When it comes to filing your taxes, having the right forms is crucial. One of the most commonly used forms is the IRS Form 1040, which is used by individuals to report their income and determine their tax liability. This form is essential for anyone who needs to file their taxes, whether they are self-employed or employed by a company.

IRS Printable Forms 1040 provide individuals with a convenient way to file their taxes without the need for an accountant or tax professional. By filling out this form accurately, taxpayers can ensure that they are meeting their tax obligations and avoiding any potential penalties or fines.

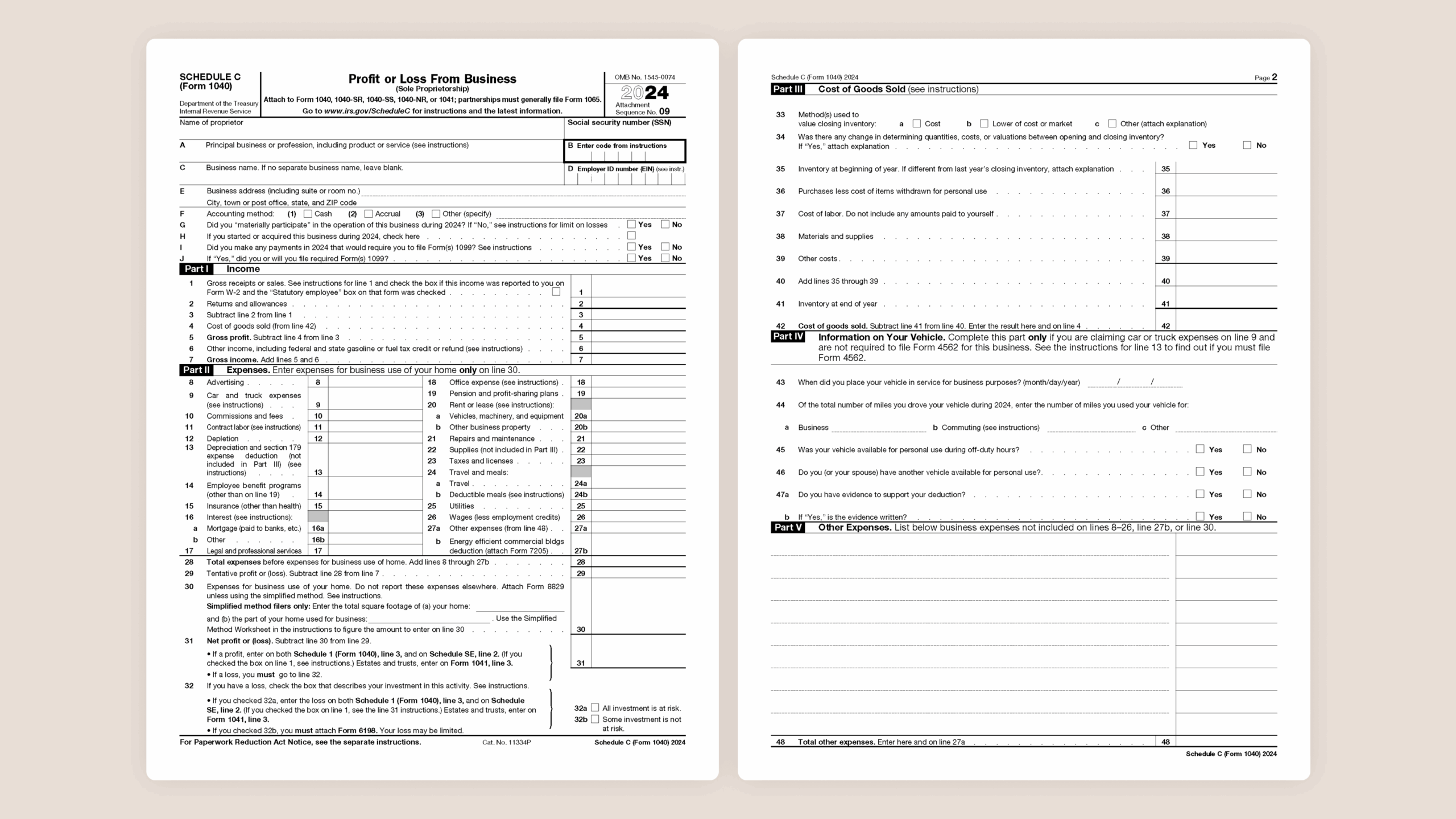

Irs Printable Forms 1040

Form 1040 is a comprehensive tax form that allows individuals to report their income, deductions, and credits. It is important to fill out this form correctly to avoid any mistakes that could lead to delays in processing your tax return. The IRS provides printable versions of Form 1040 on their website, making it easy for taxpayers to access and complete the form on their own.

When filling out Form 1040, taxpayers will need to provide information about their income, including wages, tips, and other sources of income. They will also need to report any deductions they are eligible for, such as student loan interest or mortgage interest. By accurately completing this form, individuals can ensure that they are paying the correct amount of taxes and avoid any potential audits or penalties.

It is important to note that the IRS updates Form 1040 annually, so it is essential to use the most recent version of the form when filing your taxes. By using the printable version of Form 1040 provided by the IRS, taxpayers can be confident that they are using the correct form and meeting all of their tax obligations.

In conclusion, IRS Printable Forms 1040 are a valuable resource for individuals who need to file their taxes. By using the official form provided by the IRS, taxpayers can ensure that they are accurately reporting their income and deductions, and avoiding any potential penalties or fines. It is important to take the time to fill out Form 1040 correctly to ensure a smooth tax filing process.