Filing taxes can be a daunting task, but having the right forms can make the process much easier. One of the most common forms used by individuals to file their federal income taxes is Form 1040. This form is used to report an individual’s income, deductions, and credits to determine how much tax they owe or how much of a refund they are entitled to.

Form 1040 is provided by the Internal Revenue Service (IRS) and is available for download and printing on their website. It is important to use the most current version of the form to ensure accuracy in reporting your income and deductions.

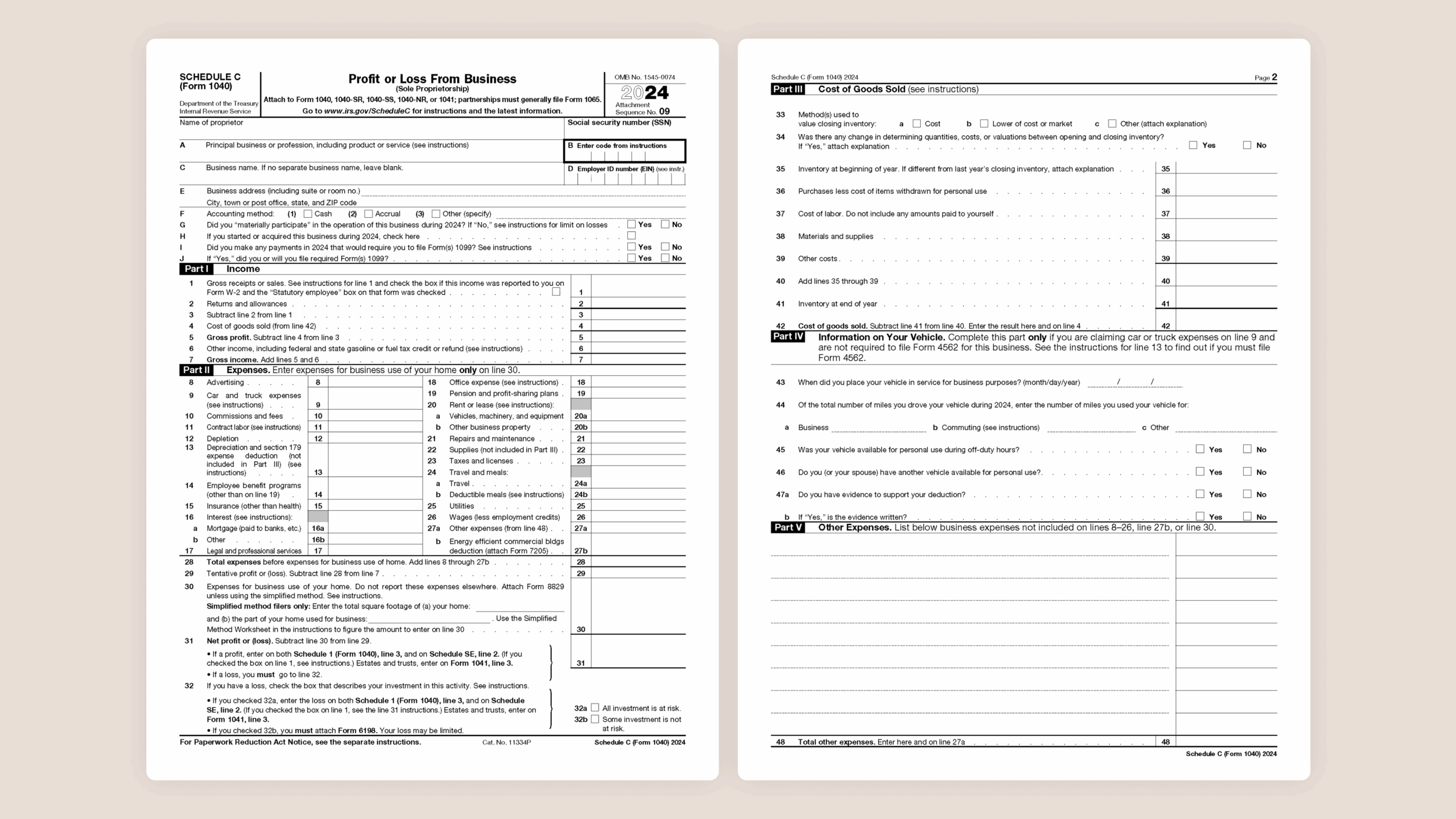

When filling out Form 1040, individuals will need to provide information such as their name, social security number, filing status, and details about their income. They will also need to report any deductions or credits they are eligible for to reduce their tax liability.

It is important to carefully review the instructions for Form 1040 to ensure that all necessary information is provided and that calculations are accurate. Any errors or omissions could result in delays in processing your return or even penalties from the IRS.

Once the form is completed, individuals can either mail it to the IRS or file electronically using tax preparation software or through the IRS website. Electronic filing is often faster and more convenient, and can also help to reduce the risk of errors on your return.

Overall, Form 1040 is an essential tool for individuals to report their income and taxes owed to the IRS. By using the form correctly and accurately, individuals can ensure that they are in compliance with tax laws and maximize any potential refunds they are entitled to.

So, if you are in need of filing your federal income taxes, be sure to download and print Form 1040 from the IRS website to get started on completing your tax return today.