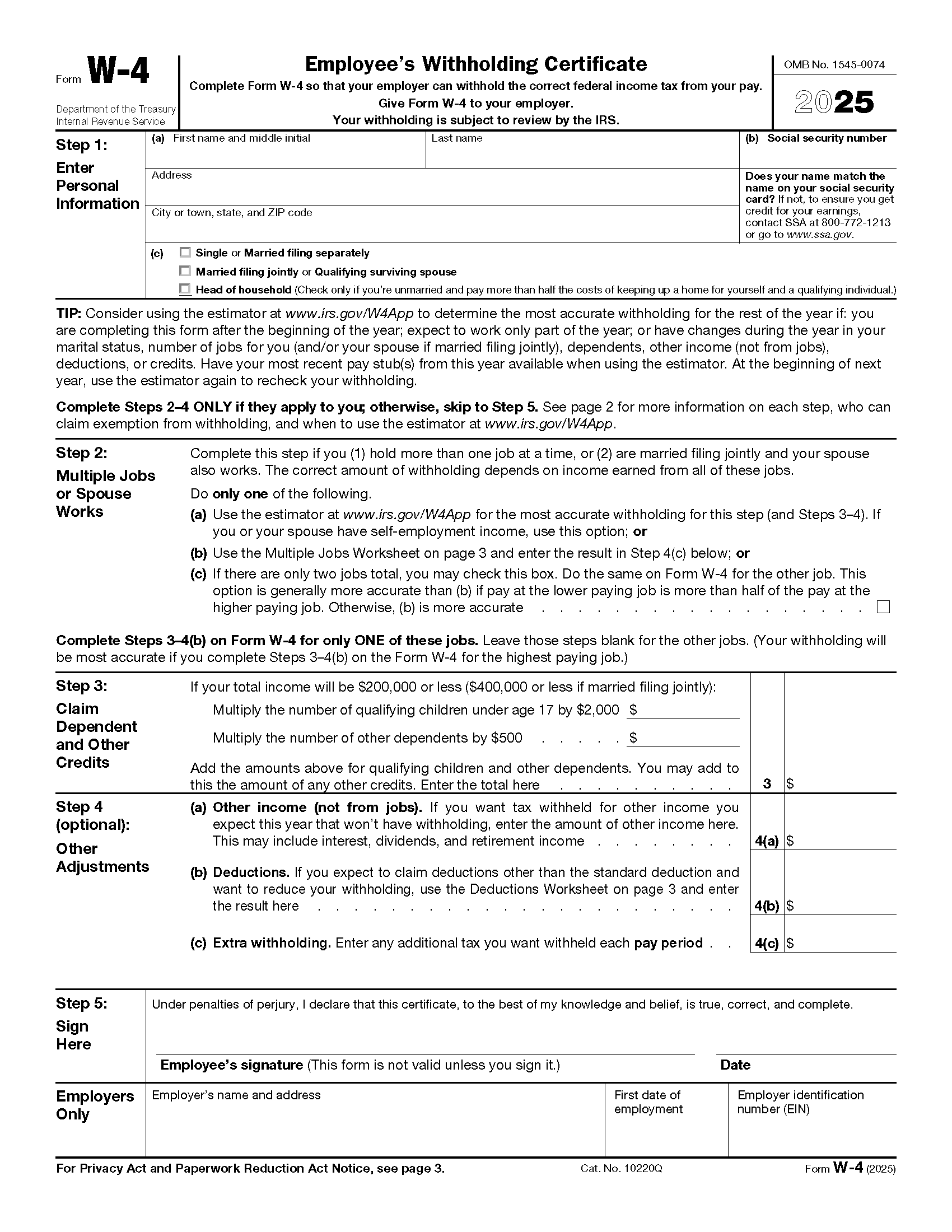

When it comes to taxes, staying organized is key. One important document that individuals need to fill out is the IRS W-4 form. This form helps employers determine how much federal income tax to withhold from an employee’s paycheck. It’s essential to fill out this form accurately to avoid any surprises come tax season.

For the year 2025, the IRS has made changes to the W-4 form to simplify the process for both employers and employees. The new form includes a step-by-step guide to help individuals determine the right amount of withholding based on their personal and financial situation. This updated version aims to make it easier for taxpayers to understand and complete the form correctly.

