When starting a new job or experiencing a change in your financial situation, it’s important to update your W-4 form to ensure that your employer withholds the correct amount of taxes from your pay. The IRS Form W-4 is a crucial document that helps determine how much federal income tax should be withheld from your paycheck.

By filling out the IRS Printable Form W-4 accurately, you can avoid overpaying or underpaying your taxes throughout the year. This form allows you to claim allowances, deductions, and credits that affect the amount of tax withheld from your wages.

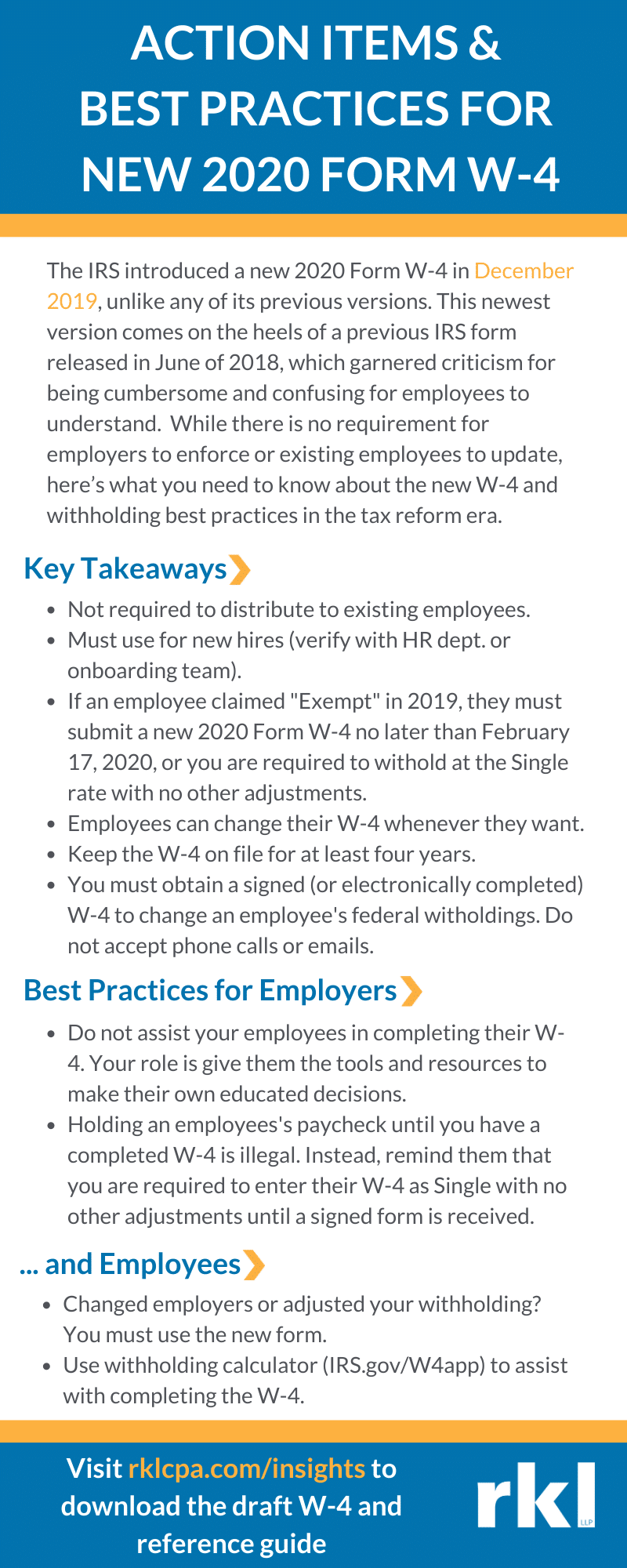

Irs Printable Form W-4

The IRS W-4 form consists of several sections where you provide information about your filing status, dependents, income, and any additional withholding amounts. It’s important to carefully review each section and make sure you provide accurate information to avoid any discrepancies in your tax withholding.

One key section of the W-4 form is the Personal Allowances Worksheet, where you calculate the number of allowances you are eligible to claim based on your marital status, number of dependents, and other factors. The more allowances you claim, the less tax will be withheld from your paycheck.

Another important section of the W-4 form is the Deductions, Adjustments, and Additional Income Worksheet, where you can enter any additional income sources, deductions, or adjustments that may affect your tax withholding. By providing accurate information in this section, you can ensure that the correct amount of tax is withheld from your pay.

Once you have completed the IRS W-4 form, make sure to submit it to your employer for processing. Your employer will use the information provided on the form to calculate the amount of federal income tax to withhold from your pay. It’s important to review your pay stubs regularly to ensure that the correct amount of tax is being withheld based on the information provided on your W-4 form.

In conclusion, the IRS Printable Form W-4 is a crucial document that helps determine the amount of federal income tax to be withheld from your paycheck. By filling out the form accurately and providing the necessary information, you can ensure that the correct amount of tax is withheld throughout the year.