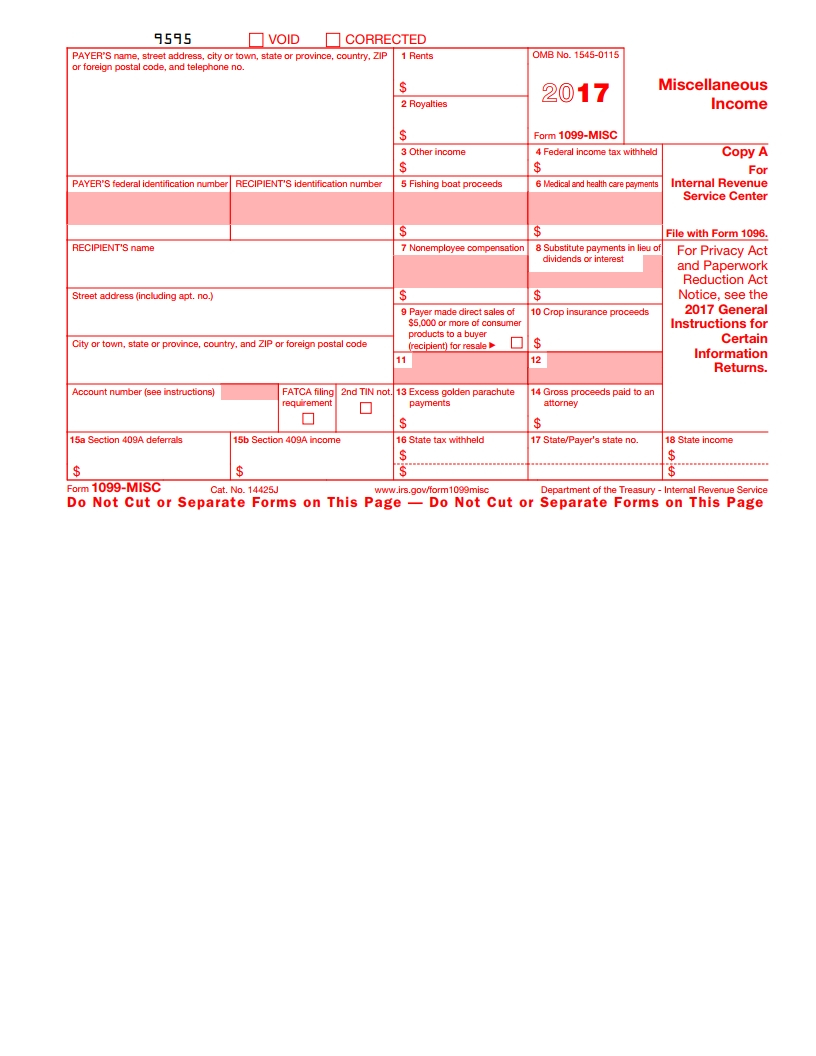

When tax season rolls around, it’s important to have all the necessary forms ready to go. One important form that many individuals and businesses need to fill out is the 1099 tax form. This form is used to report various types of income, such as freelance earnings, rental income, and more.

For those who prefer to handle their taxes on paper, the IRS provides printable versions of the 1099 tax form. These forms can be easily accessed online and printed out for use. This can be especially helpful for those who may not have access to tax software or prefer to fill out forms manually.

Once you have your hands on the printable 1099 tax form, it’s important to fill it out accurately and completely. Make sure to report all relevant income, as failing to do so could result in penalties from the IRS. Double-check your calculations and ensure that all information is correct before submitting.

If you’re unsure about how to fill out the 1099 tax form, the IRS website provides detailed instructions and guidance. You can also seek assistance from a tax professional to ensure that everything is done correctly. Remember, accuracy is key when it comes to tax forms.

After you have completed the printable 1099 tax form, make sure to keep a copy for your records. This will come in handy in case you need to refer back to it in the future. Once everything is filled out and double-checked, you can submit the form to the IRS either electronically or by mail.

Overall, the printable 1099 tax form provided by the IRS is a valuable resource for individuals and businesses that need to report various types of income. By following the instructions carefully and ensuring accuracy, you can successfully navigate the tax filing process and avoid any potential issues with the IRS.