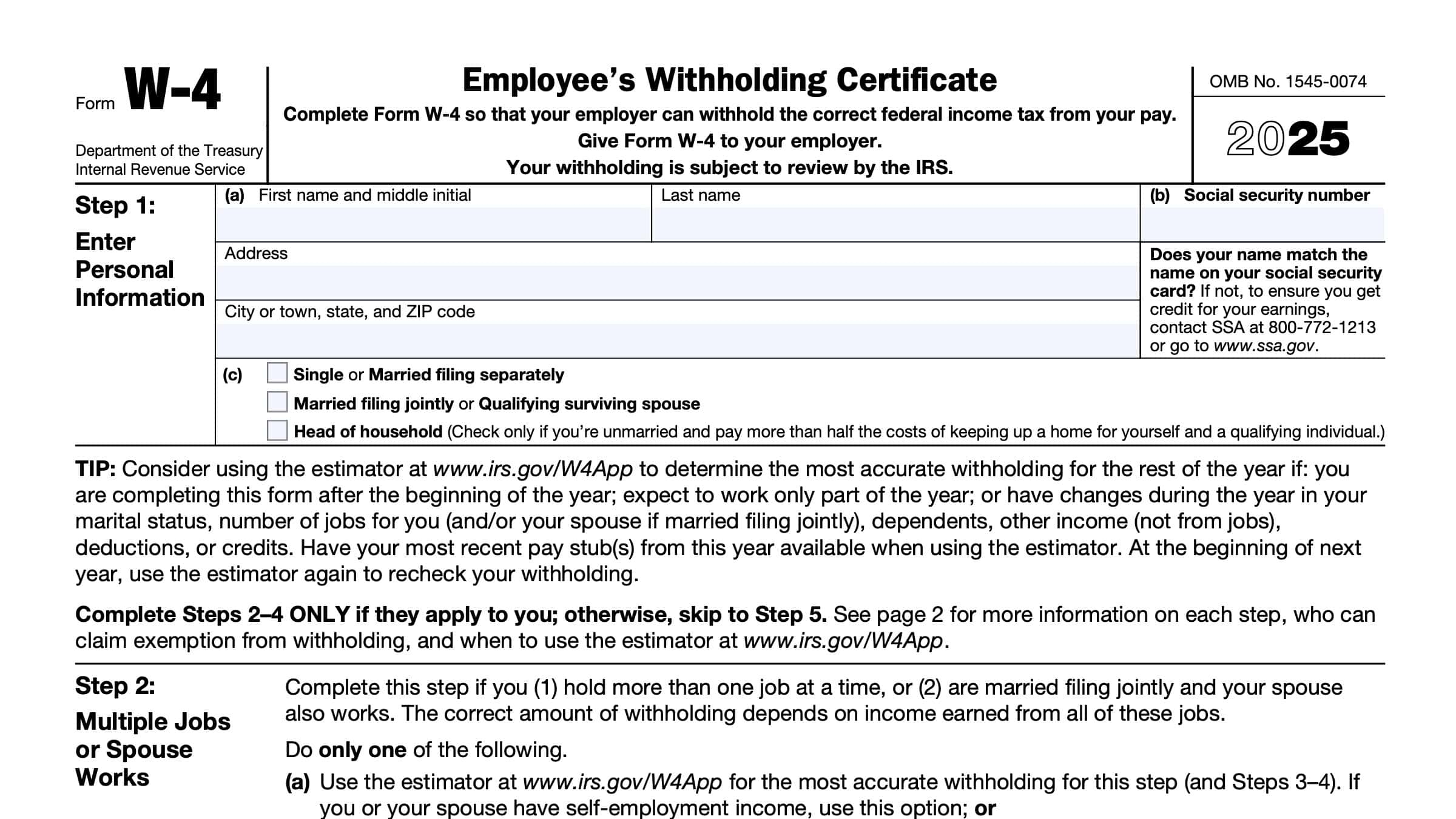

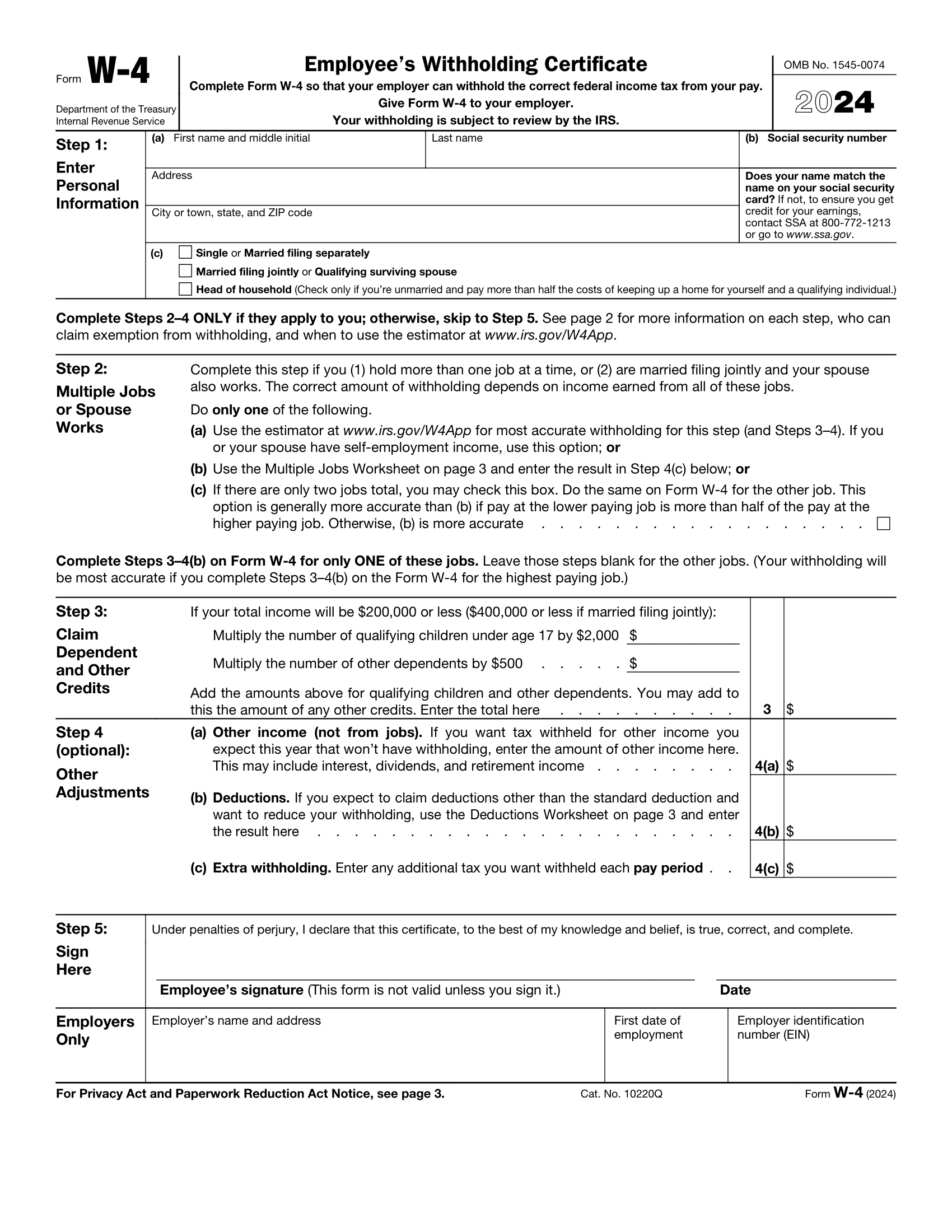

Completing your W-4 form correctly is essential to ensure that the right amount of taxes are withheld from your paycheck. The IRS recently released the new W-4 form for the year 2024, which includes updates to make it easier for taxpayers to navigate.

One of the key changes to the 2024 W-4 form is the elimination of the confusing allowances system. Instead, taxpayers will now simply input their filing status, dependents, and other relevant information to calculate their withholding.

Another important update to the W-4 form is the addition of a new line for claiming dependents. This change allows taxpayers to specify the number of dependents they have, which will help ensure that the correct amount of taxes are withheld.

Additionally, the 2024 W-4 form includes a new section for other income, such as interest, dividends, and retirement income. This information will be used to calculate the taxpayer’s total income and determine the appropriate withholding amount.

Overall, the new W-4 form for 2024 is designed to simplify the process of calculating withholding and ensure that taxpayers have the correct amount of taxes withheld from their paychecks. By carefully completing the form and providing accurate information, taxpayers can avoid potential tax issues and ensure that they are in compliance with IRS regulations.

