When it comes to tax season, one of the most important forms that individuals and businesses need to be familiar with is the IRS Form 1099. This form is used to report various types of income, such as freelance earnings, interest, dividends, and more. Understanding how to properly fill out and submit Form 1099 is essential for staying compliant with tax laws and avoiding any potential penalties.

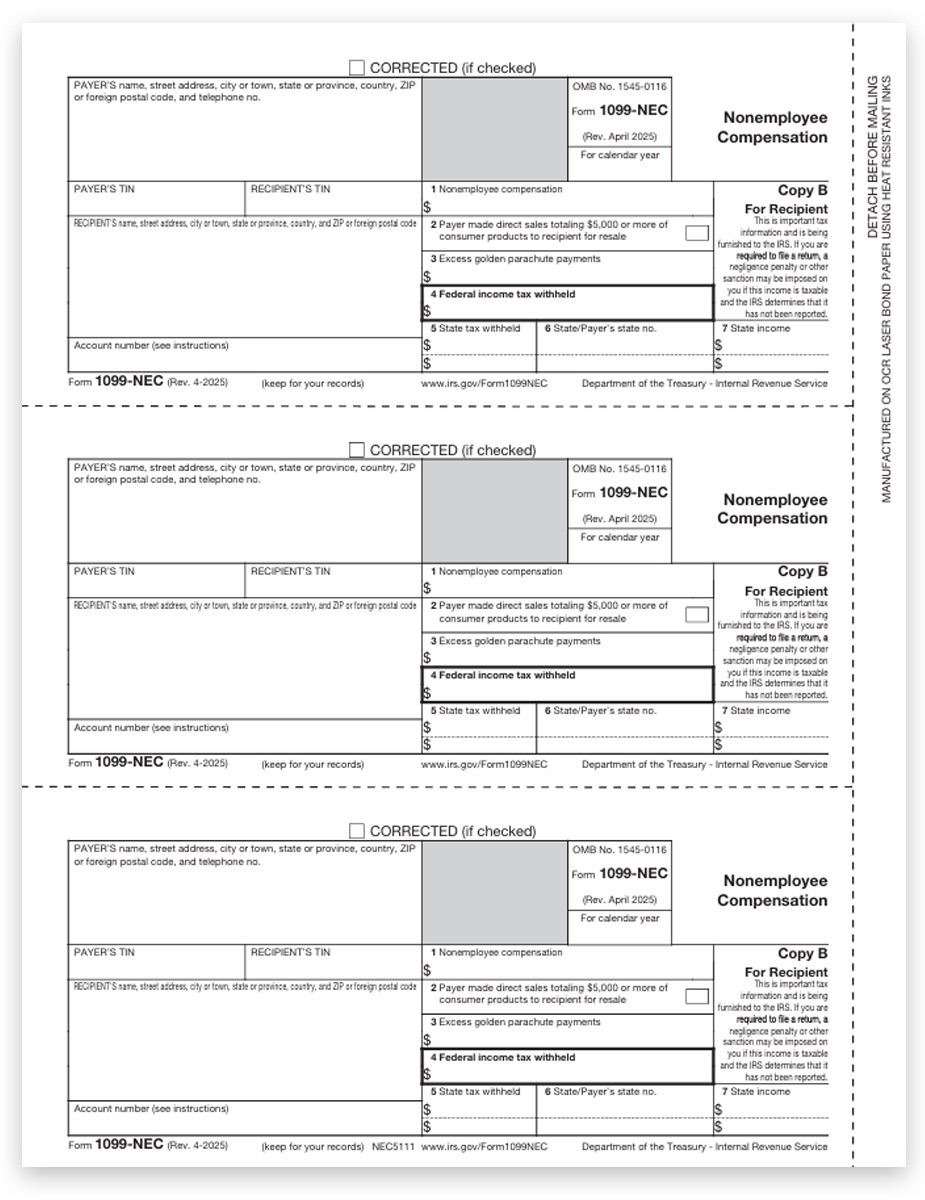

IRS Printable Forms 1099 are readily available on the IRS website for individuals and businesses to access and download. These forms can be easily filled out electronically or printed out for manual completion. It is crucial to ensure that all information is accurate and up-to-date before submitting the form to the IRS. Failure to report income correctly can result in audits and fines.

There are different types of IRS Form 1099, each used for reporting specific types of income. For example, Form 1099-MISC is commonly used for reporting payments made to independent contractors or freelancers, while Form 1099-INT is used for reporting interest income. It is important to use the correct form for each type of income being reported to avoid confusion and errors.

It is recommended to consult with a tax professional or accountant if you are unsure about how to properly fill out IRS Form 1099. They can provide guidance on which form to use, what information to include, and how to submit the form accurately. Additionally, using tax preparation software can help streamline the process and minimize the risk of errors.

Overall, understanding IRS Printable Forms 1099 is crucial for accurately reporting income and staying compliant with tax laws. By taking the time to familiarize yourself with these forms and seeking assistance when needed, you can ensure a smooth tax filing process and avoid any potential issues with the IRS.

In conclusion, IRS Printable Forms 1099 are essential tools for reporting various types of income to the IRS. It is important to use the correct form, provide accurate information, and seek professional guidance if needed to ensure compliance with tax laws. By staying informed and proactive, individuals and businesses can navigate tax season with confidence and peace of mind.