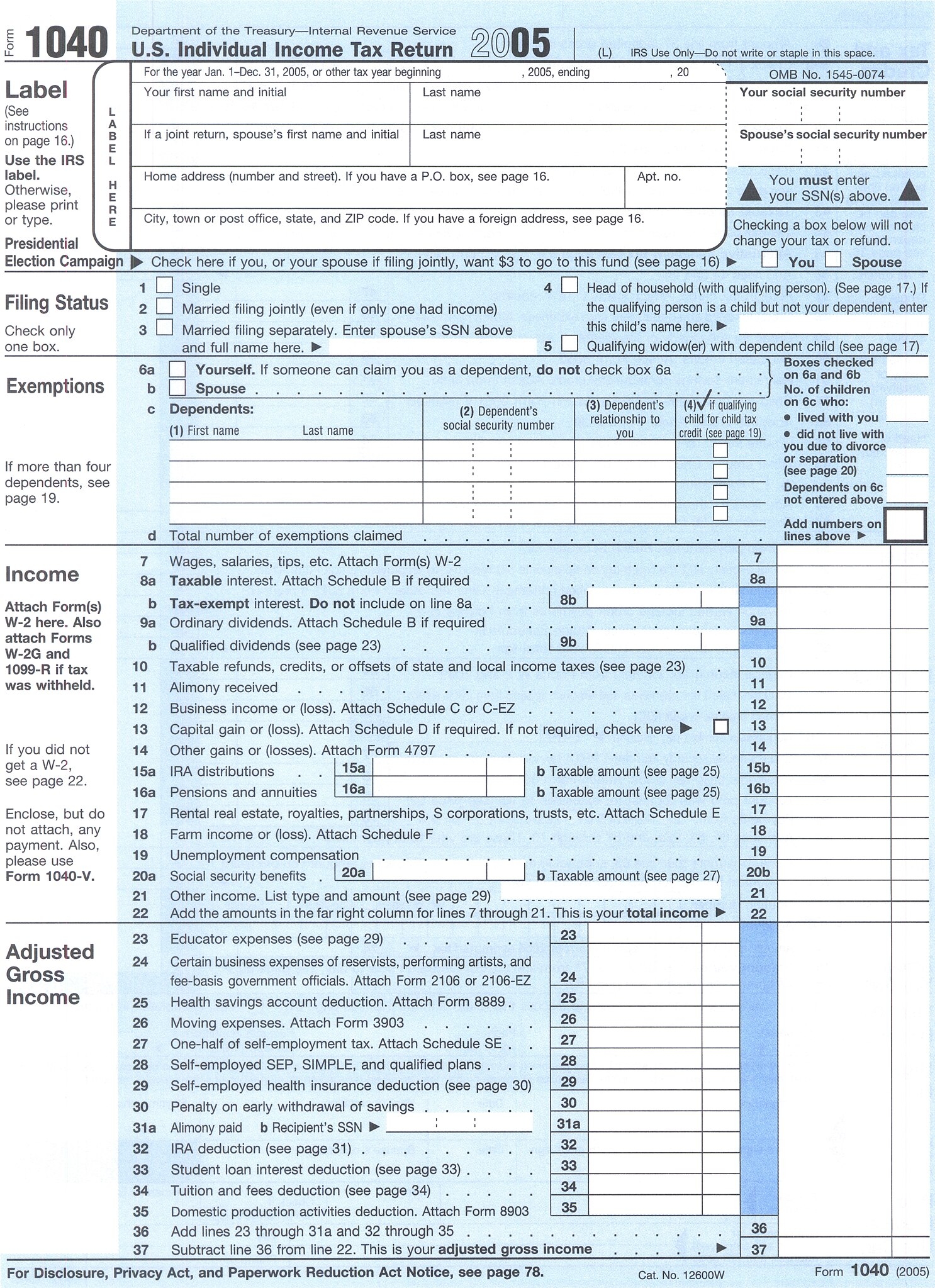

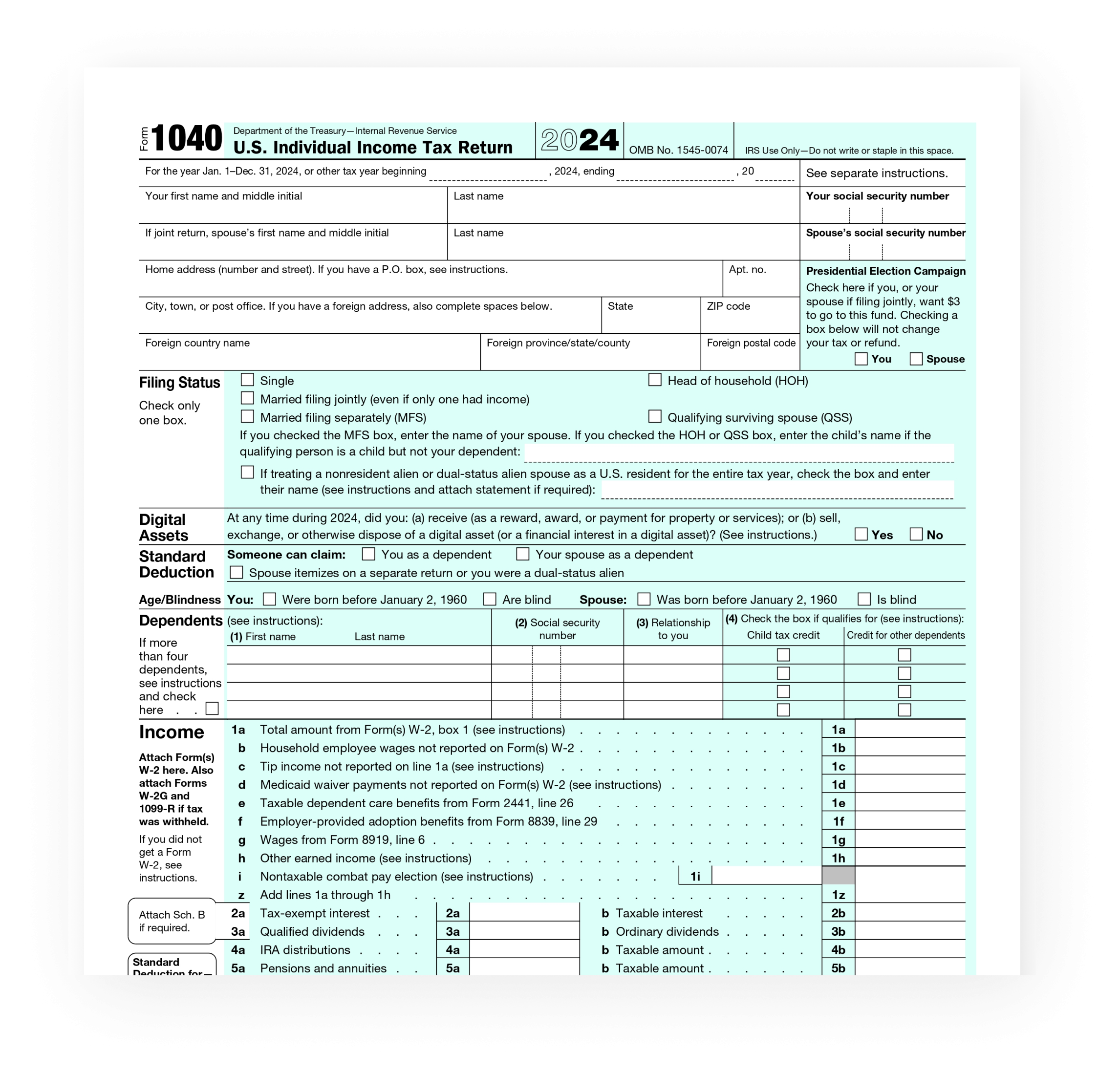

IRS Printable Tax Form 1040a

Tax season is upon us, and it’s time to start gathering all of your necessary documents to file your taxes. One important form that many taxpayers will need is the IRS Printable Tax Form 1040a. This form is commonly used by individuals who have a more straightforward tax situation and do not need to itemize deductions.

The Form 1040a is a shorter version of the standard Form 1040, making it easier to fill out for those who do not have complex tax situations. It allows taxpayers to report their income, deductions, and credits in a more simplified manner, making the tax filing process less daunting.

When filling out the Form 1040a, taxpayers will need to provide information such as their income, deductions, and credits. This form is ideal for those who have income from wages, salaries, tips, interest, dividends, and unemployment compensation. It also allows for adjustments to income, such as educator expenses, student loan interest, and tuition and fees deductions.