In conclusion, the Irs W-4 Form 2024 Printable provides taxpayers with a straightforward and user-friendly way to calculate their withholding. By taking the time to fill out the form accurately, taxpayers can avoid under or over-withholding and ensure that they are meeting their tax obligations. Be sure to download and print the updated W-4 form for 2024 to stay compliant with IRS regulations.

Easily Download and Print Irs W 4 Form 2024 Printable

Printable payroll form are ideal for teams that prefer paper documentation or need physical copies for audit purposes. Most forms include fields for employee name, date range, gross pay, withholdings, and net pay—making them both comprehensive and practical.

Take control of your payment tracking today with a trusted Irs W 4 Form 2024 Printable. Reduce admin effort, minimize mistakes, and stay organized—all while keeping your payroll records professional.

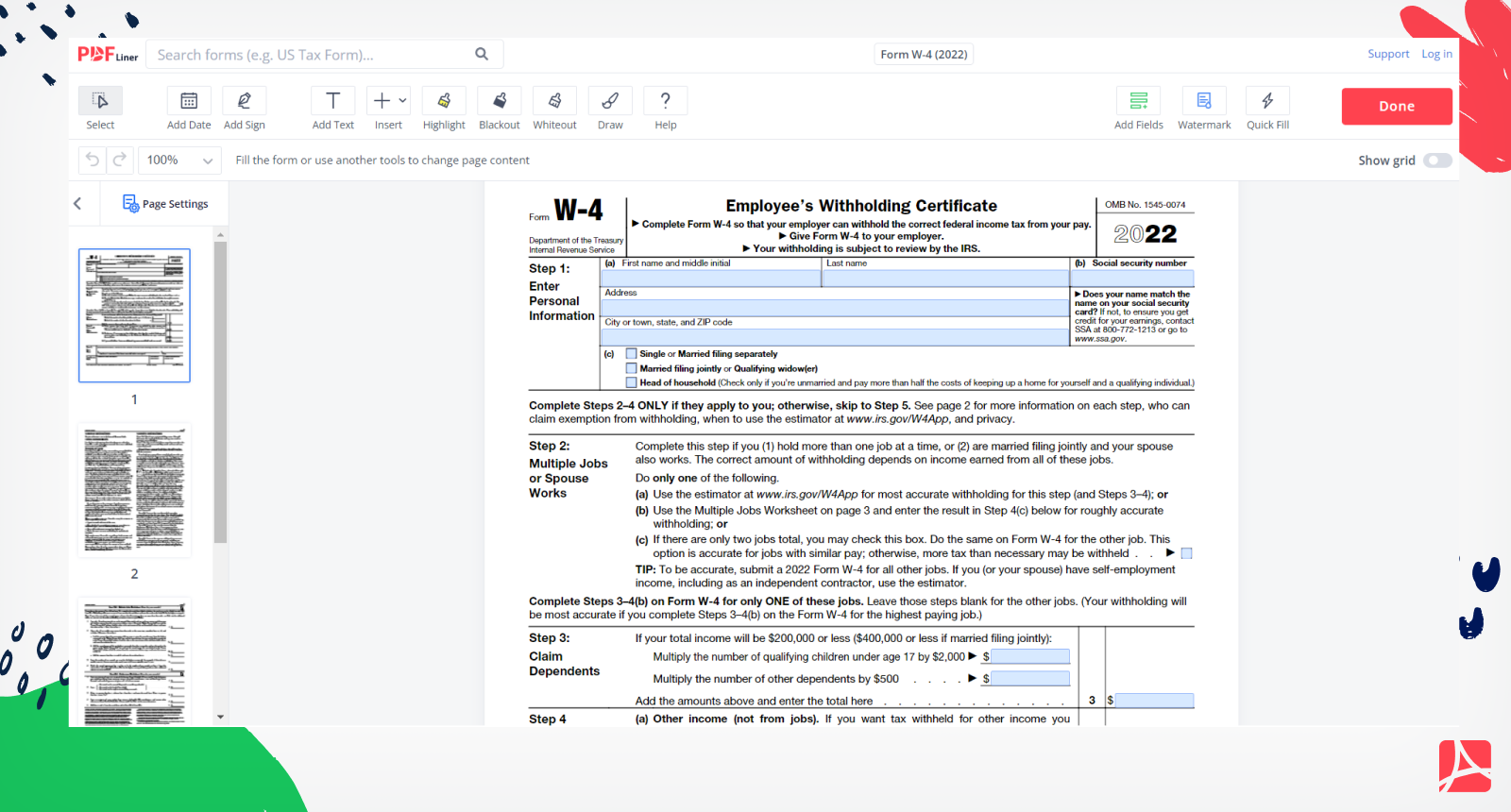

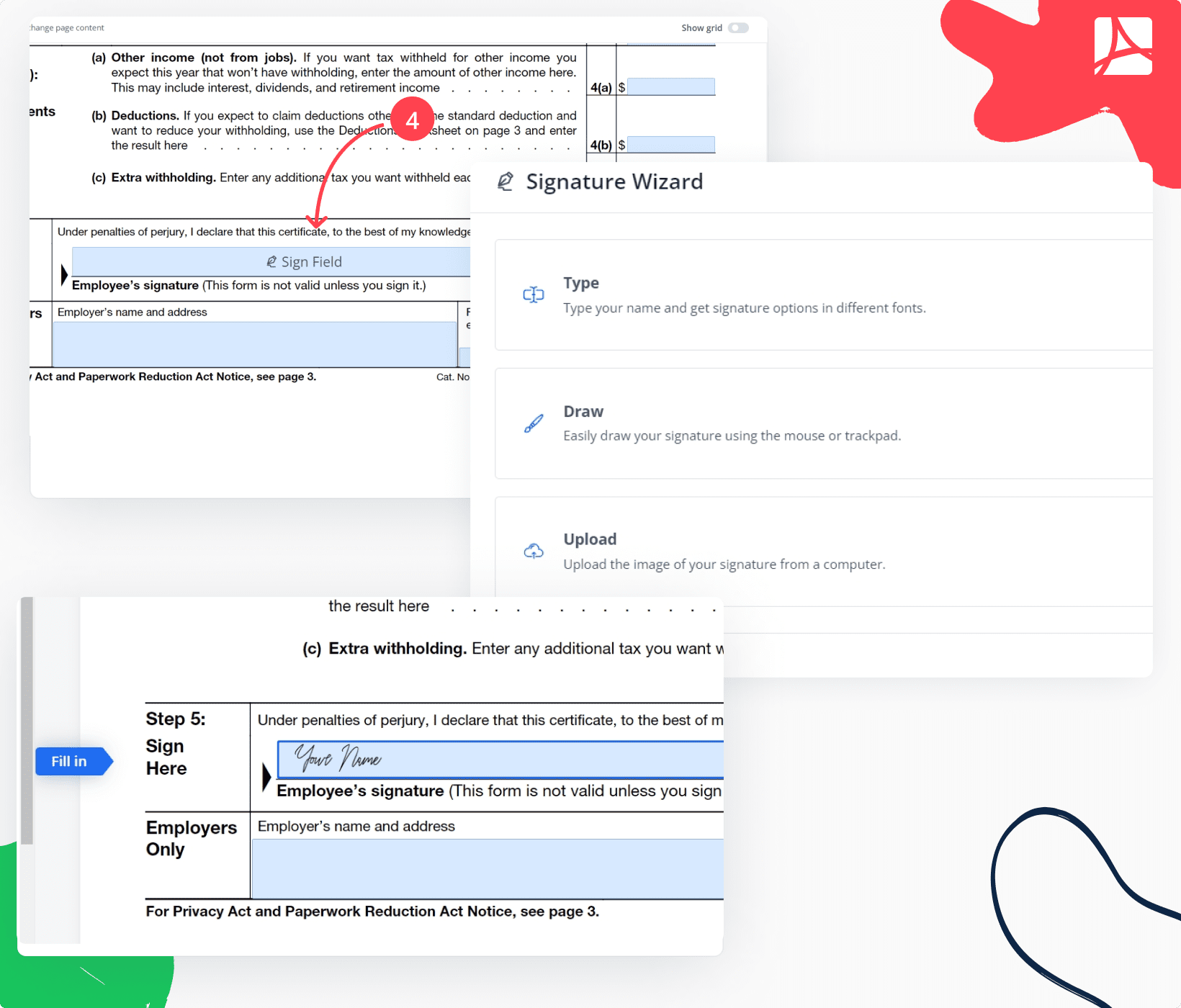

Fill Form W 4 2025 Online Simplify Tax Withholding PDFLiner

Fill Form W 4 2025 Online Simplify Tax Withholding PDFLiner