One of the key changes in the 2025 W-4 form is the removal of allowances. Instead of claiming a certain number of allowances, individuals will now provide more detailed information about their income, deductions, and credits. This new approach aims to provide a more accurate withholding amount based on the individual’s specific circumstances.

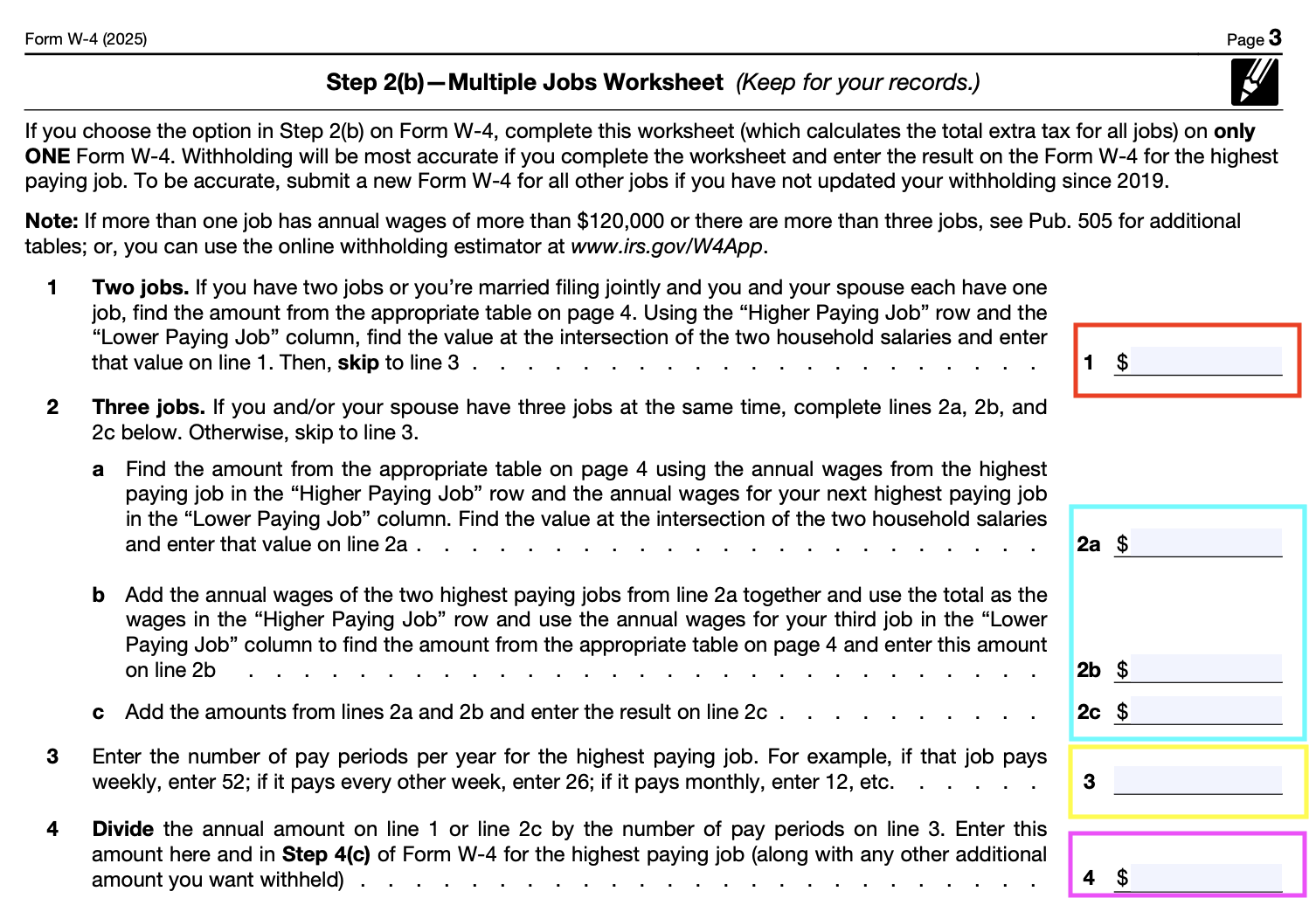

Another important update in the 2025 W-4 form is the inclusion of a section for multiple jobs. This allows individuals with more than one job to accurately calculate their total withholding amount across all sources of income. It’s important for individuals with multiple jobs to fill out this section to ensure they are not under or over withholding.

