pay.

Understanding how to correctly fill out the IRS W-4 form can save you from any surprises when tax season comes around. It’s essential to provide accurate information to avoid owing taxes or receiving a large refund. With the availability of IRS W-4 form printable, the process has become much more convenient.

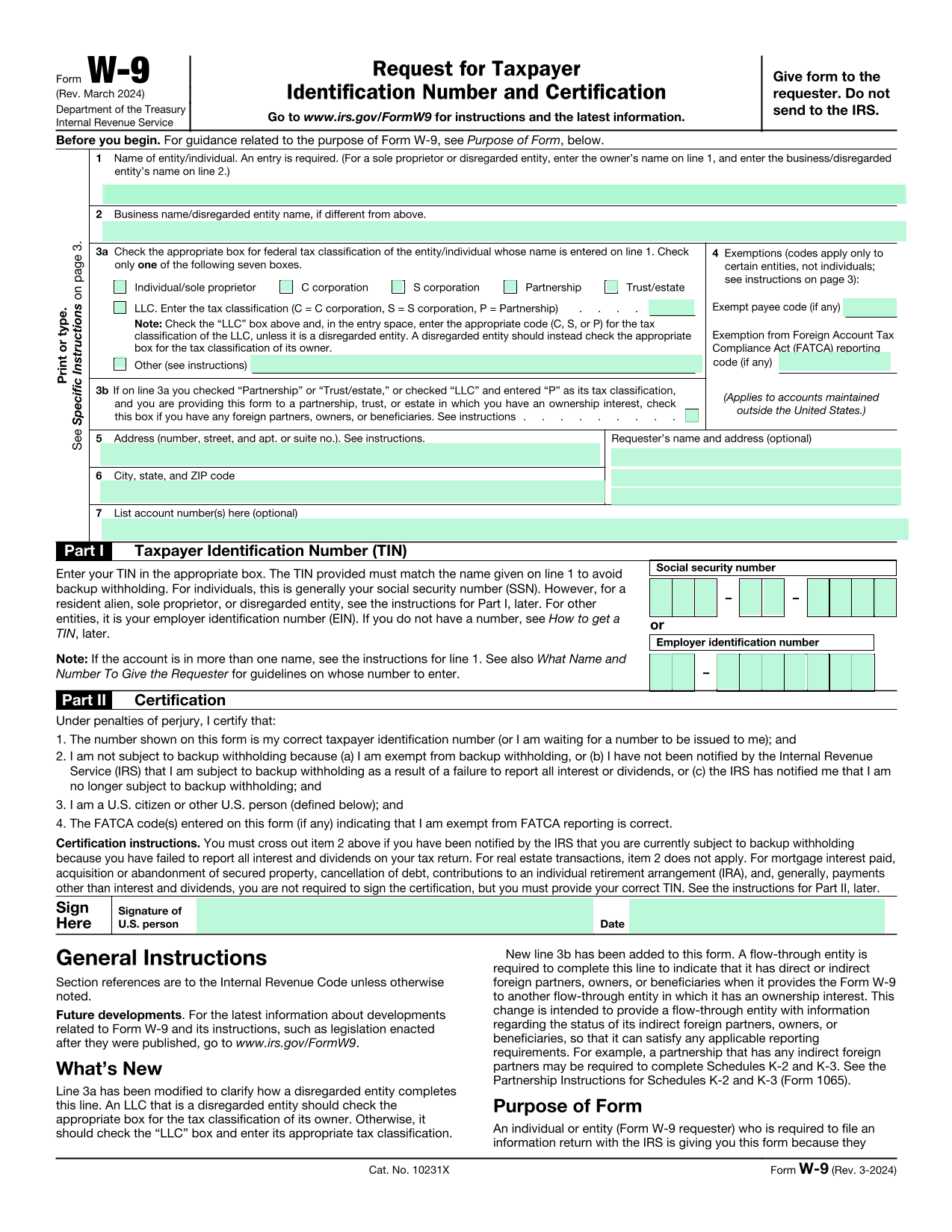

IRS W-4 Form Printable

The IRS W-4 form printable allows you to easily access and fill out the form from the comfort of your own home. You can find the form on the official IRS website or various tax preparation websites. Simply download and print the form, fill it out accurately, and submit it to your employer.

When filling out the W-4 form, you will need to provide information such as your filing status, number of dependents, and any additional income. It’s crucial to review the instructions carefully to ensure that you are providing the correct information. You can also use the IRS withholding calculator to determine the right amount of withholding for your specific situation.

Keep in mind that you can update your W-4 form at any time if your financial situation changes. Whether you get married, have a child, or experience any other significant life event, it’s essential to update your withholding information to reflect these changes accurately.

By utilizing the IRS W-4 form printable, you can take control of your tax withholding and ensure that you are not overpaying or underpaying your taxes. It’s a simple yet essential step in managing your finances and avoiding any tax-related surprises down the road.

In conclusion, the IRS W-4 form printable offers a convenient way to fill out this important document accurately. By understanding how to correctly complete the form and updating it as needed, you can ensure that your tax withholding is in line with your financial situation. Take advantage of the IRS W-4 form printable to stay on top of your taxes and avoid any unnecessary headaches during tax season.