Taxpayers who use the Form 1040a can also claim certain tax credits, such as the Child Tax Credit, the Credit for the Elderly or the Disabled, and the Earned Income Tax Credit. These credits can help reduce the amount of tax owed or increase the amount of the taxpayer’s refund.

After filling out the Form 1040a, taxpayers can then file their taxes either electronically or by mailing the form to the IRS. It’s important to double-check all information provided on the form to ensure accuracy and avoid any potential issues with the IRS.

In conclusion, the IRS Printable Tax Form 1040a is a valuable tool for individuals with a more straightforward tax situation. By using this form, taxpayers can easily report their income, deductions, and credits in a simplified manner. If you are eligible to use the Form 1040a, be sure to gather all necessary documents and fill out the form accurately to ensure a smooth tax filing process.

Quickly Access and Print Irs Printable Tax Form 1040a

Printable payroll are ideal for teams that prefer non-digital systems or need printed versions for staff files. Most forms include fields for employee name, pay period, gross pay, withholdings, and final salary—making them both detailed and user-friendly.

Begin streamlining your payroll process today with a trusted Irs Printable Tax Form 1040a. Save time, minimize mistakes, and maintain clear records—all while keeping your financial logs clear.

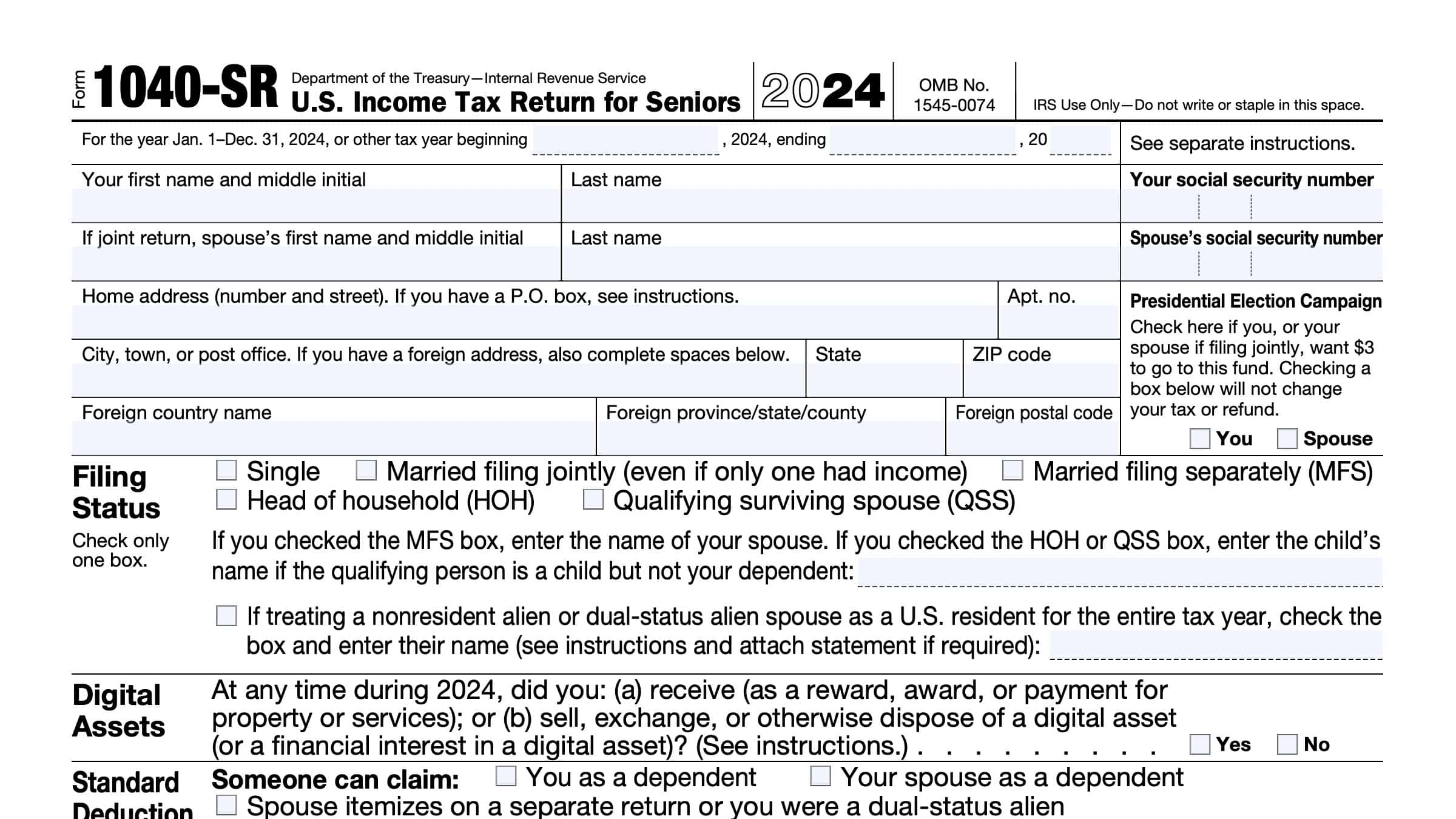

