When it comes to filing taxes as a business owner, one of the most important forms to be familiar with is the IRS Form 1099 NEC. This form is used to report nonemployee compensation, such as fees, commissions, prizes, and awards, that your business paid to individuals for services provided.

It is important to note that the IRS has made changes to the way nonemployee compensation is reported starting in the tax year 2020. Previously, nonemployee compensation was reported on Form 1099 MISC. However, the IRS has now created a separate form specifically for this purpose, Form 1099 NEC.

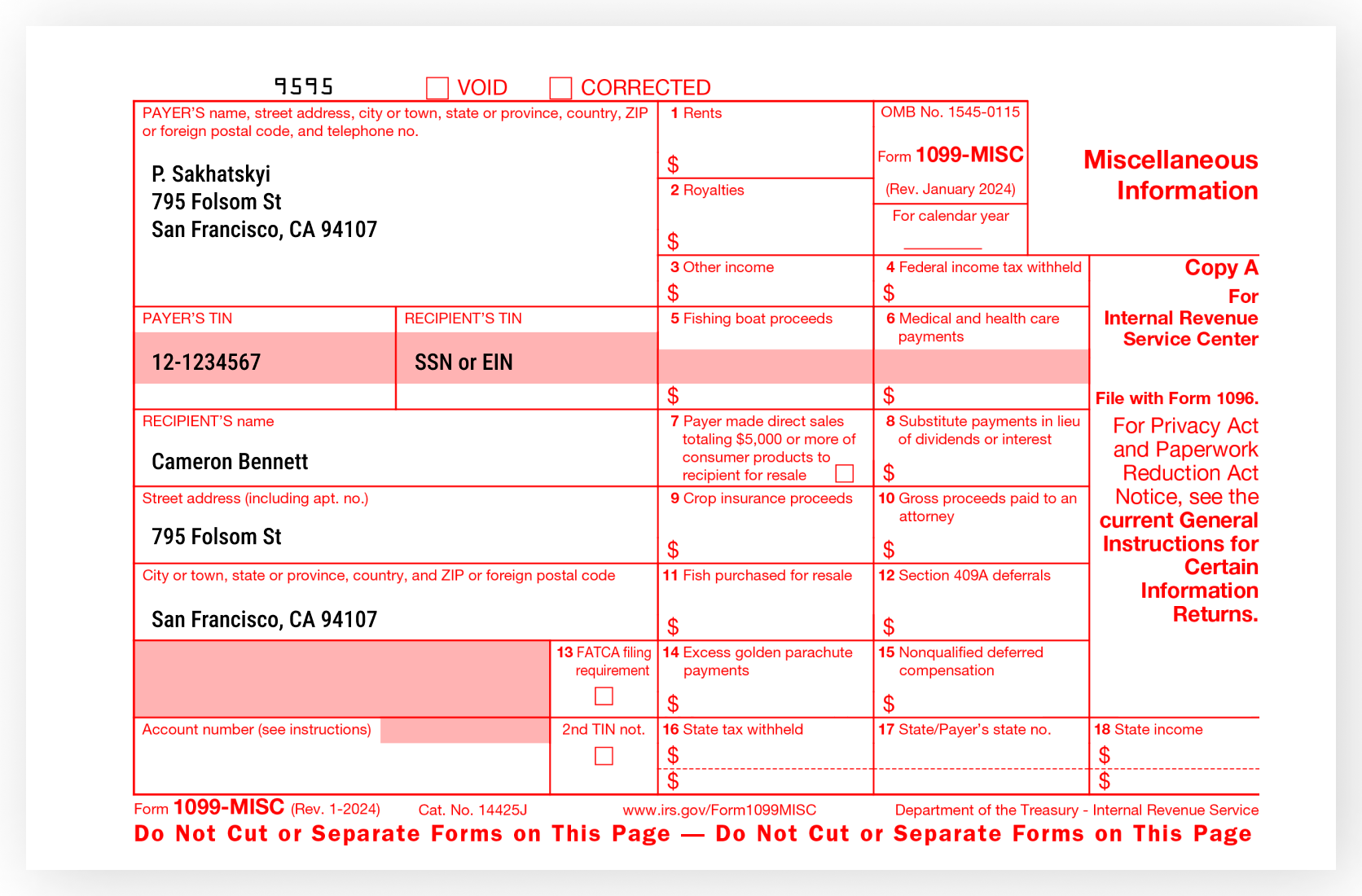

When preparing your Form 1099 NEC, you will need to gather information such as the recipient’s name, address, and taxpayer identification number (TIN). You will also need to report the total amount of nonemployee compensation paid to the individual during the tax year. Once the form is completed, you will need to provide a copy to the recipient and file a copy with the IRS.

It is important to ensure that you are using the most up-to-date version of Form 1099 NEC when filing your taxes. The IRS provides printable versions of the form on their website, making it easy for business owners to access and fill out the necessary information.

Failure to accurately report nonemployee compensation can result in penalties from the IRS, so it is crucial to take the time to carefully fill out Form 1099 NEC. By staying organized and keeping thorough records of payments made to individuals for services, you can ensure that your tax filing process goes smoothly.

In conclusion, the IRS Printable Form 1099 NEC is a vital tool for business owners to report nonemployee compensation and comply with tax regulations. By understanding the requirements for filing this form and using the resources provided by the IRS, you can effectively report payments made to individuals for services and avoid potential penalties. Make sure to stay informed and up-to-date on any changes to tax forms and regulations to ensure a successful tax filing process.