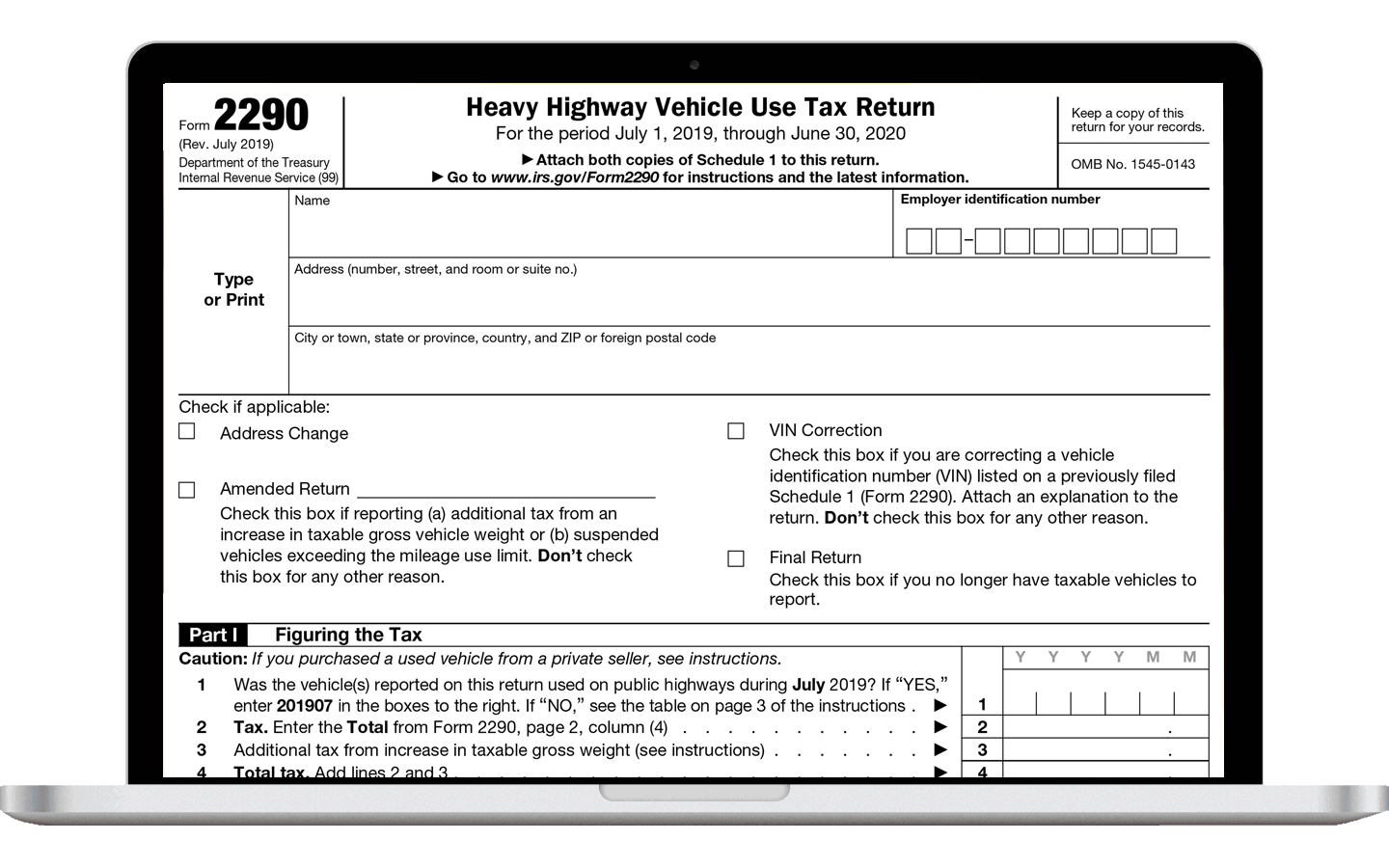

IRS Form 2290 is used by truck owners and operators to pay the federal heavy highway vehicle use tax. This tax is imposed on vehicles with a gross weight of 55,000 pounds or more that use public highways. The form must be filed annually, typically by August 31st of each year.

Truck owners can choose to file Form 2290 electronically or by mail. For those who prefer to file by mail, the IRS provides a printable version of the form on their website. This printable form allows truck owners to fill out the required information manually and submit it to the IRS.

When filling out IRS Form 2290, truck owners will need to provide information such as the taxable gross weight of the vehicle, the VIN number, and the date the vehicle was first used on the highway during the tax period. They will also need to calculate the tax due based on the weight of the vehicle.

In addition to the basic information required on Form 2290, truck owners may also need to provide additional documentation depending on their specific situation. This could include proof of payment for previous taxes, proof of exemption from the tax, or documentation related to leased vehicles.

Once the form is complete, truck owners can mail it to the address provided on the form along with payment for the tax due. It is important to ensure that the form is filled out accurately and that all required documentation is included to avoid any delays in processing.

In conclusion, IRS Form 2290 is an important document for truck owners and operators who are required to pay the federal heavy highway vehicle use tax. By understanding the requirements for filing this form and using the printable version provided by the IRS, truck owners can ensure that they are in compliance with federal tax laws.