IRS Form 1040 SR Instructions Tax Return For Seniors

IRS Form 1040 SR Instructions Tax Return For Seniors

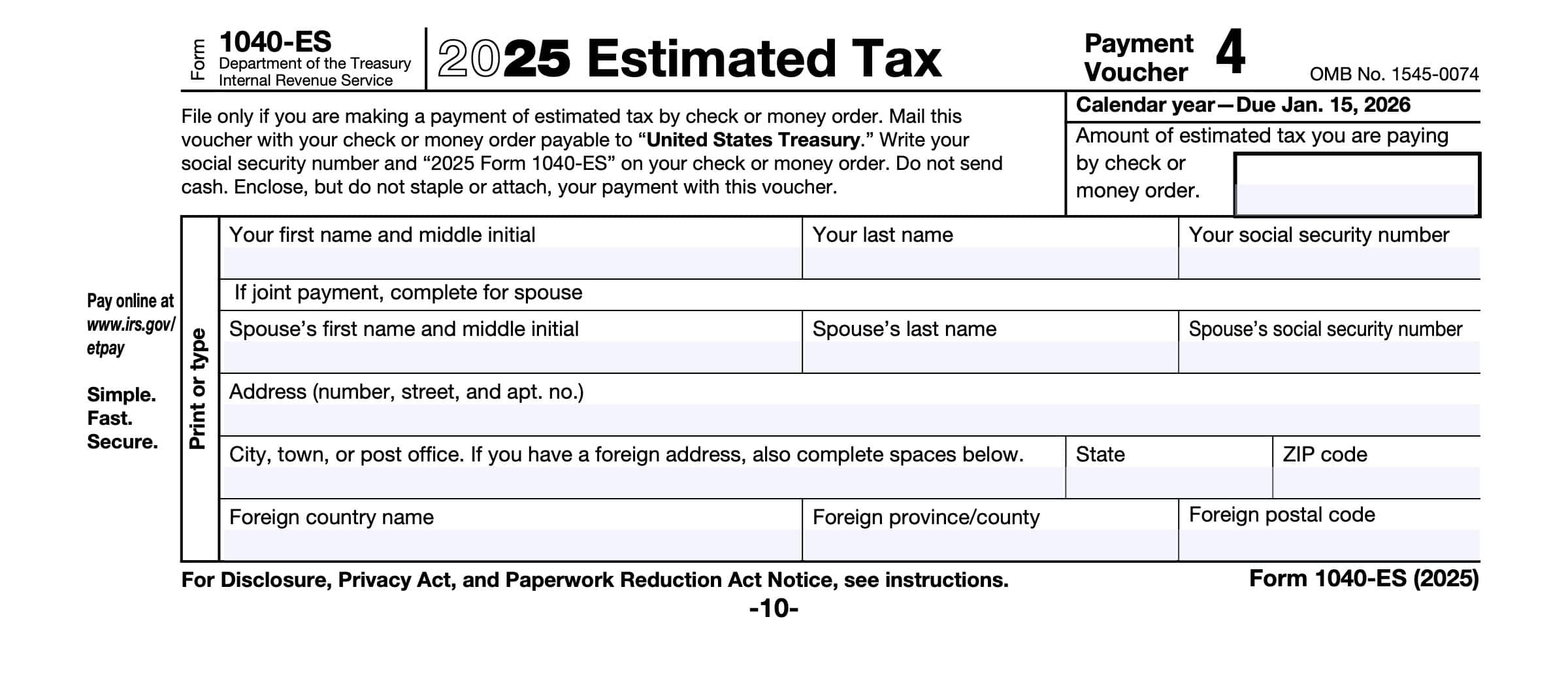

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments

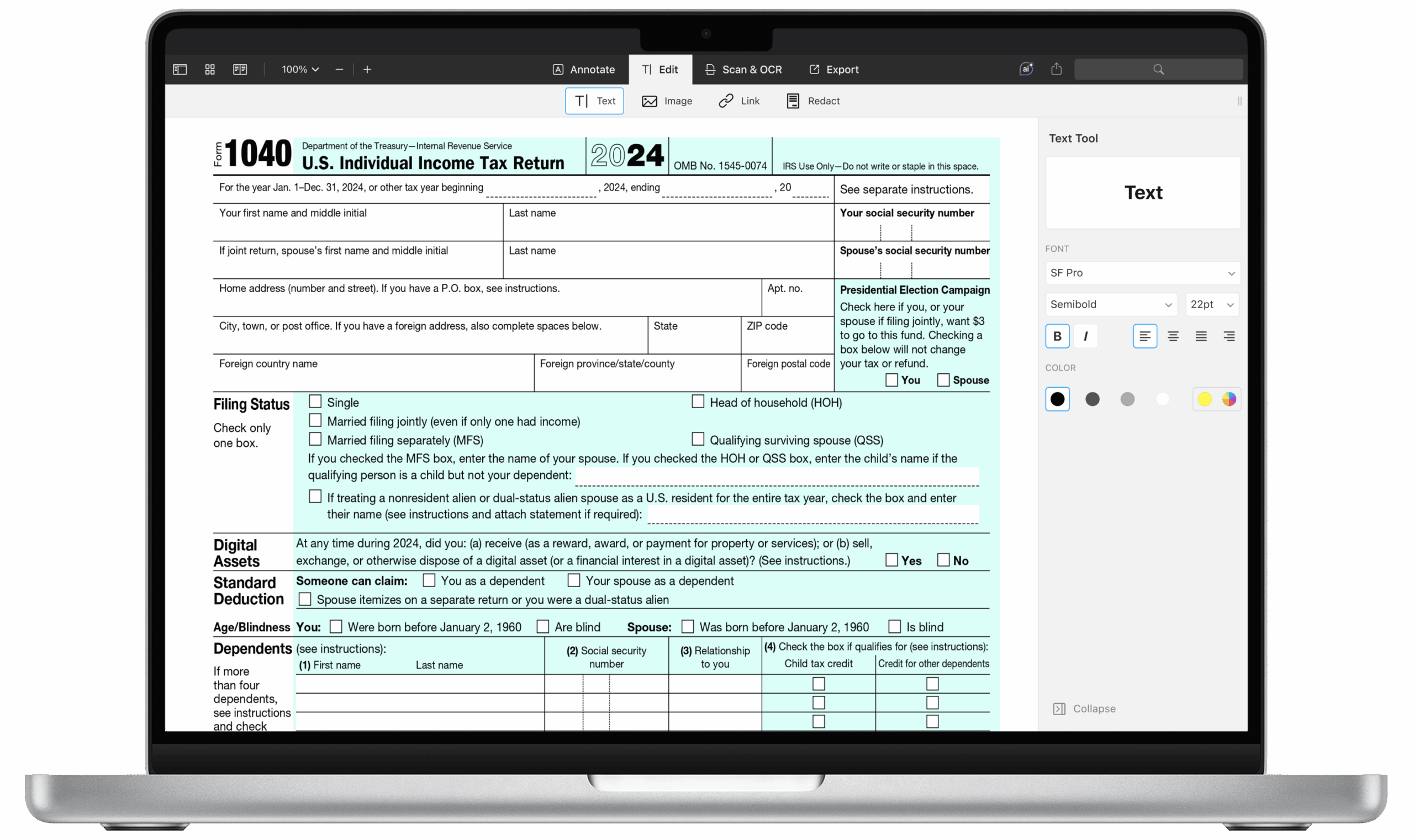

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

Handling staff wages doesn’t have to be complicated. A payroll printable offers a fast, reliable, and straightforward method for tracking wages, shifts, and deductions—without the need for complicated tools.

Whether you’re a small business owner, HR professional, or independent contractor, using aprintable payroll helps ensure accurate record-keeping. Simply access the template, print it, and fill it out by hand or type directly into the file before printing.