As we approach the year 2025, it’s essential to stay informed about the latest updates and changes in tax regulations. The IRS is constantly updating its forms to ensure accurate reporting and compliance with tax laws. IRS printable forms for 2025 will provide taxpayers with the necessary tools to file their taxes correctly and efficiently. It’s important to familiarize yourself with these forms to avoid any potential issues or penalties.

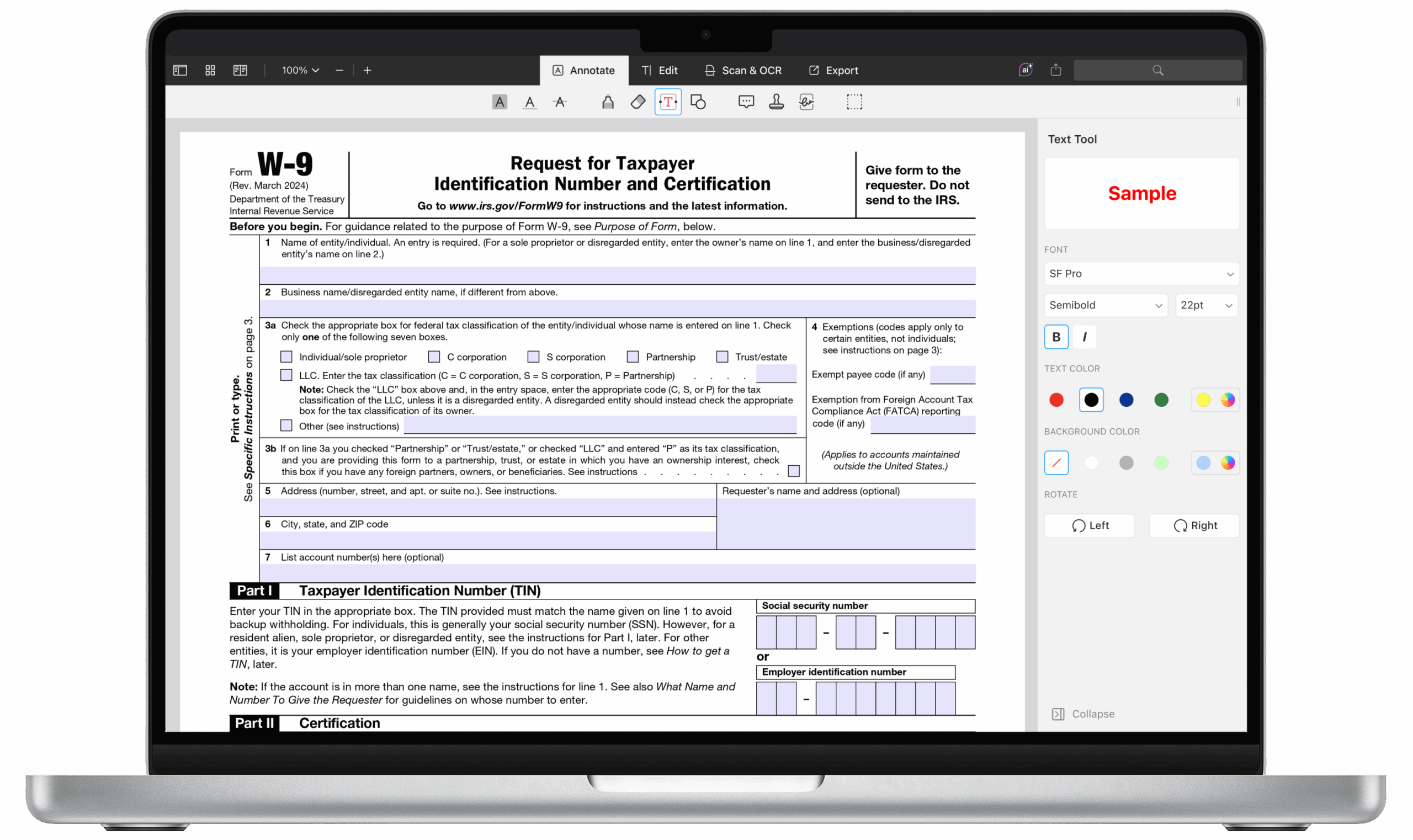

With the advancement of technology, many taxpayers opt for online filing methods. However, there are still individuals who prefer to fill out physical forms. The IRS understands this preference and continues to provide printable forms for those who choose to file their taxes manually. These forms are readily available on the IRS website and can be easily accessed and printed for convenience.

IRS printable forms for 2025 will include essential documents such as Form 1040 for individual tax returns, Form 1120 for corporate tax returns, and various schedules and worksheets for reporting specific income and deductions. These forms will be updated to reflect any changes in tax laws and regulations that may impact taxpayers in the upcoming year.

It’s important to note that the IRS encourages electronic filing as it is more efficient and secure compared to paper filing. However, for those who prefer to file manually, printable forms offer a viable option. Taxpayers should ensure they have the most current version of the forms to avoid any discrepancies in their tax return.

As we move closer to 2025, taxpayers should stay informed about any updates or changes to IRS printable forms. By familiarizing themselves with these forms, individuals can ensure accurate reporting and compliance with tax laws. Whether filing online or using printable forms, it’s crucial to file taxes correctly to avoid any potential issues with the IRS.

In conclusion, IRS printable forms for 2025 will play a crucial role in helping taxpayers accurately report their income and deductions. By staying informed and utilizing the necessary forms, individuals can navigate the tax filing process with ease. Whether filing electronically or manually, it’s important to take the time to understand and complete the required forms accurately.