When tax season rolls around, one of the most important forms that individuals need to have on hand is the IRS W-2 form. This form is used by employers to report wages paid to employees and taxes withheld from their paychecks. It is crucial for individuals to have this form in order to accurately file their taxes and ensure that they are in compliance with tax regulations.

For the year 2024, the IRS has made the W-2 form available in a printable format, making it easier for individuals to access and fill out. This printable version of the form can be found on the IRS website or through various tax preparation software programs. Having the form in a printable format allows individuals to easily fill it out and submit it along with their tax return.

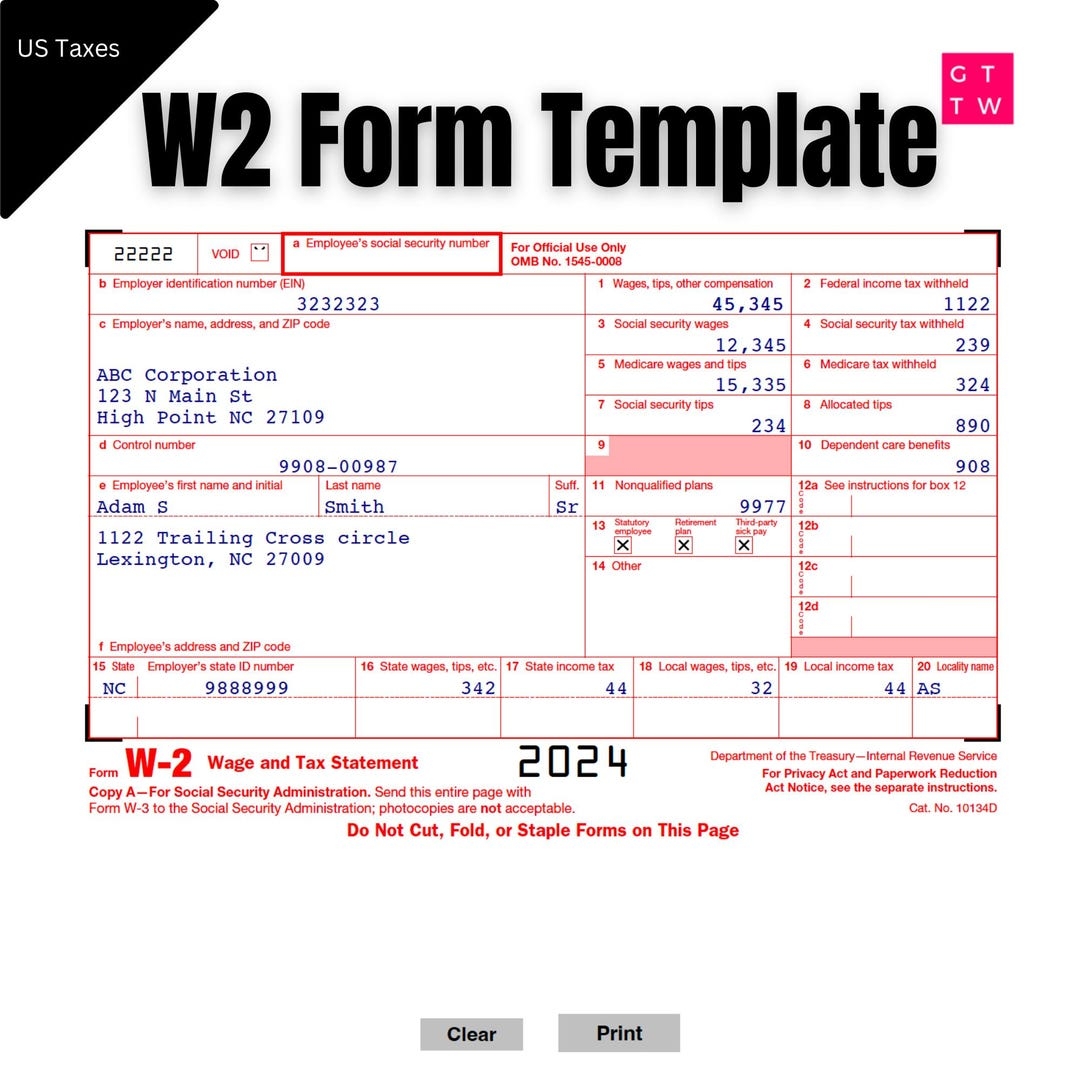

When filling out the IRS W-2 form, individuals will need to provide information such as their name, address, Social Security number, and details about their employer. They will also need to report their wages, tips, and other compensation received during the tax year. Additionally, individuals will need to report any taxes withheld from their paychecks, such as federal income tax, Social Security tax, and Medicare tax.

Once the form is completed, individuals should double-check all the information provided to ensure accuracy. Any errors or discrepancies could result in delays in processing their tax return or potential penalties from the IRS. It is important to take the time to review the form thoroughly before submitting it.

After the form has been completed and reviewed, individuals can submit it along with their tax return to the IRS. If filing electronically, they can simply upload the form as part of their tax return. If filing by mail, individuals should include a copy of the form with their tax return and keep a copy for their records.

In conclusion, the IRS W-2 form for the year 2024 is now available in a printable format, making it easier for individuals to access and fill out. It is important for individuals to have this form on hand when filing their taxes in order to accurately report their income and taxes withheld. By taking the time to fill out the form correctly and review it for accuracy, individuals can ensure a smooth tax filing process.