As we approach the tax season, it’s important to be prepared with all the necessary forms and documents to file your taxes accurately. The IRS provides a variety of tax forms that taxpayers can use to report their income, deductions, and credits. One of the key components of filing taxes is having access to printable IRS tax forms for the year 2023.

Printable IRS tax forms make it convenient for taxpayers to fill out their information and submit it to the IRS either by mail or electronically. These forms are easily accessible on the IRS website and can be downloaded and printed for free. Whether you are an individual taxpayer, a business owner, or a tax professional, having access to printable IRS tax forms is essential for fulfilling your tax obligations.

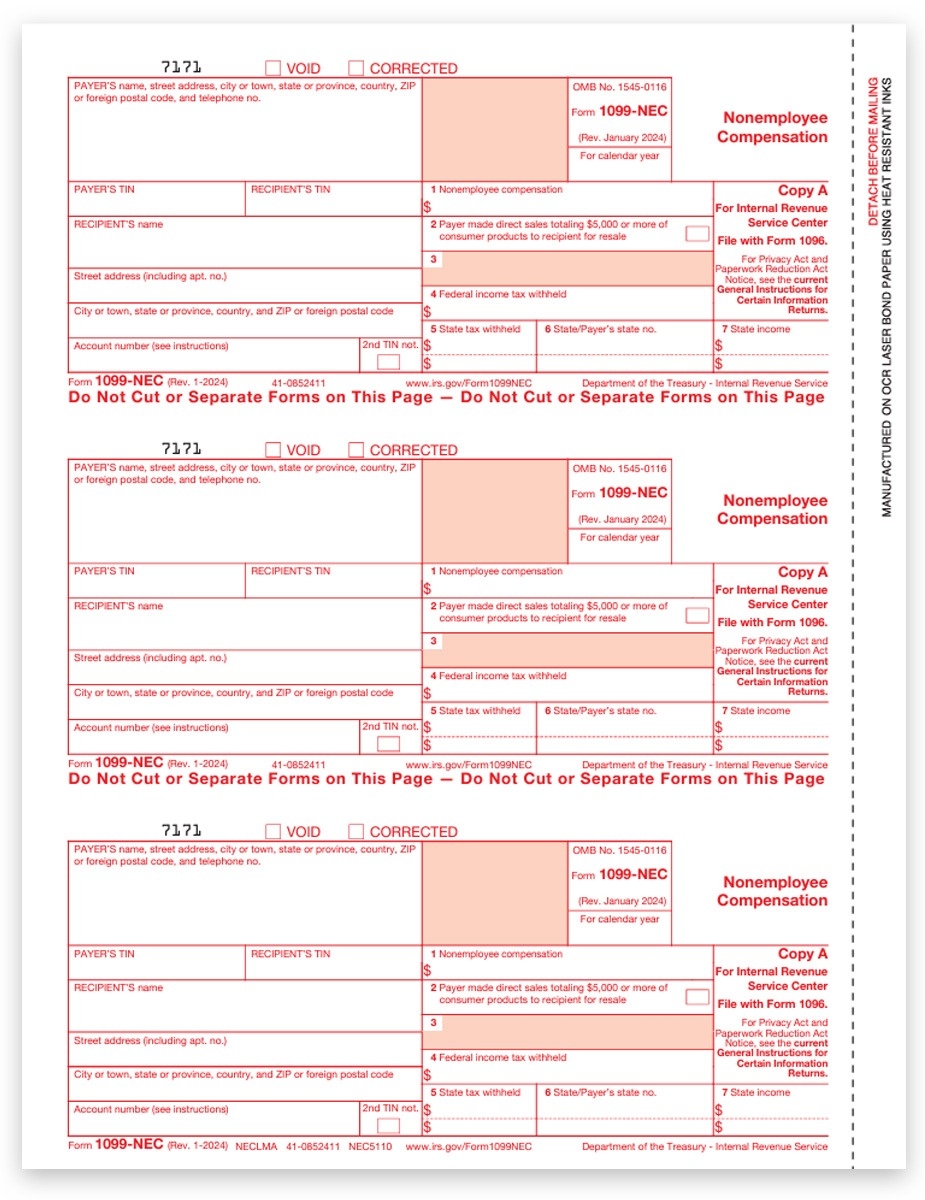

When it comes to tax forms for the year 2023, the IRS offers a wide range of options to accommodate different tax situations. From the basic Form 1040 for individual income tax returns to the more complex forms for businesses and self-employed individuals, there is a form for everyone. Some of the commonly used IRS tax forms for 2023 include Form 1040, Form 1040-ES for estimated tax payments, Form 1065 for partnership income, and Form 1120 for corporate income tax.

It’s important to note that not all taxpayers will need to file the same forms, as it depends on their specific tax situation. Whether you are a salaried employee, a freelancer, a business owner, or an investor, you must determine which IRS tax forms are applicable to you. Consulting with a tax professional can help you identify the right forms to use and ensure that you are in compliance with tax laws.

As you gather your financial documents and prepare to file your taxes for the year 2023, make sure to download and print the necessary IRS tax forms from the official IRS website. Having these forms on hand will make the tax filing process smoother and more efficient. Remember to double-check all the information you provide on the forms to avoid any errors or discrepancies that could result in penalties or delays in processing your tax return.

Stay informed about any updates or changes to the IRS tax forms for the year 2023 by visiting the IRS website regularly. Being proactive and prepared will help you navigate the tax filing process with ease and ensure that you meet your tax obligations in a timely manner.