Overall, the 2025 W-4 form aims to simplify the process of withholding federal income tax for both employers and employees. By providing more detailed information and guidance, individuals can ensure that the right amount of tax is withheld from their paychecks throughout the year. It’s important to review and update this form as needed to avoid any surprises when it comes time to file taxes.

In conclusion, the IRS W-4 form for the year 2025 has been updated to make it easier for individuals to determine the correct amount of federal income tax withholding. By providing more detailed information and guidance, this new form aims to streamline the process for both employers and employees. It’s essential for individuals to fill out this form accurately to avoid any issues come tax season.

Easily Download and Print Irs W 4 Form 2025 Printable

Printable payroll are ideal for teams that prefer paper documentation or need physical copies for staff files. Most forms include fields for employee name, date range, total earnings, taxes, and final salary—making them both complete and easy to use.

Start simplifying your payroll process today with a trusted payroll template. Save time, reduce errors, and maintain clear records—all while keeping your payroll records organized.

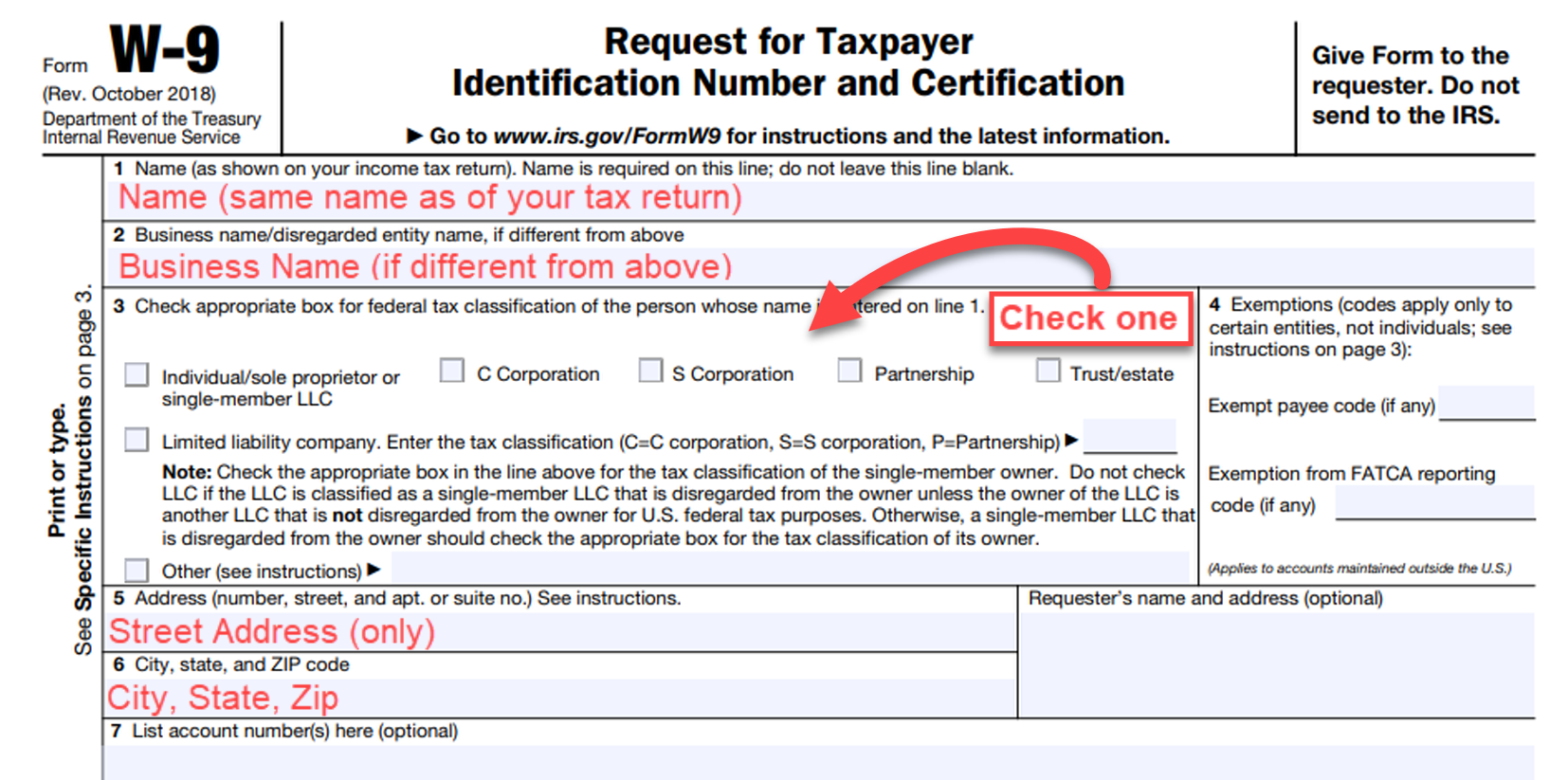

Free IRS Form W9 2025 PDF EForms

Free IRS Form W9 2025 PDF EForms

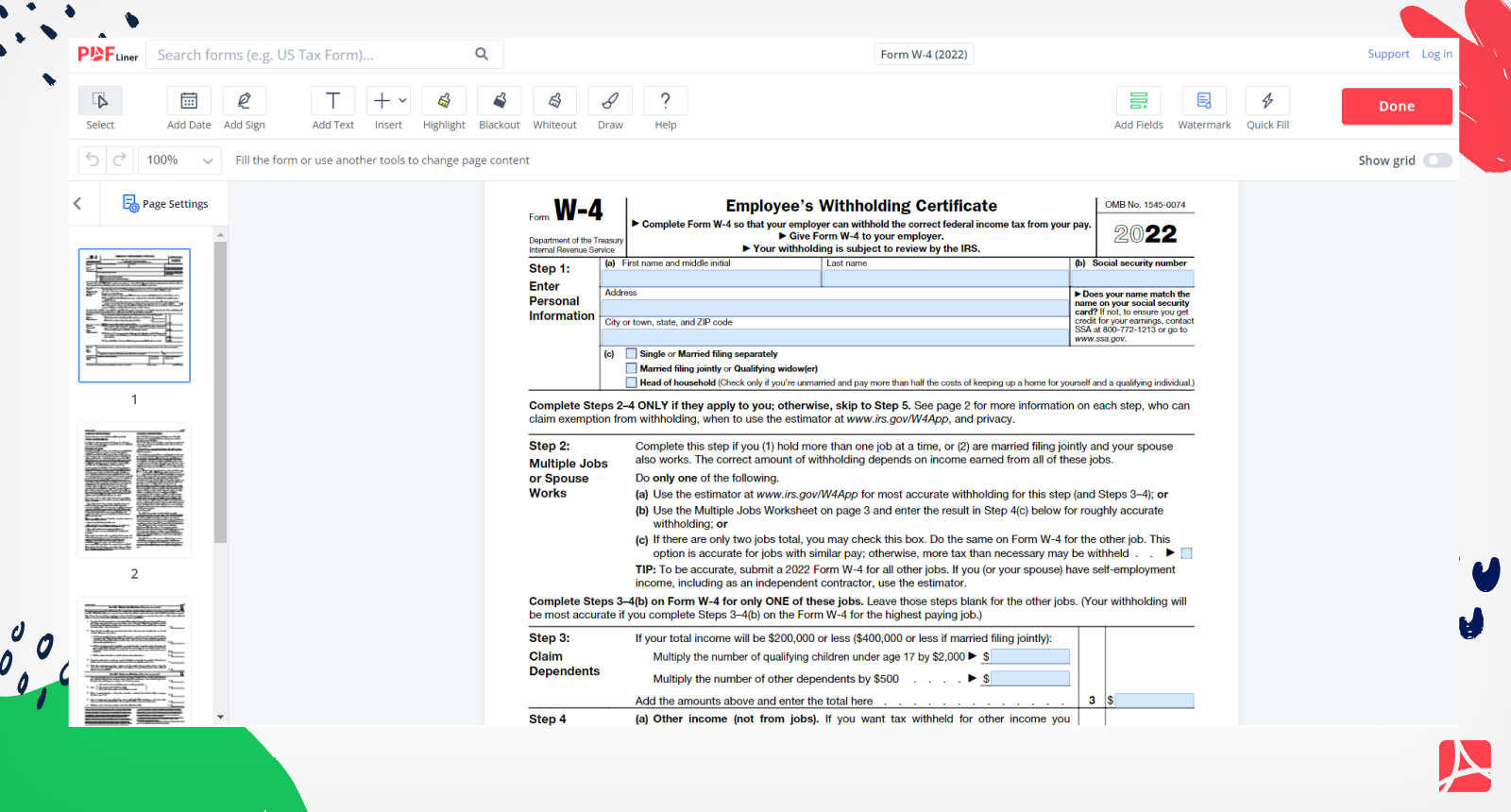

Form W 4 2022 Print And Sign W 4 Form Online PDFliner

Form W 4 2022 Print And Sign W 4 Form Online PDFliner

2025 W 4 Form Step By Step Guide To Get Your Withholding Right

2025 W 4 Form Step By Step Guide To Get Your Withholding Right

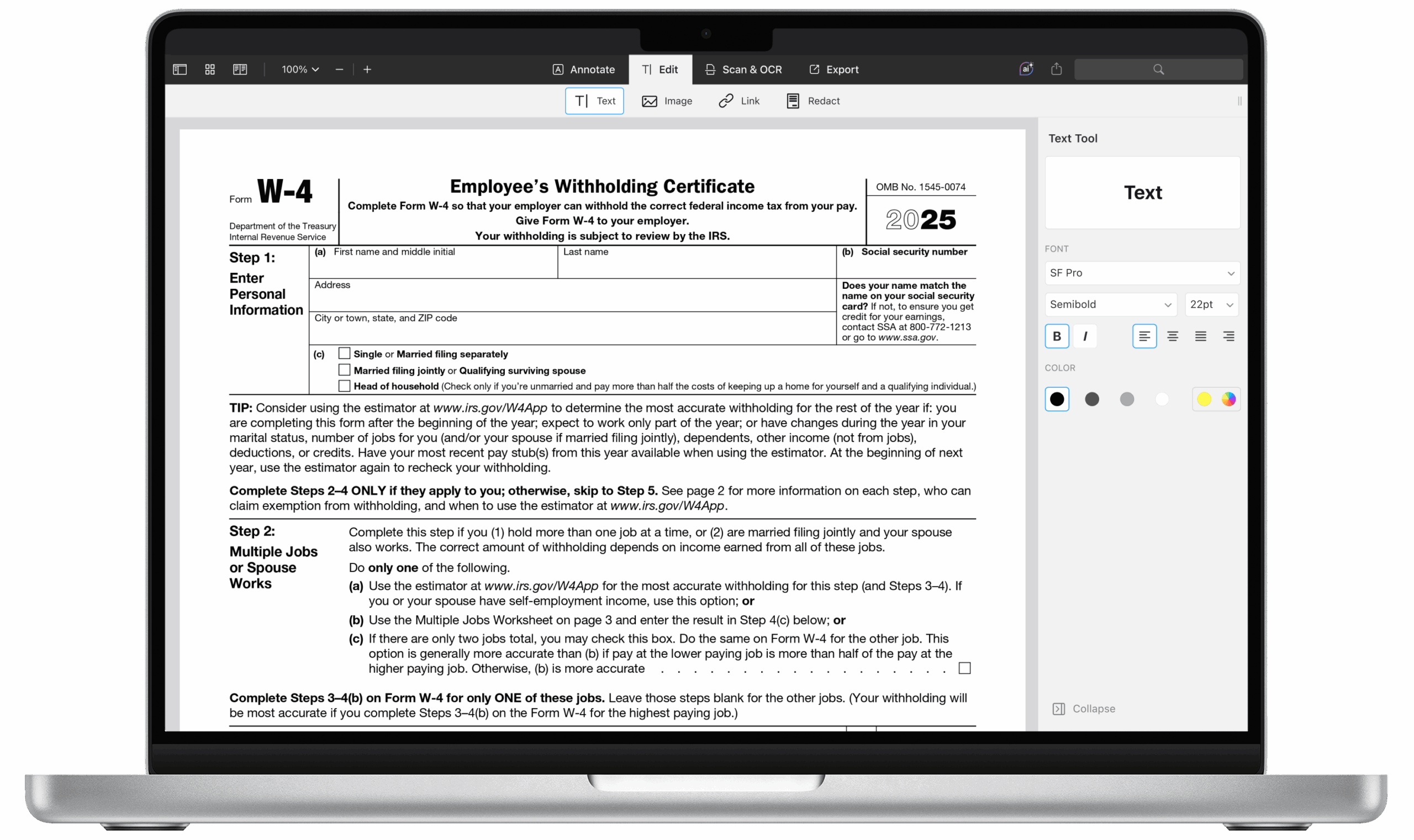

How To Fill Out IRS W4 Form 2025 PDF PDF Expert

How To Fill Out IRS W4 Form 2025 PDF PDF Expert

