The IRS tax forms for 2023 are essential documents that individuals and businesses must fill out and submit to the Internal Revenue Service (IRS) to report their income, expenses, and other financial information. These forms help taxpayers calculate their tax liability and determine whether they owe additional taxes or are entitled to a refund.

One convenient way to access these forms is through printable PDF versions that can be easily downloaded from the IRS website. This allows taxpayers to fill out the forms electronically or print them out and complete them by hand.

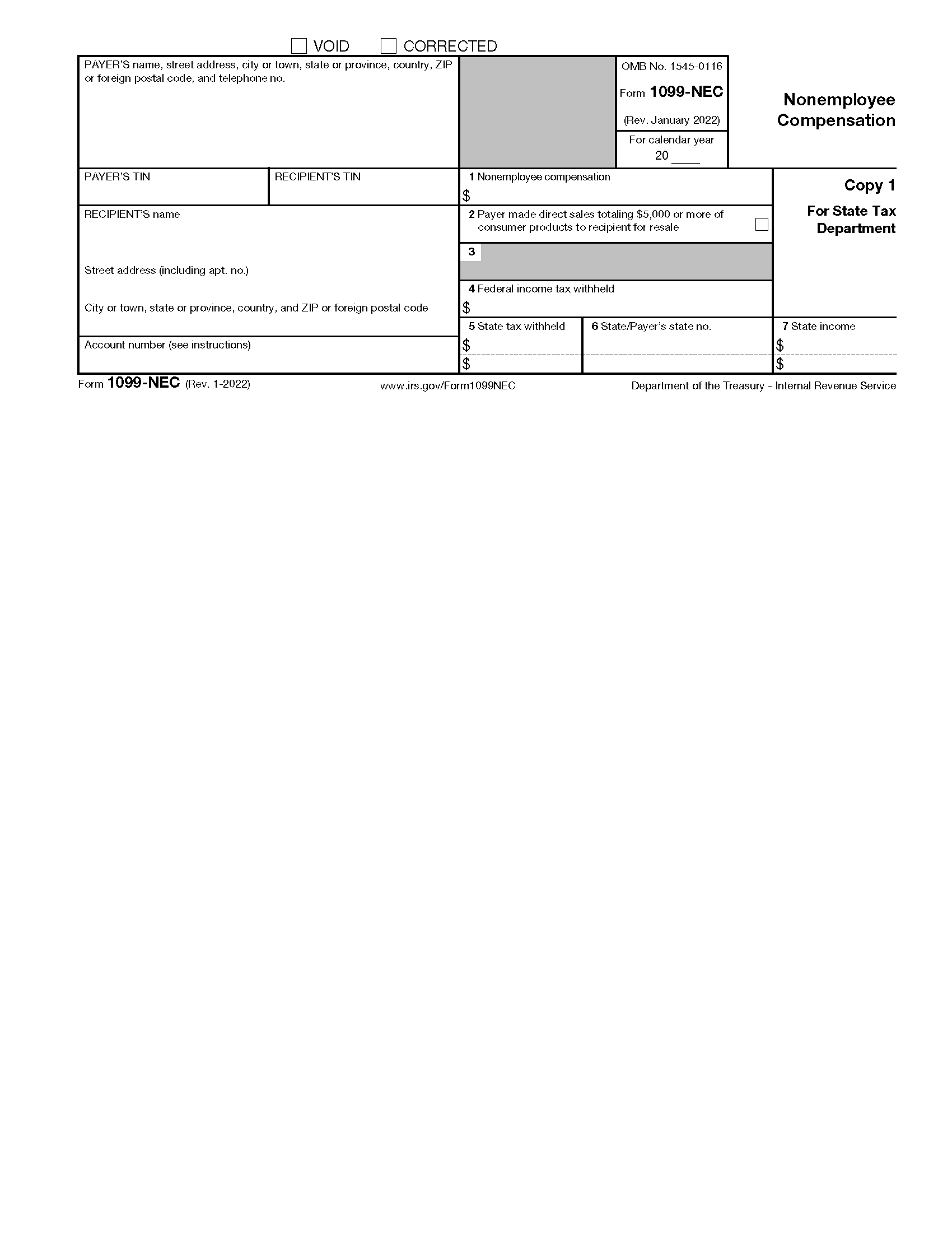

Irs Tax Forms 2023 Printable Pdf

Irs Tax Forms 2023 Printable Pdf

IRS Tax Forms 2023 Printable PDF

Some of the most commonly used IRS tax forms for 2023 include Form 1040 for individual income tax returns, Form 1120 for corporate tax returns, and Form 941 for employer’s quarterly federal tax returns. Each form serves a specific purpose and must be completed accurately to avoid penalties or fines.

When using the printable PDF versions of these forms, taxpayers should ensure that they have the latest version to comply with any updates or changes in tax laws. It is also important to double-check all information entered on the forms to avoid errors that could delay processing or lead to audits.

In addition to tax return forms, there are also various schedules and worksheets that may need to be attached to the main form depending on individual circumstances. These additional documents provide more detailed information on specific deductions, credits, or income sources that may impact the final tax liability.

Overall, IRS tax forms for 2023 are an essential part of the tax filing process, and using printable PDF versions can make it easier for taxpayers to complete and submit their returns accurately and on time. By staying organized and keeping track of all necessary documents, individuals and businesses can ensure a smooth tax filing experience and avoid any potential issues with the IRS.

In conclusion, accessing IRS tax forms for 2023 through printable PDF versions is a convenient and efficient way to fulfill tax obligations. By familiarizing yourself with the various forms and requirements, you can navigate the tax filing process with confidence and peace of mind.