When tax season rolls around, it’s important to make sure you have all the necessary forms to accurately report your income. One important form that many individuals and businesses need is the IRS Printable 1099 Misc Form. This form is used to report miscellaneous income that is not included on a W-2 form, such as freelance earnings, rental income, or prize winnings.

It’s crucial to accurately report all sources of income to avoid any penalties or fines from the IRS. By using the IRS Printable 1099 Misc Form, you can ensure that you are reporting all necessary income and staying in compliance with tax laws.

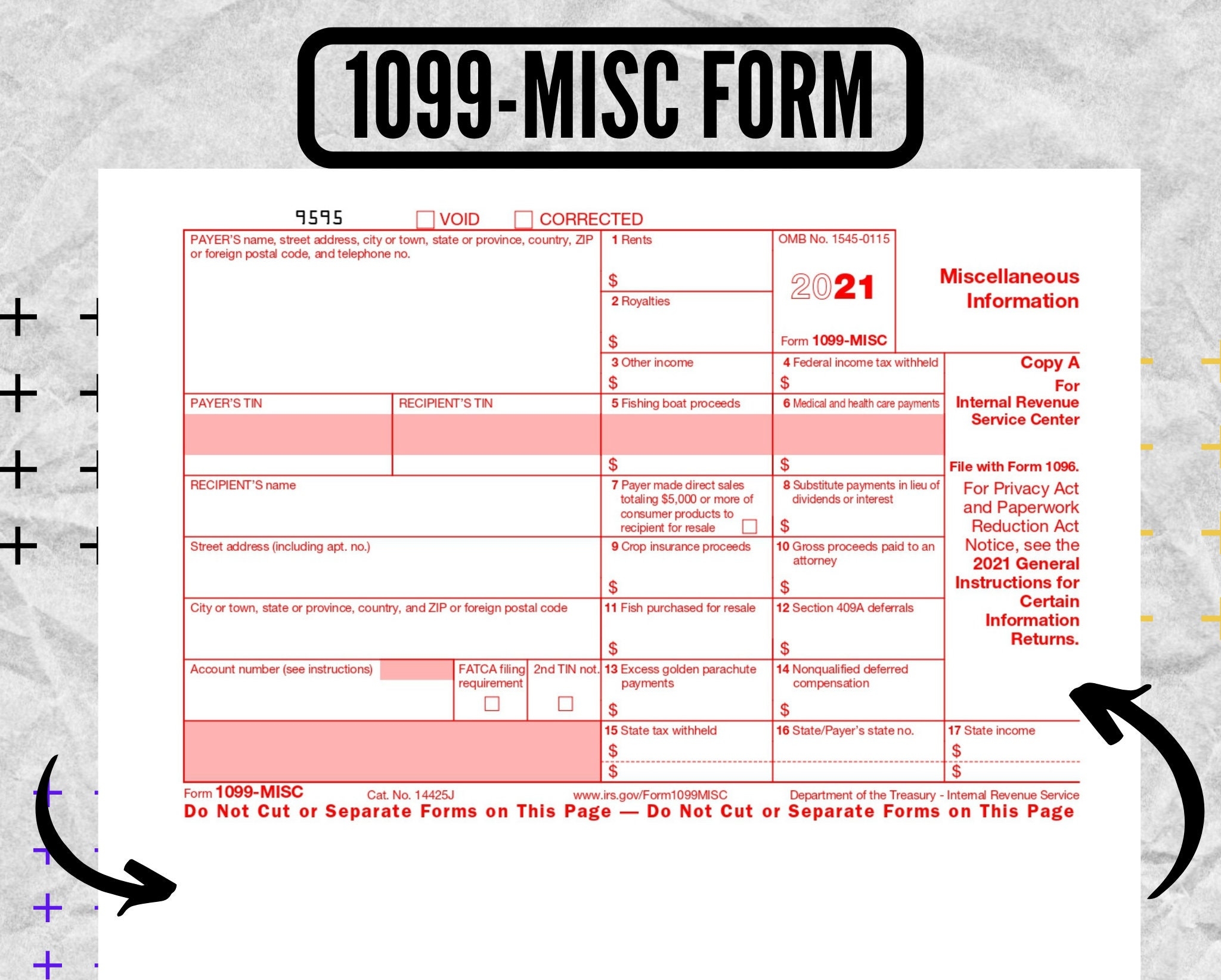

IRS Printable 1099 Misc Form

The IRS Printable 1099 Misc Form is a simple and straightforward form that allows you to report any miscellaneous income that you have received throughout the year. The form includes sections for reporting income from non-employee compensation, rents, royalties, and other types of miscellaneous income.

When filling out the form, you will need to provide your personal information, the payer’s information, and details about the income you received. Once completed, you can then file the form with the IRS and provide a copy to the individual or business that paid you the income.

It’s important to note that the deadline for filing the IRS Printable 1099 Misc Form is January 31st, so be sure to gather all necessary information and file the form on time to avoid any late fees.

Overall, the IRS Printable 1099 Misc Form is a crucial tool for accurately reporting miscellaneous income and ensuring that you are in compliance with tax laws. By using this form, you can make the tax filing process smoother and avoid any potential issues with the IRS.

So, make sure to download and fill out the IRS Printable 1099 Misc Form when tax season rolls around to stay organized and on top of your tax obligations.