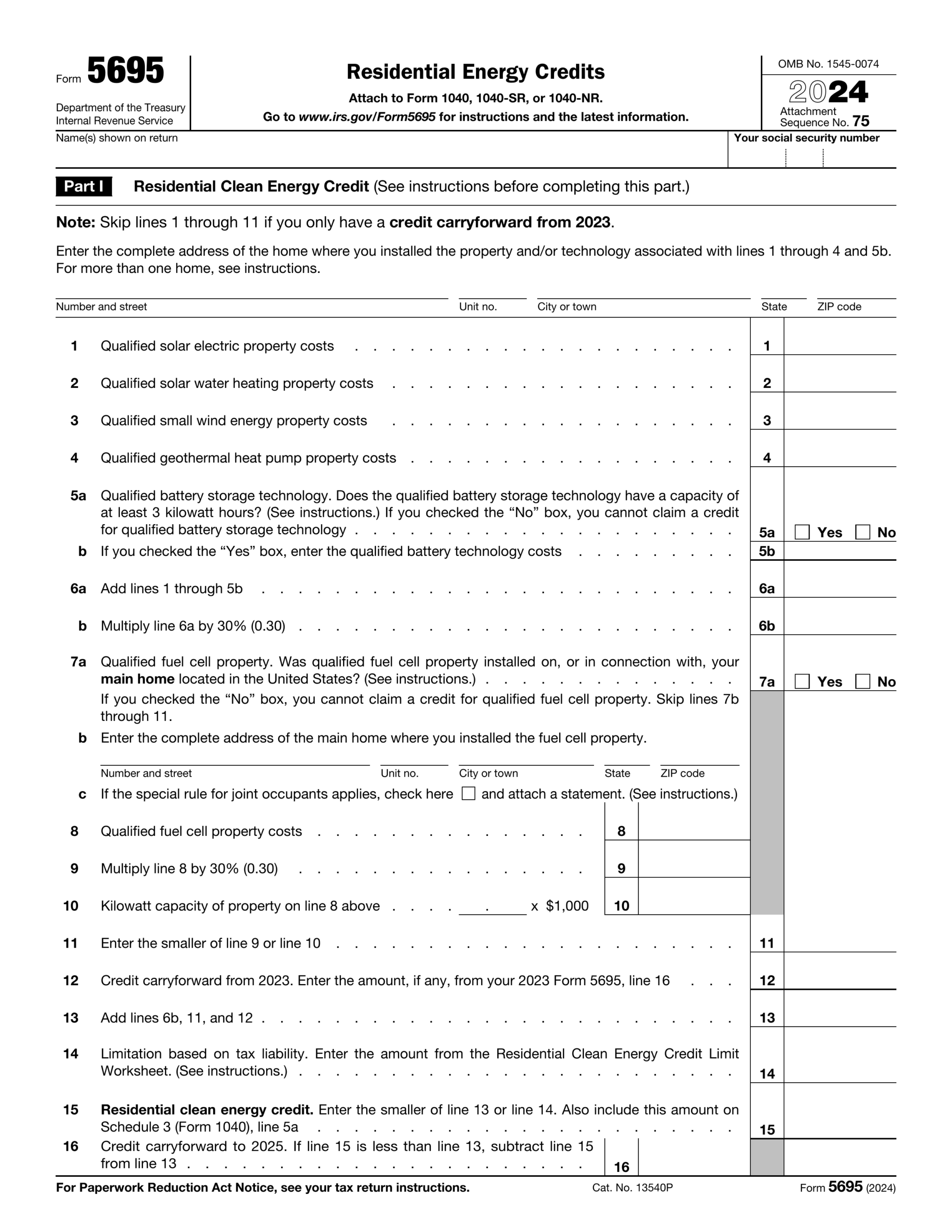

Free IRS Form W4 2024 PDF EForms

Free IRS Form W4 2024 PDF EForms

Handling payroll tasks doesn’t have to be complicated. A printable payroll form offers a fast, reliable, and straightforward method for tracking wages, work time, and withholdings—without the need for digital systems.

Whether you’re a small business owner, HR professional, or sole proprietor, using aprintable payroll template helps ensure accurate record-keeping. Simply download the template, produce a hard copy, and fill it out by hand or type directly into the file before printing.