As tax season approaches, it’s important to have all the necessary forms and documents in order to file your taxes accurately and on time. The IRS provides a range of printable tax forms for taxpayers to use, including those for the tax year 2016. These forms are essential for individuals and businesses to report their income and deductions to the government.

Whether you’re filing as an individual or a business, having access to IRS printable tax forms for the year 2016 can make the process of filing your taxes much simpler. These forms are readily available on the IRS website, making it easy for taxpayers to download and print them at their convenience. By using the correct forms for the tax year 2016, you can ensure that your tax return is accurate and complete.

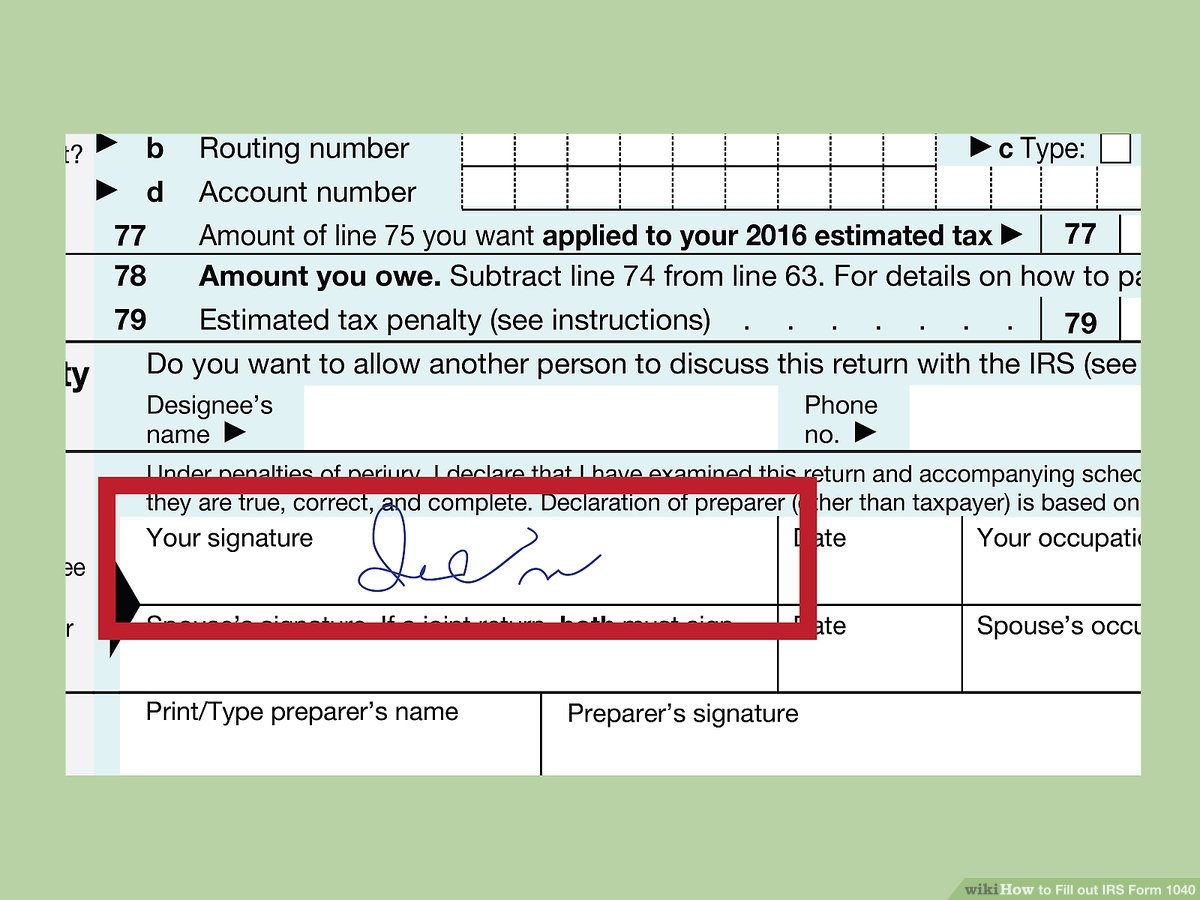

Some of the most common IRS printable tax forms for the year 2016 include Form 1040 for individual income tax returns, Form 1120 for corporate tax returns, and Form 941 for employer’s quarterly federal tax returns. These forms, along with many others, are vital for taxpayers to report their income, deductions, and credits to the IRS. By filling out these forms accurately and submitting them on time, you can avoid penalties and ensure that your tax return is processed promptly.

It’s important to note that some tax forms may have changed from year to year, so it’s essential to use the correct forms for the tax year 2016. By accessing the IRS website, taxpayers can easily find and download the necessary forms for their specific tax situation. Additionally, the IRS provides instructions for each form to help taxpayers fill them out correctly.

As tax season approaches, be sure to gather all the necessary documents and forms to file your taxes accurately and on time. By utilizing IRS printable tax forms for the year 2016, you can streamline the tax filing process and ensure that your tax return is complete. Remember to double-check your forms for accuracy before submitting them to the IRS to avoid any potential issues.