As tax season approaches, it’s essential to have all the necessary forms ready for filing your taxes. The IRS Tax Forms for 2025 are crucial documents that individuals and businesses need to accurately report their income and expenses. These forms provide the framework for calculating how much tax you owe or how much of a refund you may be eligible for.

With the advancement of technology, many tax forms can now be easily accessed and printed from the IRS website. This convenience makes it simpler for taxpayers to fill out their forms accurately and efficiently. By having the IRS Tax Forms 2025 printable, you can ensure that you have all the necessary documents at your fingertips when it’s time to file your taxes.

When printing IRS Tax Forms for 2025, it’s important to double-check that you are using the most up-to-date version of the forms. The IRS regularly updates their forms to reflect changes in tax laws and regulations. By using the latest forms, you can avoid any potential errors or delays in processing your tax return.

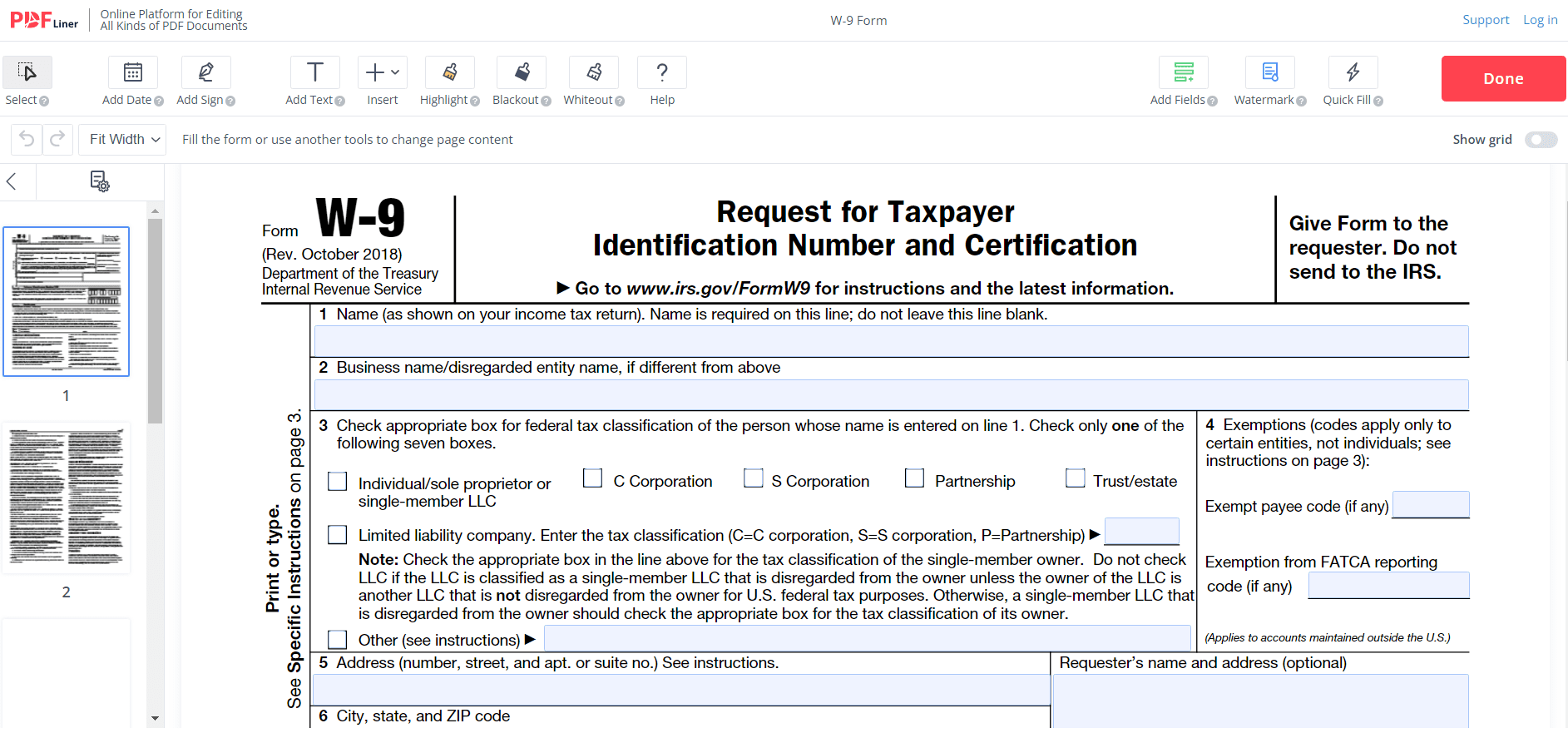

Some common IRS Tax Forms for 2025 that individuals may need to print include Form 1040 for individual income tax returns, Form 1099 for reporting various types of income, and Form W-2 for reporting wages and salaries. Businesses may need to print forms such as Form 1065 for partnerships, Form 1120 for corporations, and Form 941 for payroll taxes.

It’s also important to keep in mind that not all tax forms can be printed. Some forms may need to be requested directly from the IRS or obtained from a tax professional. Additionally, certain forms may require specific software to fill out electronically before printing. Be sure to read the instructions carefully for each form to ensure you are completing it correctly.

In conclusion, having access to IRS Tax Forms 2025 printable can make the tax filing process much more manageable. By printing the necessary forms ahead of time, you can stay organized and ensure that you have all the information you need to accurately report your income and expenses. Remember to check for updates to the forms and follow the instructions carefully to avoid any potential errors. With the right tools and resources, you can successfully navigate the tax filing process and meet your obligations as a taxpayer.