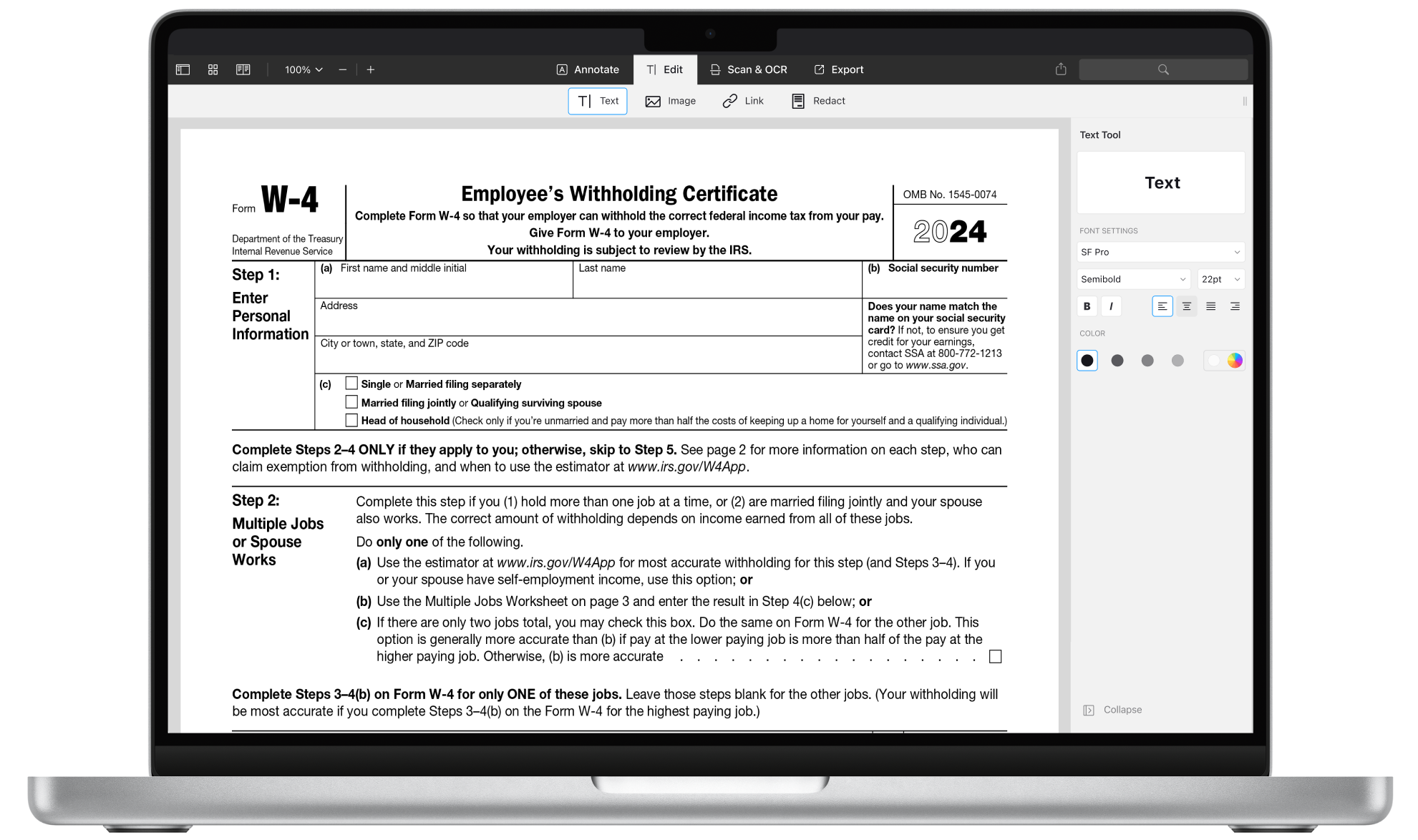

Das IRS Formular W4 F R 2024 Als PDF Ausf Llen PDF Expert Worksheets Library

Das IRS Formular W4 F R 2024 Als PDF Ausf Llen PDF Expert Worksheets Library

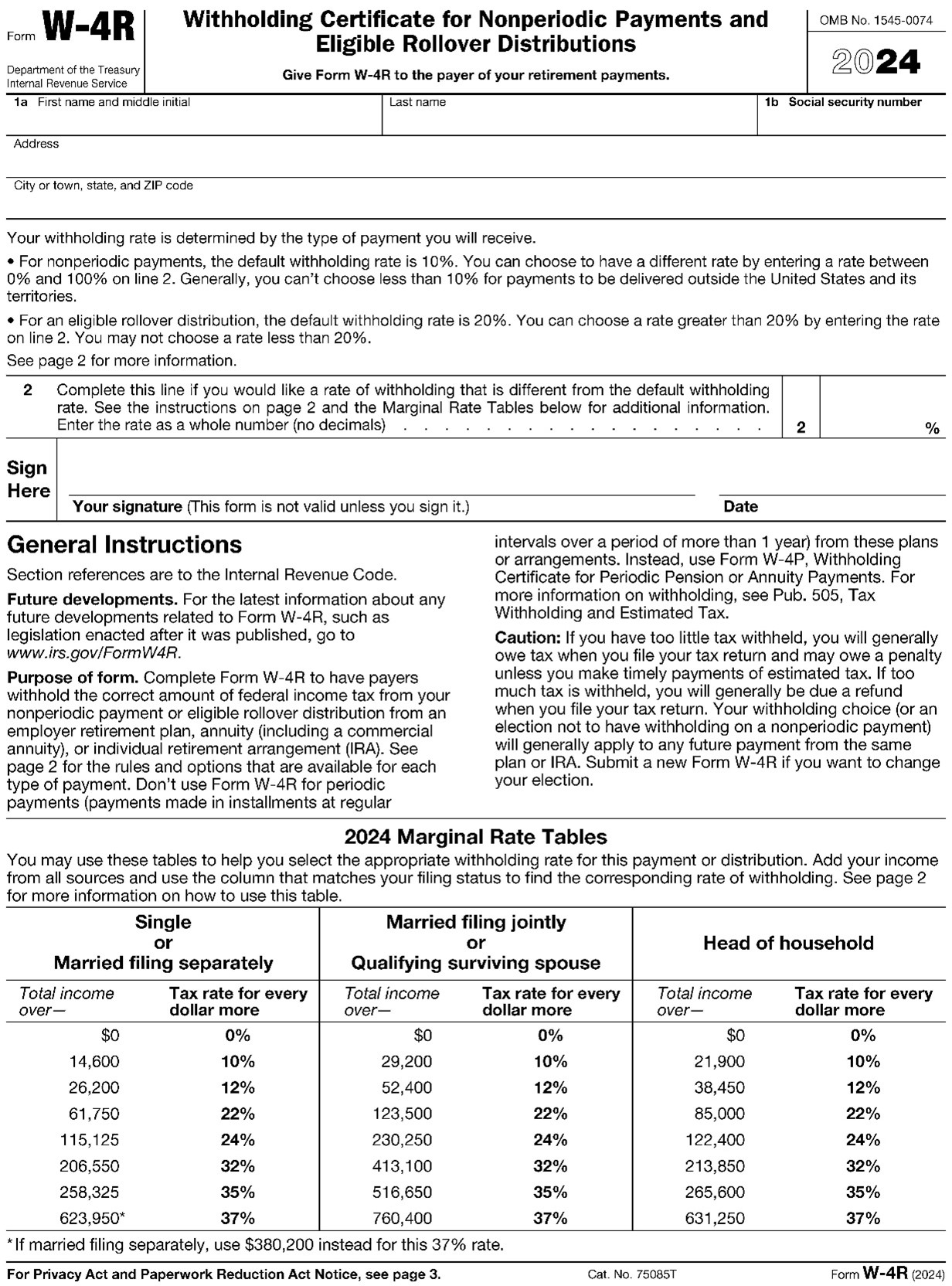

IRS Releases 2024 Form W 4R Wolters Kluwer Worksheets Library

IRS Releases 2024 Form W 4R Wolters Kluwer Worksheets Library

IRS Form W 4 Instructions Employee S Withholding Certificate

IRS Form W 4 Instructions Employee S Withholding Certificate

2024 IRS Form W 4 Fill Out U0026 Save With Our PDF Editor

2024 IRS Form W 4 Fill Out U0026 Save With Our PDF Editor

Processing payroll tasks doesn’t have to be difficult. A payroll template offers a speedy, dependable, and straightforward method for tracking salaries, work time, and taxes—without the need for complex software.

Whether you’re a startup founder, payroll manager, or independent contractor, using apayroll template helps ensure compliance with regulations. Simply access the template, produce a hard copy, and fill it out by hand or type directly into the file before printing.