Dealing with taxes can be a daunting task, especially when it comes to filing taxes for trusts and estates. Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts, is the form that must be filed by these entities each year. This form helps ensure that these entities are in compliance with tax laws and regulations set forth by the Internal Revenue Service (IRS).

Form 1041 is used to report income, deductions, and credits for trusts and estates. It is similar to the individual income tax return form (Form 1040), but with some key differences. Trusts and estates are separate entities from their beneficiaries, so they are required to file their own tax returns and pay taxes on any income they generate.

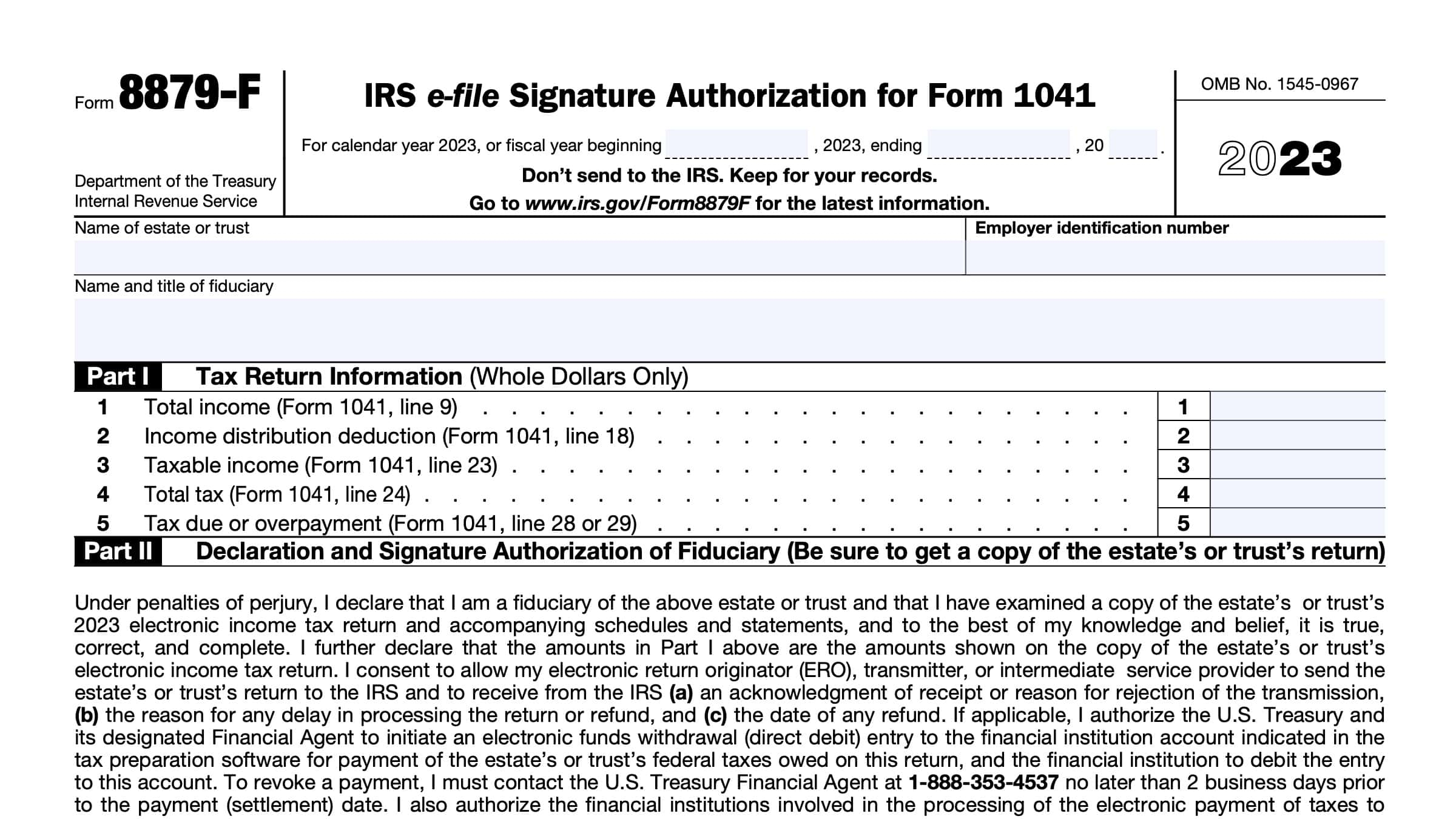

When filling out Form 1041, trustees and executors must provide detailed information about the trust or estate’s income, deductions, and distributions. This includes reporting any interest, dividends, capital gains, rental income, and other types of income received throughout the year. Deductions such as administrative expenses, trustee fees, and charitable contributions can also be claimed to offset the taxable income.

It is important to note that Form 1041 must be filed annually, typically by the 15th day of the fourth month following the end of the tax year. Failure to file this form or pay any taxes owed can result in penalties and interest charges. To make the process easier, the IRS provides a printable version of Form 1041 on their website, along with instructions on how to fill it out correctly.

Trusts and estates with complex financial situations may require the assistance of a tax professional to ensure that Form 1041 is filled out accurately. These professionals can help navigate the complexities of tax laws and maximize deductions to minimize tax liabilities. By staying organized and keeping detailed records, trustees and executors can make the tax filing process smoother and avoid any potential issues with the IRS.

In conclusion, Form 1041 is an essential tool for trusts and estates to report their income and ensure compliance with tax laws. By understanding the requirements of this form and seeking assistance when needed, trustees and executors can fulfill their tax obligations and avoid any penalties from the IRS.