When tax season rolls around, many individuals and businesses find themselves in need of more time to file their returns. This is where the IRS printable extension form comes in handy. By filling out this form, you can request an extension on your tax deadline, giving you extra time to gather all necessary documents and information.

It’s important to note that an extension of time to file does not mean an extension of time to pay any taxes owed. You will still need to estimate and pay any taxes due by the original deadline to avoid penalties and interest. However, the extension form can provide relief for those who need more time to accurately complete their tax returns.

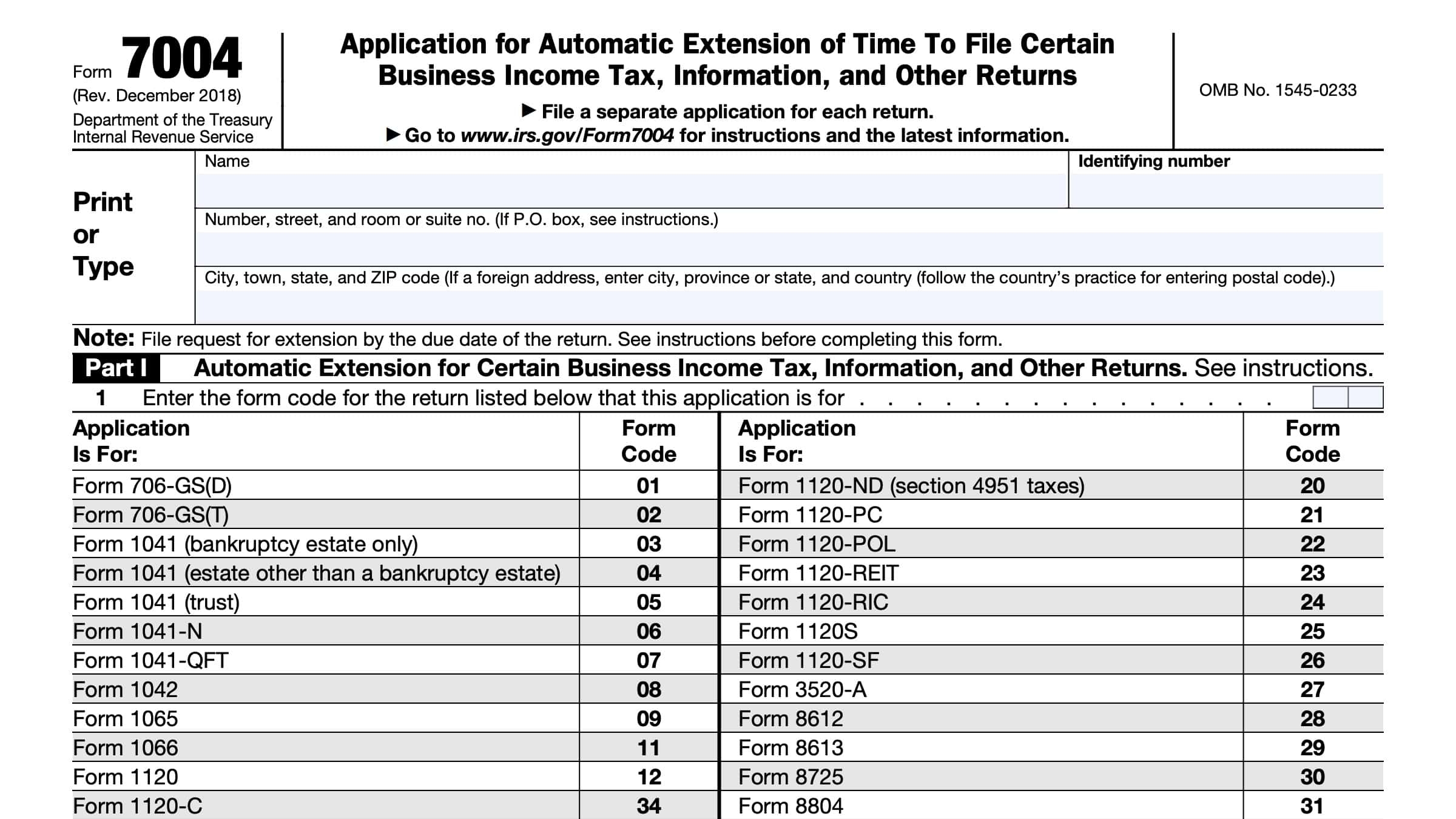

When filling out the IRS printable extension form, you will need to provide basic information such as your name, address, Social Security number, and the type of return you are filing. You will also need to estimate your total tax liability for the year and make a payment if you owe taxes. The form is simple and straightforward, making it easy for individuals and businesses to request an extension.

Submitting the extension form is free and can be done electronically or by mail. If filing by mail, be sure to send it to the correct address listed on the form and allow enough time for it to be processed before the original deadline. Once approved, you will receive confirmation from the IRS, giving you peace of mind knowing that you have more time to file your taxes accurately.

Remember that requesting an extension is not a sign of wrongdoing or evasion. It is a legitimate way to ensure that your tax return is completed correctly and on time. By utilizing the IRS printable extension form, you can alleviate the stress of rushing to meet the deadline and instead focus on preparing a thorough and accurate tax return.

In conclusion, the IRS printable extension form is a valuable tool for those who need extra time to file their tax returns. By providing basic information and estimating your tax liability, you can request an extension with ease. Whether you file electronically or by mail, be sure to submit the form before the original deadline to avoid penalties. Take advantage of this option if you need more time to ensure that your tax return is completed accurately and on time.