As tax season approaches, it’s important to be prepared with all the necessary documents to ensure a smooth filing process. One crucial aspect of tax preparation is having access to the right forms, and the IRS Tax Forms for 2025 are essential for individuals and businesses alike. These forms provide the necessary information for reporting income, deductions, and credits to accurately calculate taxes owed or refunds due.

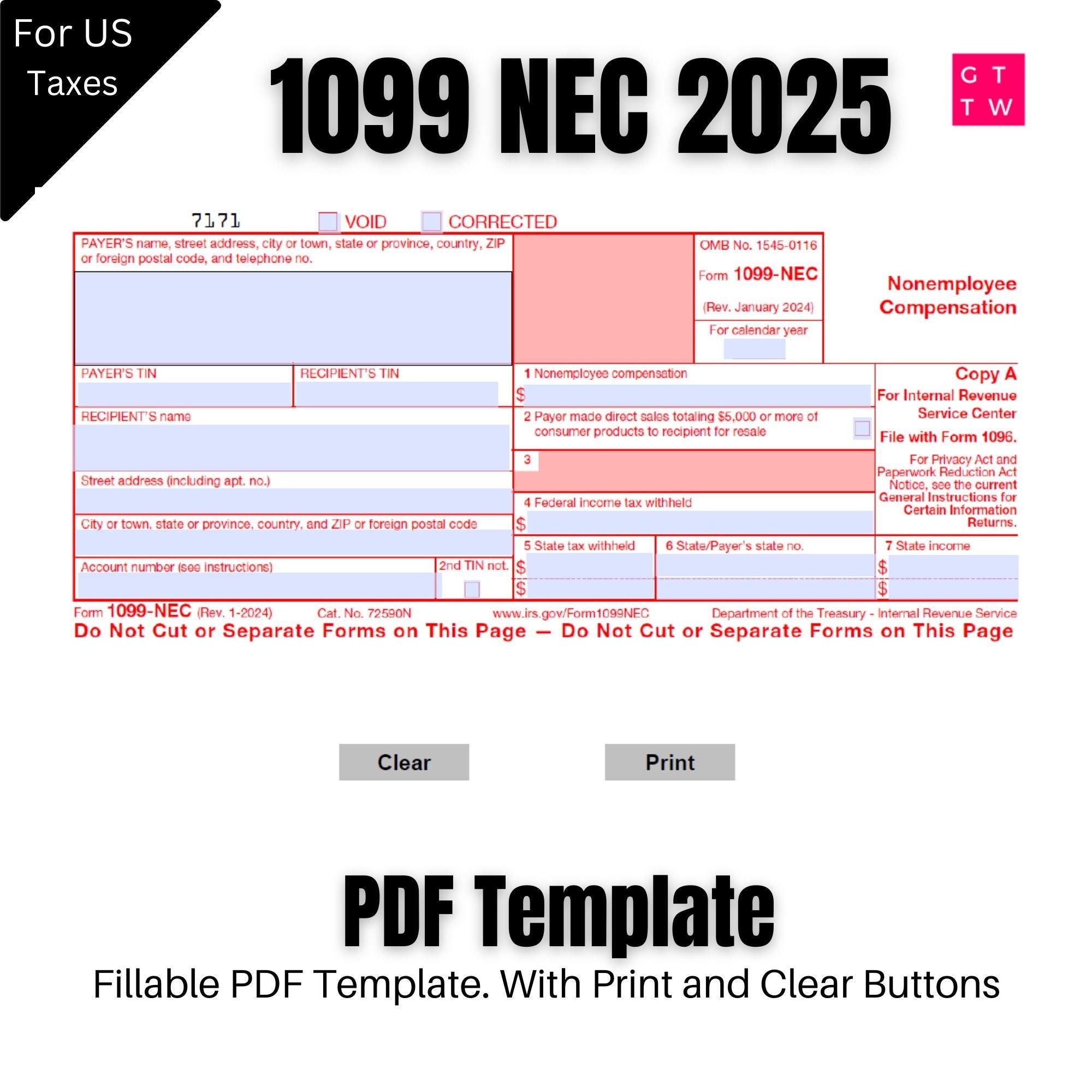

For those who prefer to have physical copies of their tax forms, the IRS offers printable PDF versions that can be easily downloaded and filled out at your convenience. This option allows for flexibility in completing the forms, whether you prefer to fill them out by hand or electronically before printing.

Irs Tax Forms 2025 Printable Pdf Download

Irs Tax Forms 2025 Printable Pdf Download

With the IRS Tax Forms 2025 Printable PDF Download, individuals and businesses can access forms such as the 1040, 1099, W-2, and more. These forms are crucial for reporting various sources of income, deductions, and credits to accurately calculate taxes owed or refunds due. By having these forms readily available in PDF format, taxpayers can easily navigate through the filing process and ensure that all necessary information is included.

It’s important to note that the IRS updates its forms annually to reflect any changes in tax laws or regulations, so it’s crucial to use the most current version of the forms for accurate reporting. By downloading the IRS Tax Forms 2025 Printable PDF, taxpayers can ensure they have the most up-to-date forms for their filing needs.

Whether you’re an individual taxpayer or a business owner, having access to the IRS Tax Forms 2025 Printable PDF Download can streamline the tax filing process and ensure accurate reporting. By utilizing these forms, taxpayers can effectively report their income, deductions, and credits to calculate their tax liability or refund amount with ease.

Overall, the IRS Tax Forms 2025 Printable PDF Download provides a convenient and accessible way for taxpayers to access the necessary forms for tax filing. By staying organized and prepared with the right documents, individuals and businesses can navigate the tax season with confidence and accuracy.